[ad_1]

[ad_1]

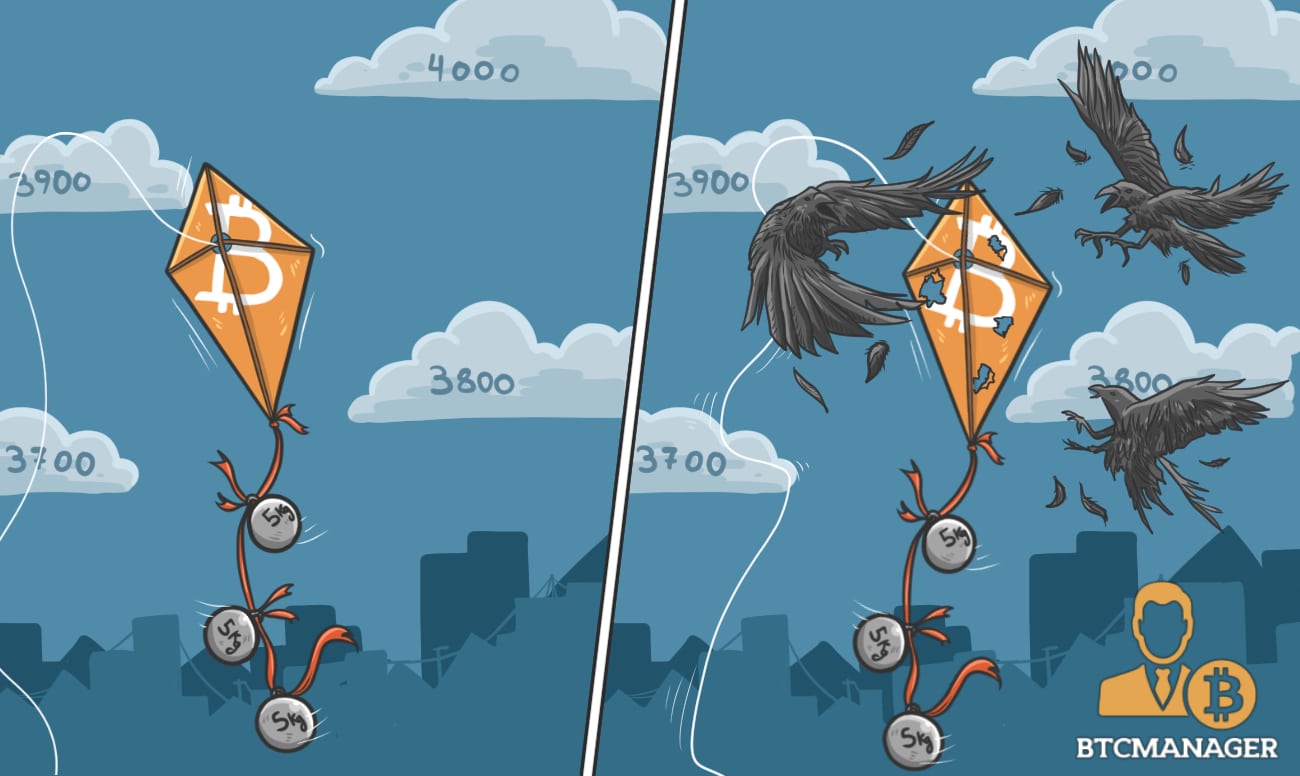

It was a hellish year for bitcoin investors. Twelve months ago, we were coming out of bitcoin's all-time high of over $ 20,000. Today, the price of bitcoin is struggling to keep the $ 4000 mark after falling more than 70 percent from the start of the year.

As expected, the news flow was deactivated during the holiday period. The most important titles of the week come from the giant Bitcoin Mining Bitmain, which is said to be cut the staff by 50% in light of the decline in the bitcoin mining market in 2018, and India, which is reportedly considering legalized cryptocurrencies.

Reportedly, Bitmain silently fired the BCH development team in a strange move after winning the BH hash war and is now presumably about to lay off 1,000 of its 2,000 employees. In light of the decline in profitability in bitcoin mining and the decline in the value of old data mining hardware, it can be assumed that Bitmain's revenues have suffered substantially in the last six months.

As Bitmain is preparing to list on the Hong Kong Stock Exchange, the company will probably have to reorganize itself to make sure its profitability will be less tied to the cryptor-fascist values pending IPO approval.

India, which was halfway between the ban and somehow allowed cryptocurrencies within its borders, could finally legalize cryptocurrencies in the next year but "under strong rules".

Moreover, for those who have been on the market long enough, the Mt.Gox saga could end slowly to end up as Mark Karpelès, the former head of the collapsed cryptocurrency exchange. Gox apologized for the losses that ruined the company but insisted he was innocent on charges of embezzlement.

Except for the ether, the altcoins are also red in the last week of trading in the year. The top 15 major players are falling from 1 to 18 percent, with BCH and BSV being the biggest losers of the week, down 18 percent and 17 percent respectively.

This week's contributions were provided by Aisshwarya Tiwari, Ogwu Osaemezu Emmanuel, Priyeshu Garg,

According to a report published by Finance magnatesOn December 24, 2018, the giant Bitcoin Bitmain fired the entire Copernicus team, which was responsible for the development of the Bitcoin Cash client of the company.

For sources close to the issue, Bitmain silently fired the entire Bitcoin Cash client development team with only a week's notice. Blockstream CSO and BTCC's former COO, Samson Mow, made public on Twitter on December 24, 2018, adding that some employees "had just joined the company."

