[ad_1]

[ad_1]

Time compression

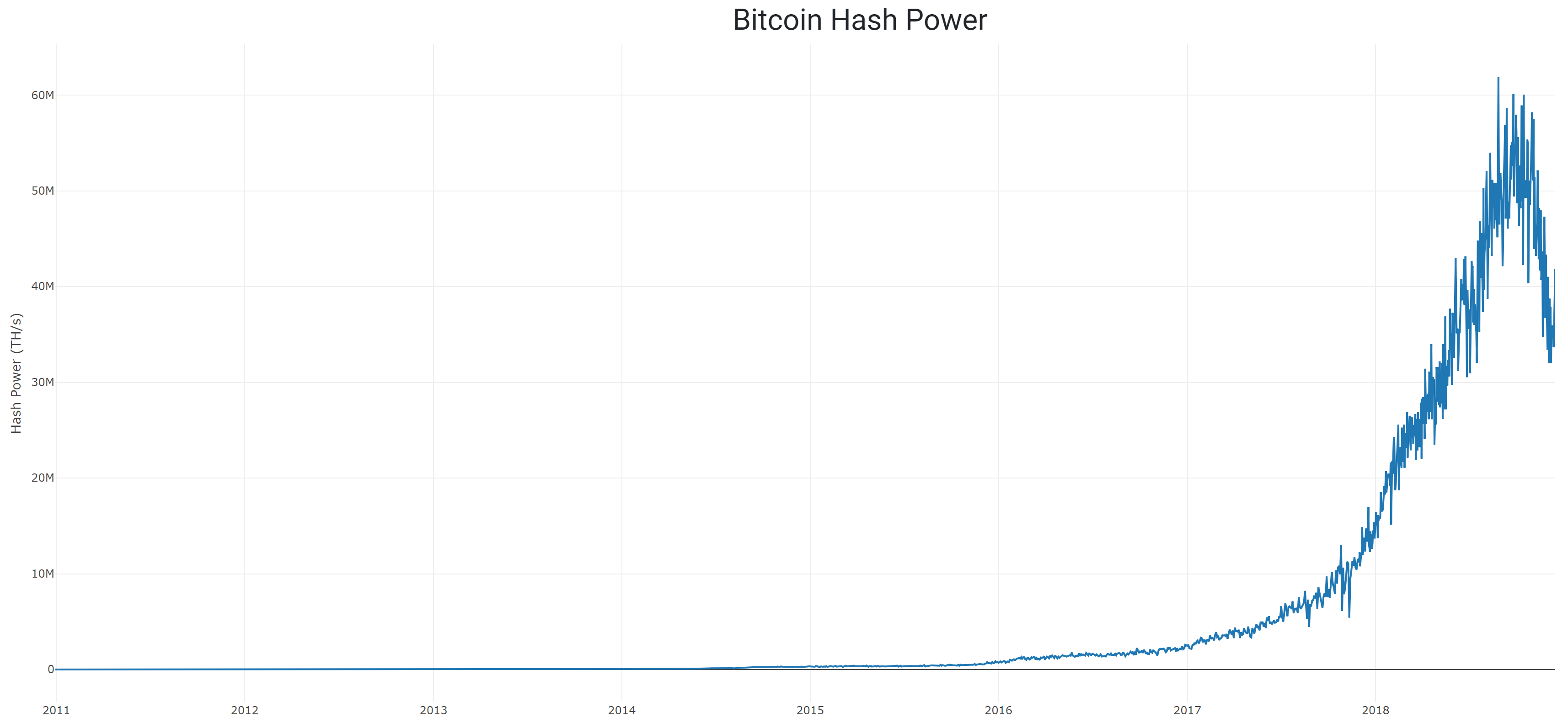

I presented my case for the point of view that Bitcoin (BTC-USD) (COIN) (OTCQX: GBTC) is a log-scale phenomenon many times. However, if this is the first time you read one of my articles or any article on Bitcoin, consider the following graphs.

