[ad_1]

[ad_1]

introduction

If this is the first time you read a report on the value of Bitcoins, you may want to be involved in the initial post explaining the reasoning and the methodology that is following it.

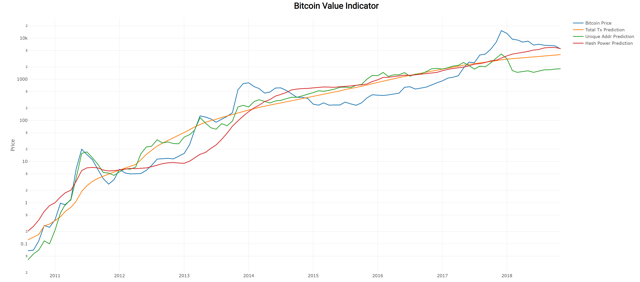

The TLDR; the version is that the price of Bitcoin (BTC-USD) (COIN) (OTCQX: GBTC) grows together with the network. This means that when we look at the data in the log scale, we can see a strong relationship between the total transactions, the unique addresses and the hash power of the network.

Sometimes, the price is offered up to levels beyond the natural growth rate of the system. These times tend to precede a Bitcoin bubble. At other times, the price of Bitcoin tends to be lower than the price we would expect from other network statistics. These are optimal times to buy Bitcoins, which tend to precede a large price increase.

Therefore, the Bitcoin Value Indicator is a tool that maximizes the return on investment; you should decide to venture into the dangerous waters of Bitcoin. Never invest more than you are willing to lose. This is a new class of activity and everything could happen.

Important changes

Before entering this month's report, I want to mention some things that have changed about the system itself.

- I finally automated the creation of the chart, which until now I had done manually in Excel. With this change, I have also moved on to a new graphics framework, which I think is better than the visual aspect and the readability of the report.

- Instead of looking at the market capitalization of the system, we now look directly at the price. The strength of the relationships between the input metrics and the price is equal to the relationship with the market capitalization. However, I personally do not like the term "capitalization" or even the way it is usually derived, which is not the same for crypto as for stocks (many scrambled manipulate their "circulating offer" to assert themselves on the market reference). Furthermore, I think that talking about the price is a more direct approach that will make it even easier to use this tool.

- Our data feed has improved. From 2009 to 2017 I was able to get complete network statistics in 48 hour increments. But, as of the end of 2017 and moving forward, we have samples every 24 hours. This will improve the quality of long-term production, but will also give more weight to the recent measurements because we are now getting 365 years instead of 183.