Having a total force of 2,000 employees, a sudden layoff of nearly 50 percent of the workforce will undoubtedly affect the mining giant's goodwill. Bitmain is indisputably the biggest bitcoin mining enterprise in the world. The fact that its hash rate is consistently reaching 51% of the Bitcoin Network testifies to its dominance in the crypto mining industry.

Bitmain has not yet confirmed the reports, but it can safely be assumed that the recent collapse of the encryption market could have had an impact on the long-term strategies of the company.

Owning and using Bitcoin could soon become allowed in India, as the second interdisciplinary committee charged with voting on the legality of cryptocurrencies is in favor of legalization, New Indian Express reported on December 26, 2018.

According to New Indian ExpressSome members of the Interdisciplinary Committee, such as RBI Executive Director Ganesh Kumar and some officials from the Ministry of Finance, actively participated in the G20 and FATF working party meetings.

Seeing how the G20 countries have recently agreed to introduce regulations on cryptographic assets to combat money laundering and financial terrorism, we expect a much more lenient approach to Bitcoin regulation by the commission.

The newly appointed committee has already met twice to discuss the matter, a senior official who participated in the group said at the New Indian Express, adding that among the members there was a consensus that the cryptocurrency can not be dismissed as completely illegal.

The next meeting is scheduled for January 2019, but the unnamed official stated that most likely the committee will present its final report to the Ministry of Finance as early as February 2019.

"We have also taken input from cryptocurrency exchanges and experts and will look into legal issues with the Ministry of Law.This is a complicated problem.After all aspects are decided, then we will have more clarity," the official added.

Mark Karpelès, the former head of the collapsed cryptocurrency exchange Gox apologized for the losses that bankrupted the company but insisted that he was innocent on charges of embezzlement during the final arguments of his trial in Tokyo, the South China Morning Post reported on December 27, 2018.

During the hearing of the final arguments in his trial in Tokyo, Mark Karpelès, the former head of the Monte. Gox reaffirmed his innocence and denied any wrongdoing in the events that eventually led to the company's bankruptcy.

The 33-year-old French citizen faces charges of embezzlement of over 340 million yen, or about $ 3 million, from the exchange. He is also accused of fraudulent manipulation of Monte's financial and customer data. Gox.

According to South China Morning PostAt the beginning of December, Tokyo prosecutors asked Karpelès for a 10-year prison term, claiming that his alleged acts "were extremely vicious, as they completely undermined trust in commerce".

Litecoin Foundation, the DLT (distributed ledger technology) project behind litecoin (LTC), announced on 27 December 2018 that it had joined forces with the Ultimate Fighting Championship (UFC), a US-based martial arts company to sponsor an event that will promote the adoption of cryptocurrency and create greater awareness of the cryptocurrency project.

Litecoin Foundation reported that they are sponsoring the UFC event 232: JONES vs. GUSTAFFSON 2, a match between Jon Jones and Alexander Gustafsson scheduled for December 29, 2018. Here is where Jones, a former light heavyweight champion will fight with Gustafsson, the current champion at the Inglewood Forum, in California.

The report also found that sponsoring an event of this nature in which the Litecoin logo will be displayed on the Octagon canvas and seen by millions of people will have a significant impact.

The company stressed that they are the first in the industry to promote a UFC event and the move marks another significant success for blockchain technology and cryptospace, which are increasingly approaching global adoption with each passing day.

The Samourai wallet has introduced a new privacy feature that prevents coin-tracking services from freezing user funds and blocking their accounts, trying to tap into the market for those seeking complete privacy, the company explained in their post on the blog in January 2017.

"Protection with the vibration of a switch" is the motto of Ricochet, Samourai's most popular and precious instrument. Introduced in 2017, the feature adds additional steps or steps to every Bitcoin transaction.

Blockchain's espionage software usually examines the history of a coin with five hops in depth, which means that these third-party apps would need to look ten hops back to achieve the same level of "security". However, the ten transactions deep in the history of each currency are almost impossible due to the higher costs and overheads that these applications would have faced.

According to the Samourai website, when activated, the Ricochet function allows the portfolio to collect the necessary inputs and calculates the total rate of miners for the entire ricochet. The wallet then transmits the first decoy transaction, which looks like a normal transaction to a blockchain espionage software. After another three hops, the wallet proceeds as usual with the transaction.

Ricochet was updated in 2018 to use Samourai's Segwit bech32 addresses for all added transaction hops, which managed to reduce commissions on miners. The company has also introduced a new algorithm that, combined with the number of payments function, drastically reduces the fingerprint of the Ricochet transaction on the blockchain.

WSJ I examined 3,291 ICOs to check for duplicates in their objectives, identify the theft and eradicate the non-existent team members, and so far managed to catch 16% of potential scam projects. For research purposes, a diary of several white papers was created, with their PDF versions being dropped by ICOBench, Tokendata.io and ICORating.com. They were subsequently automatically and manually reviewed to find out elements of plagiarism and their originality.

WSJ He says that several criteria have been used to judge each ICO, including the level of risk involved, duplication of words and phrases, the inability to access their web pages and the fake members of the team on its board of directors.

The level of risk involved in each ICO was determined based on access to specific keywords used in all white papers. Some of these words are "guaranteed profit", "no risk", "nothing to lose" and "return on investment" (ROI). Over 2,000 projects have shown one or more of these red flags.

Category: Altcoin, Blockchain, Business, Ethereum, News, Platform, Tech

Tags: bitcoin, cryptocurrency, digital tokens, ICO, India, litecoin, Samourai, week in review