Source: Blockchain.com and the tables of the author

Source: Blockchain.com and the tables of the author

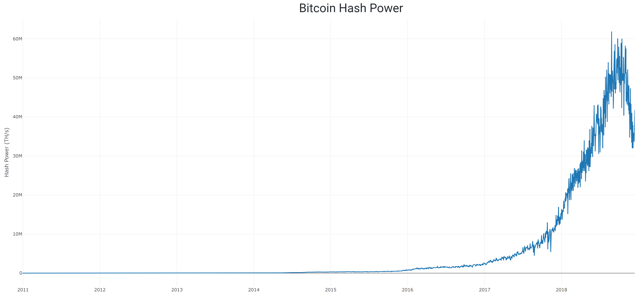

Here is the hash power of the linear scale Bitcoin network. Not very significant, is it? But when we turn the Y axis to record the scale …

Source: Blockchain.com and the tables of the author

Source: Blockchain.com and the tables of the author

It's better, right? Look at all the information we have not been able to see before, like what happened in 2011 and 2014. For the sake of my regular readers, we will move on from this topic that I feel like I could beat to death.

However, further examination has shown that there may still be some life in this scale-log horse. So, today we will talk about an interesting statistic that we can draw from the Bitcoin network, total transactions.

What are the total transactions?

When you hear me talk about total transactions, I am referring to the subtotal of all Bitcoin transactions that have never been transmitted and confirmed on the Bitcoin blockchain. This number can not go down because it is a current account. If there are 10 transactions sent per day, the number increases by tens. If there are thousands, then it grows by thousands. But if the number stops growing, Bitcoin is actually dead.

Now, since the total transaction account can tell us if Bitcoin is still alive, and we know it grows faster with increasing transaction frequency (and slower if they decrease, of course), I've suggested that there are two new uses for this piece of data.

- It can be used as a proxy for time. The more transactions are transmitted, the "older" Bitcoin is.

- It behaves like a sort of trend line, from which we can evaluate the disparity between the current era and the price.

A curious Twitter follower (TWTR) noted that since the price of Bitcoin tends to increase over time, it is possible to find a positive correlation with anything else that increases over time:

This is true and a valid concern. However, I believe we can do better than simply linking a trend line over a data set over time. Let me show you what I mean.

Source: Blockchain.com and the tables of the author

Source: Blockchain.com and the tables of the author

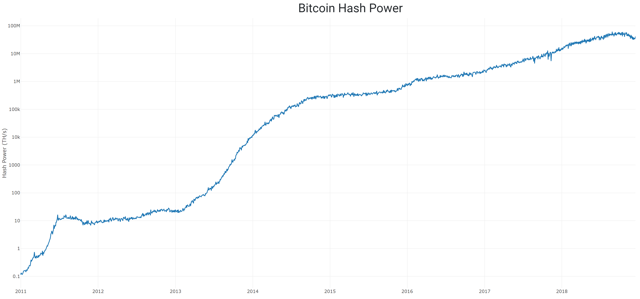

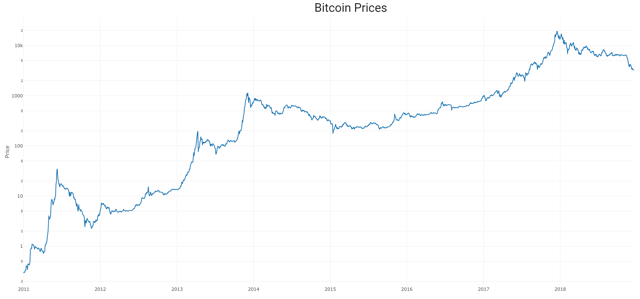

You've probably already seen this chart before. But there's something else you may not have noticed. This graph has a Y axis in the register scale, yet the X axis is in constant time, which is a linear scale. See how the graph seems to curve right? The data actually follow a register curve in the register scale. What does this mean? See the table below for a useful illustration of this curve.