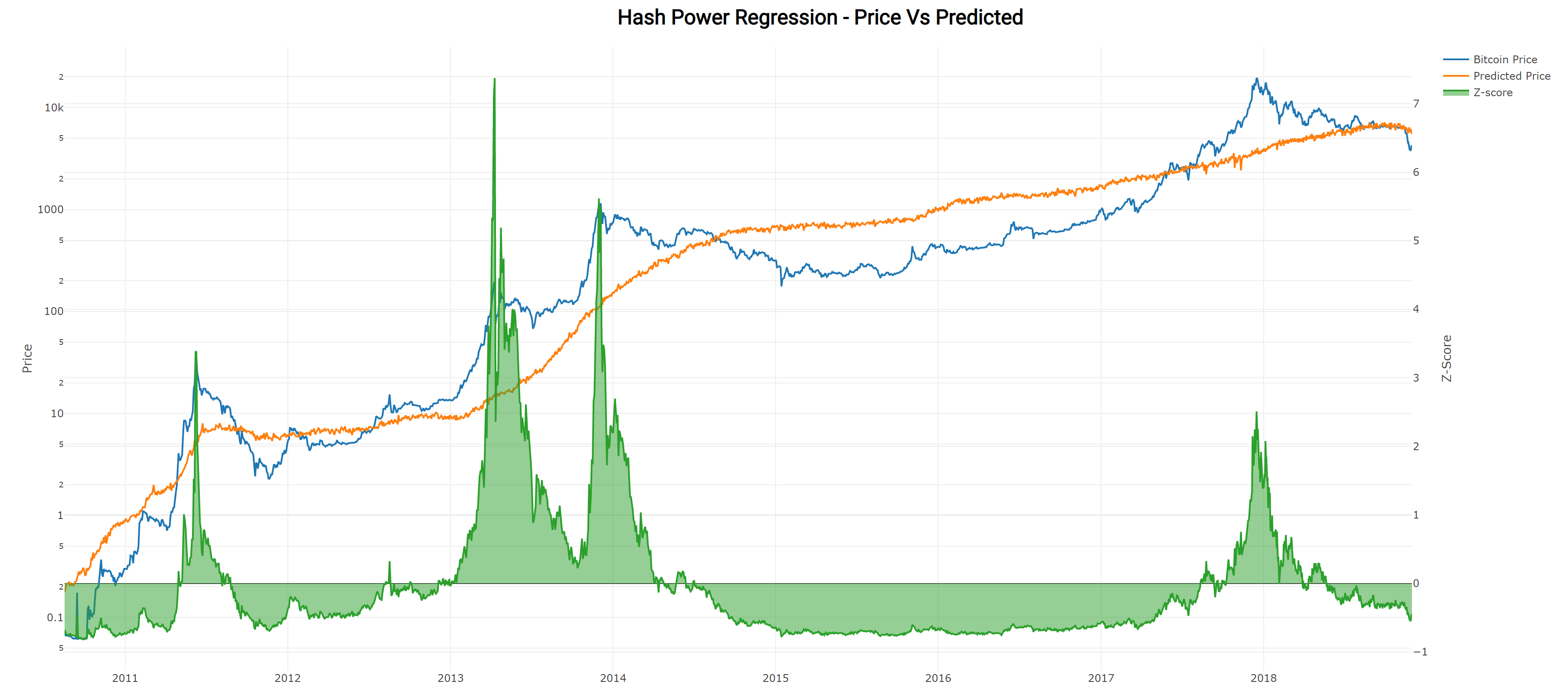

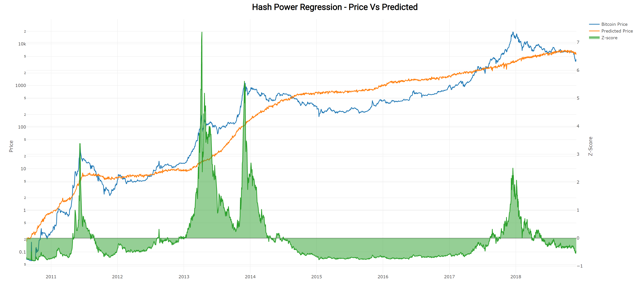

Network hash speed

The network hash rate is a response to the rising price of Bitcoin. However, unlike the Bitcoin price; the hash rate tends to be more stable because entering or leaving the mining business is an important decision. Investments in a large mine require CAPEX and time. Going out is also a great decision not to be taken lightly.

What we have seen this year has been the fact that the price of Bitcoin has returned at the beginning of the year, but the hash rate has continued to increase until the end of August. Now, the network hash rate has started to decline.

Some pointed out that the price drives the hash rate and has questioned the validity of using the hash rate to determine the price. To this I will do the following topics:

- The hash power of the network has increased by several orders of magnitude between January 2009 and August 2010 (when the first price was recorded). If the price always pushes hash power, then how did it happen?

- While it is true that a higher price of Bitcoin will attract more miners, an increase in the number of miners and the resulting power of hashes actually benefits Bitcoins. The huge hash power that we see protecting the Bitcoin network makes it more resistant to attack and makes the system more secure. A safer system is more attractive, more robust. This creates a cycle of positive feedback that I think leads to a higher price.

In Zen they ask "does the fish move the water or the water move the fish?" I think the correct answer is "yes".

Let's take a look at the regression of hash power in isolation first.

Source: blockchain.com and new author graphics

Source: blockchain.com and new author graphics

Is not it a nice table? Feel free to comment below and let me know what you think of the new graphic framework provided by plotly.js.

What you see here is the price of Bitcoin compared to the expected price based on the network hash rate. The Bitcoin value indicator looks at monthly averages, but here you see more fine-grained details.

As you can see, the prediction of hash frequency towards the end of last year was sending a warning signal; but now it seems to be back in the negative Z-score range (safer time to buy, but not necessarily the bottom of the market).

Is the hashing rate in decline a problem?