Source: Awe and Wonder via Medium

Source: Awe and Wonder via Medium

Is there really a way to observe the X axis in the register scale? And if there was a way, is it useful or better?

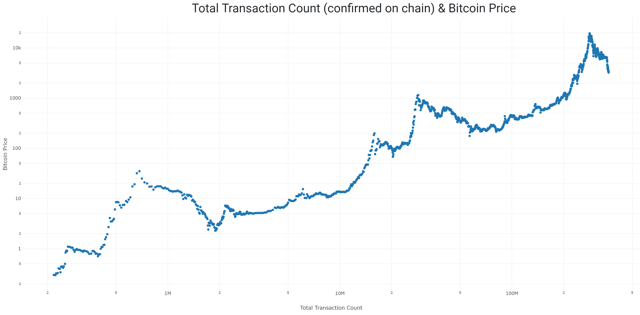

I have good news, there is a way and I think it is very useful for a variety of reasons. Do you remember how I said that total transactions could be a proxy for the weather? We put those on the X axis and the price on the Y axis, just for kicks.

Source: Blockchain.com and the tables of the author

Source: Blockchain.com and the tables of the author

The total transactions here are set to be displayed in the scale of the log and note that the graph is now more a straight line rather than a logarithmic curve? Now, go back to the price chart I posted above (the one with the white background) with the time of the X axis. Do you notice anything else that's weird? I'll give you a hint, the chart is compressed as you move forward in time.

Bitcoin is not just getting bigger, it's getting faster and faster as it grows. By measuring this in linear scale, time forces you to do one of the two things, draw a curve like Awe & Wonder has made or compresses time if you want to run a linear regression model. I chose this one here, and to make sure this relationship is actually stronger, I did a little test.

I ran a regression analysis on the log price over a linear time, so I compared the log price with the total transaction of the log. The results confirmed my suspicions.

| Price / Hour Log | Price Register / Log transaction count | |

| R2 | 0.866 | 0,922 |

This may not seem like a huge difference, but if my theory is correct, the log / log relationship will grow stronger over time as the linear log / time relationship increases steadily. (It is not possible to adapt a linear trend line to curved data very well).

So, time is accelerating?

Exactly! But this should not surprise you, since we produce more data every year than in the previous year, and computers have increased exponentially the price / performance for over 100 years. It's almost as if we were sucked into a technological singularity …

Cause

One of the things I hear most is "your models do not show causality". Thanks for that. In fact, I can guarantee that someone reading this will insert exactly this in the comments section. Yes, for the millionth time, the correlation does not imply causality. However, I maintain that there are many more subtleties in the world than we realize.

For example, just the other day I published an article that validated some of my basic assumptions about the price of Bitcoin. Specifically, we used non-parametric statistics to show that there was a relationship between the Bitcoin price and the network statistics (daily transactions, unique addresses and the like).

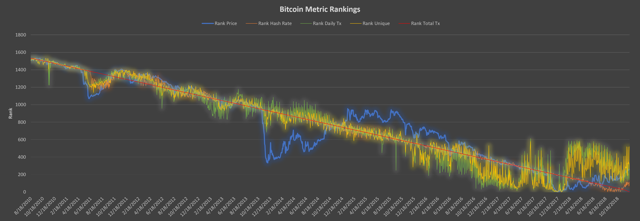

A chart that I created from this process was based on the ranking of these statistics from high to low. You could remember this chart:

Source: Hans Hauge via Seeking Alpha

Source: Hans Hauge via Seeking Alpha

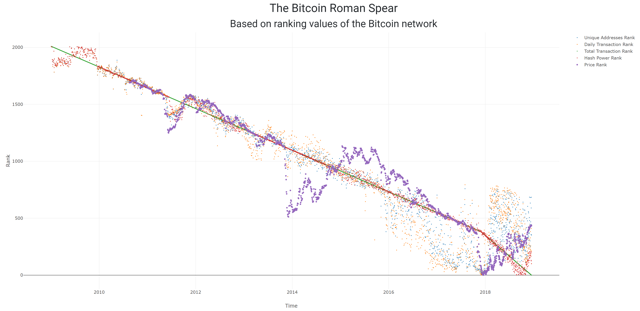

I really liked this chart, so I imported it into my new library of charts. When I did it, I noticed several things. Look down:

Source: Blockchain.com and the tables of the author

Source: Blockchain.com and the tables of the author

First of all, you may have noticed that there seems to be a cluster of giant points near the bottom right of the graph. Secondly, you may have noticed that the green and red dots seem to change direction from the beginning of 2018. Both of these things can be explained by the simple fact that my dataset contains points from every 48 hours from 2009 until 2017 Starting at the end of 2017, I have data points every 24 hours. So this means that there are twice as many points this year, which drags down the "spearhead". For now, I'm going to leave this as it is. But, at some point in the future, I could make an adjustment to take account of this disparity.

The third thing I noticed is that there is no purple in the upper left corner. Why? Well, normally my cards do not come back to 2009, because I'm looking at the price, and there simply was not one then. But this raises a new question. Let's examine the quadrant at the top left of the graph.

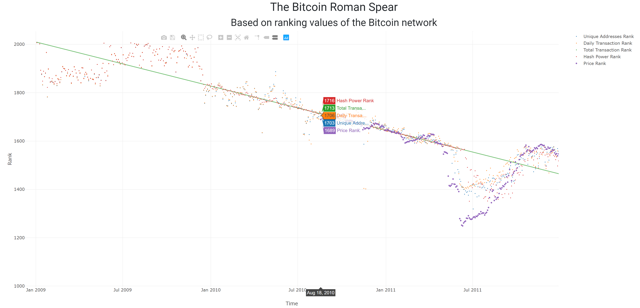

Source: Blockchain.com and the tables of the author

Source: Blockchain.com and the tables of the author

I placed my mouse over the first point in time when we have a price for Bitcoin (second blockchain.com). That date was August 18, 2010. The question I have for you is this: "because the number of daily transactions, hash power, unique addresses in use and the current account of all Bitcoin transactions increase between January 2009 and August of 2010? "

It's a simple question So, what's your answer? The Bitcoin network has been growing steadily for 20 months before there was a price, why? We have beaten the living devils of the causality horse, right? The growth of the network could not determine the price, right?