I was asked if the decrease in the hash rate of the network is a problem. Before I said that more miners make the network more solid. So if we have less miners, are we in danger?

This is a good question. In the long run, the decline of miners would be a problem. However, after the bubbles in the past we have seen before the decline of the hash power. The longest decline observed was a six-month decline between 2011 and 2012. So far, we have seen the hashing rate down for just over three months.

I expect that we will see the power of the hash decrease further for two reasons:

- I do not think we are still at the foot of the market

- There is a delayed effect since the price moves and when the hash power responds.

In my opinion, the power of the hash will stabilize in the coming months because there are a lot of new equipment that hit the market that is more efficient, and I think the price will stabilize soon. These are just my opinions, we will have to see. We should monitor this situation, but I think this correction is the natural reaction to a market that has been overheated for too long.

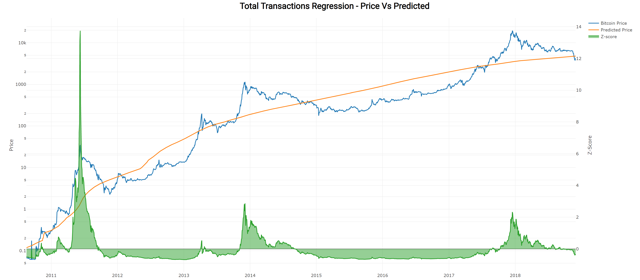

Total Bitcoin transactions (confirmed, on the chain)

The total count of Bitcoin transactions will continue to rise until people (or software platforms) are using the network. The speed with which this count increases is an indicator of the adoption of the network and of the time that has been alive. Like the hash power, this is a more stable metric; but it measures the total life of the network instead of the hash frequency of the miners. Look down.

Source: blockchain.com and new author graphics

Source: blockchain.com and new author graphics

The forecast of total transactions makes a much bigger deal than what happened in 2011 compared to what happened in 2013. But, like the hash rate, we are seeing that the price is finally below the expected levels.

Remember that since the Bitcoin value indicator uses monthly averages and the price has started to drop only in the last two weeks, on a monthly basis we will not see a movement as big as we would expect.

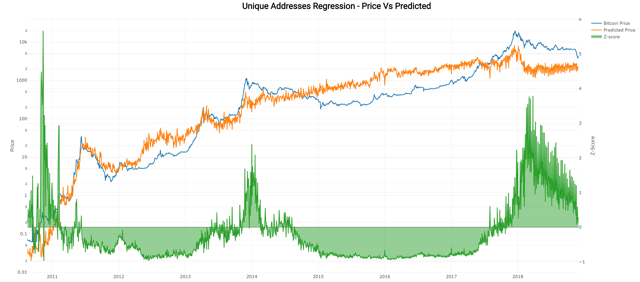

Unique addresses

The unique addresses in use are a way to quantify the number of users. This metric has its strengths and weaknesses, as I wrote here. Let's take a look at the chart.

Source: blockchain.com and new author graphics

Source: blockchain.com and new author graphics

The highest peak / expected price recorded by this metric was in 2010. However, the broadest mountain range is where we are now. Note that using this approach, the price of Bitcoin is still too high.

Indicator graph of the value of Bitcoin

Without further delay, let's take a look at the graph of the indicator of the value of Bitcoins for December 2018.

Source: blockchain.com and new author graphics

Source: blockchain.com and new author graphics

For the first time since June 2017, the average Bitcoin price for the month was low based on a single metric, the price predicted by the hash rate. However, the other two metrics still provide lower prices (total tx and unique addresses).

It can be seen that in 2014 the price first crossed the hash indicator before crossing the other lines. Will the story be repeated? Guys, do you think this could end up being the longest bear market in Bitcoin's history?

So far the longest price drop has been a period of 15 months, set after the mountain. Gox has collapsed. We are 11 months right now … I suppose we'll have to wait and see.

Signal distribution

| Name of the indicator | Unique addresses | Hash Power | Total transactions |

| Expected price | $ 1.802 | $ 5.554 | $ 3.969 |

| Effective / expected | 3.02x | 0.98x | 1.37x |

| Metric signal | Overbought | Oversold | Overbought |

Source: tables showing the value of Bitcoin and blockchain.com

December 2018 Signal

It's complicated!