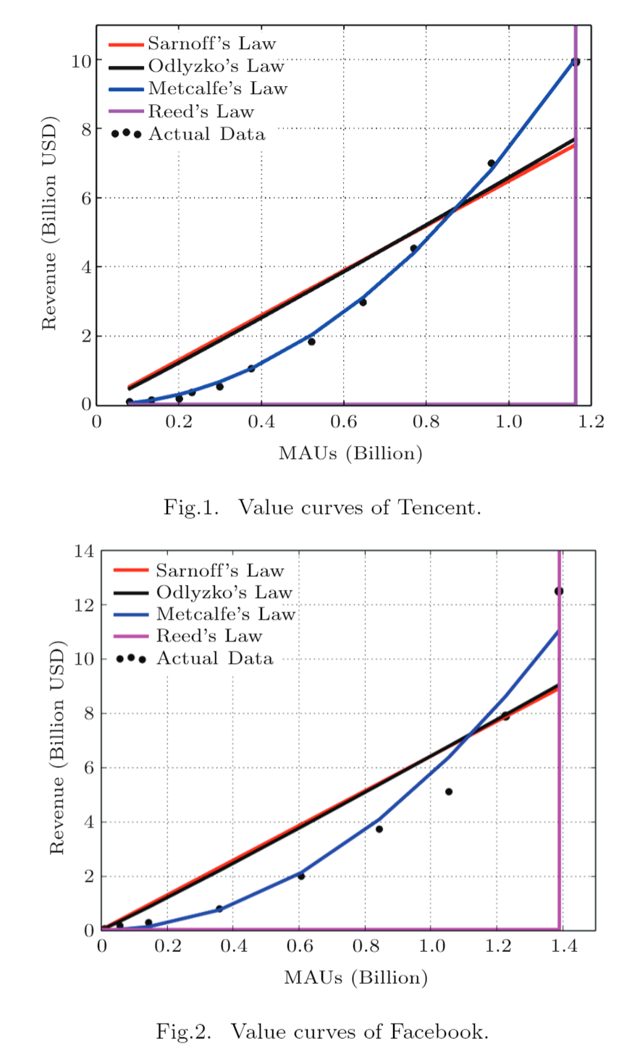

Stranger things have happened. After all, Metcalfe's law was used to successfully forecast Facebook (FB) and Tencent (OTCPK: TCTZF) (OTCPK: TCEHY) revenue. Maybe the value comes from the network?

Source: Journal of Computer Science and Technology, 2015

Source: Journal of Computer Science and Technology, 2015

Feedback rings

Have you ever been to a concert, and does the musician have the microphone too close to the speakers? What happened? If you've ever had that terrible experience, then you know what I'm talking about. The sound coming out of the speakers returns to the microphone, which returns to the speakers. As soon as that happens, that original noise (usually an acute screech) returns from the loudspeakers stronger than it was the first time. This sound becomes louder and louder until someone turns off the sound system, or the microphone is repositioned, or the heads of everyone simultaneously explode.

So, what caused the feedback? Was it the microphone or the speaker? If you said "in reality, feedback is a system, it is not caused by one or the other, you need both the speaker, the microphone and a certain combination of settings and positioning to create the feedback loop ", so you'd be 100% correct!

The Zen monks picked this age ago when they asked "does the fish move the water, or does the water move the fish?" Likewise, with Bitcoin, I think the only rational way to understand Bitcoin's price action is as part of a system. Let's go back to the miners' argument and the price for a moment.

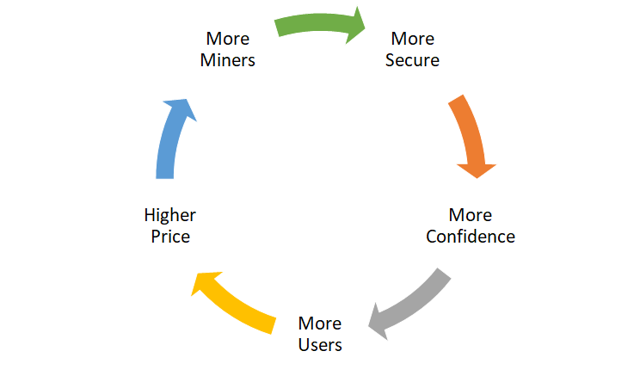

The feedback cycle on the prices of bitcoin miners

Source: diagrams of the author

One of the cornerstones of Bitcoin's security comes from the huge amount of hash power of the network and the globally distributed mining network. These miners are encouraged to extract Bitcoin and act in the best interest of the network. As they do so, the system becomes more robust, which increases trust and attracts more users. Since we know that there is a limited number of Bitcoins that can exist, an increase in the user base increases the price, which in turn attracts more miners.

Conclusion

I hope I challenged you to think about Bitcoin in a new way. Is it always correct to think in terms of linear scale when Bitcoin is a logarithmic phenomenon? Is the action of Bitcoin prices the cause of the growth of the network and the only determining factor of the hash power? Or is the price simply a piece of the puzzle that we can understand and model by studying and understanding the system itself?

Greetings,

Hans

This article was first published in Crypto Blue Chips.

Revelation: I am / we are long BTC-USD. I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

[ad_2]Source link