Ah, complexity. The only drawback of the decision-making process. What should we do when an input says that the price is too low, and the other two say it is too high?

Ah, complexity. The only drawback of the decision-making process. What should we do when an input says that the price is too low, and the other two say it is too high?

An option is the average dollar cost at the time we enter the bottom of the market, but another way is to change your perspective. Consider the Z-Signal Bitcoin.

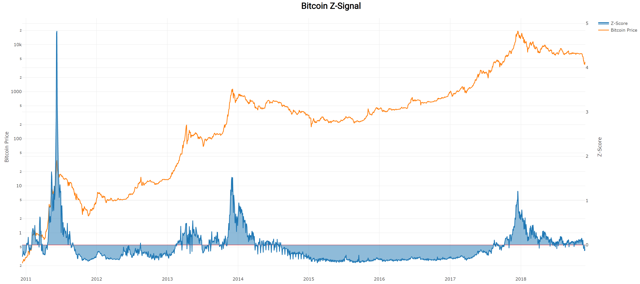

The Bitcoin Z-Signal

The new member of my metric family is the Bitcoin Z-Signal, of which I wrote here, and here. I posted daily updates on Twitter (TWTR) that you can see if you follow me on that platform

The Z signal takes total transactions, unique addresses and daily transactions and rolls them into a single graph (using multiple regression, rather than independent linear regressions in parallel). The idea here is to simplify decision making. If you do not want to handle more predictions and the fact that they will rarely say the same thing, then Z-Signal is for you.

It is important to underline that the signal Z actually has a higher R ^ 2 and a lower standard error than all its inputs. So, it could be the best way I know to evaluate the current price at a glance.

Let's first take a look at the long chart.

Source: blockchain.com and new author graphics

Source: blockchain.com and new author graphics

As you can see, when we use all three input metrics we get a simplified perspective. Funds from previous bear markets tend to be lower than where we are now, but at the same time we are no longer in the "dangerous bubble" territory.

If we look at where we are now, compared to the last two bubbles; that's how it breaks out.

| Low price | High price | Maximum ROI | Low Z score | Z high score | |

| 2011-2013 | $ 2.29 | $ 1.151 | 502.6x | -0.36 | 1:53 |

| 2015-2017 | $ 243.99 | $ 19.498.68 | 79.9x | -0.41 | 1:21 |

To date, we have a reading of -0.12. The lower the value, the more attractive is the purchase opportunity (in theory).

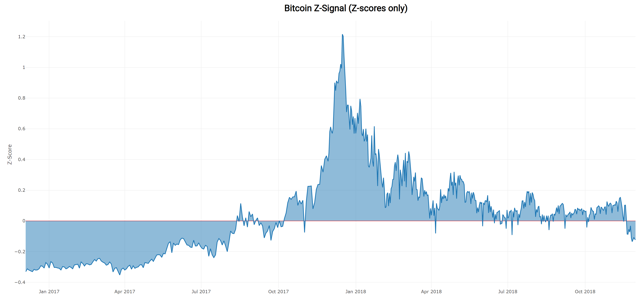

The Z score has been negative since November 20th. Let's zoom in over the past two years and focus on them.

Source: blockchain.com and new author graphics

Source: blockchain.com and new author graphics

You can see the depth of last winter still lingering on the two-year chart. Are you ready to buy the dive? I'm.

Conclusion

I have already said before, and I will say again; please use these metrics with caution. Nobody can predict the future. Got to believe in the power of the Bitcoin network, and I think we'll see these trends continue unless they completely fail. This was the topic of my article on Bitcoin's Binary Future.

If you're looking for a way to pinpoint your Bitcoin entry and exit points, then I humbly suggest that the approaches I've shown here are part of your search cannon. There were many high quality researchers who predicted the last bubble and were not surprised by the crisis. It would be wise to look for these people and follow their work if you are in this space.

Greetings,

Hans

If you like the Bitcoin Value Indicator, you will love the BVIPE (the Bitcoin Value Indicator Professional Edition). The BVIPE contains a much larger data set and is updated once a week instead of once a month. Find out in Crypto Blue Chips!

Revelation: I am / we are long BTC-USD.

I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

[ad_2]Source link