[ad_1]

[ad_1]

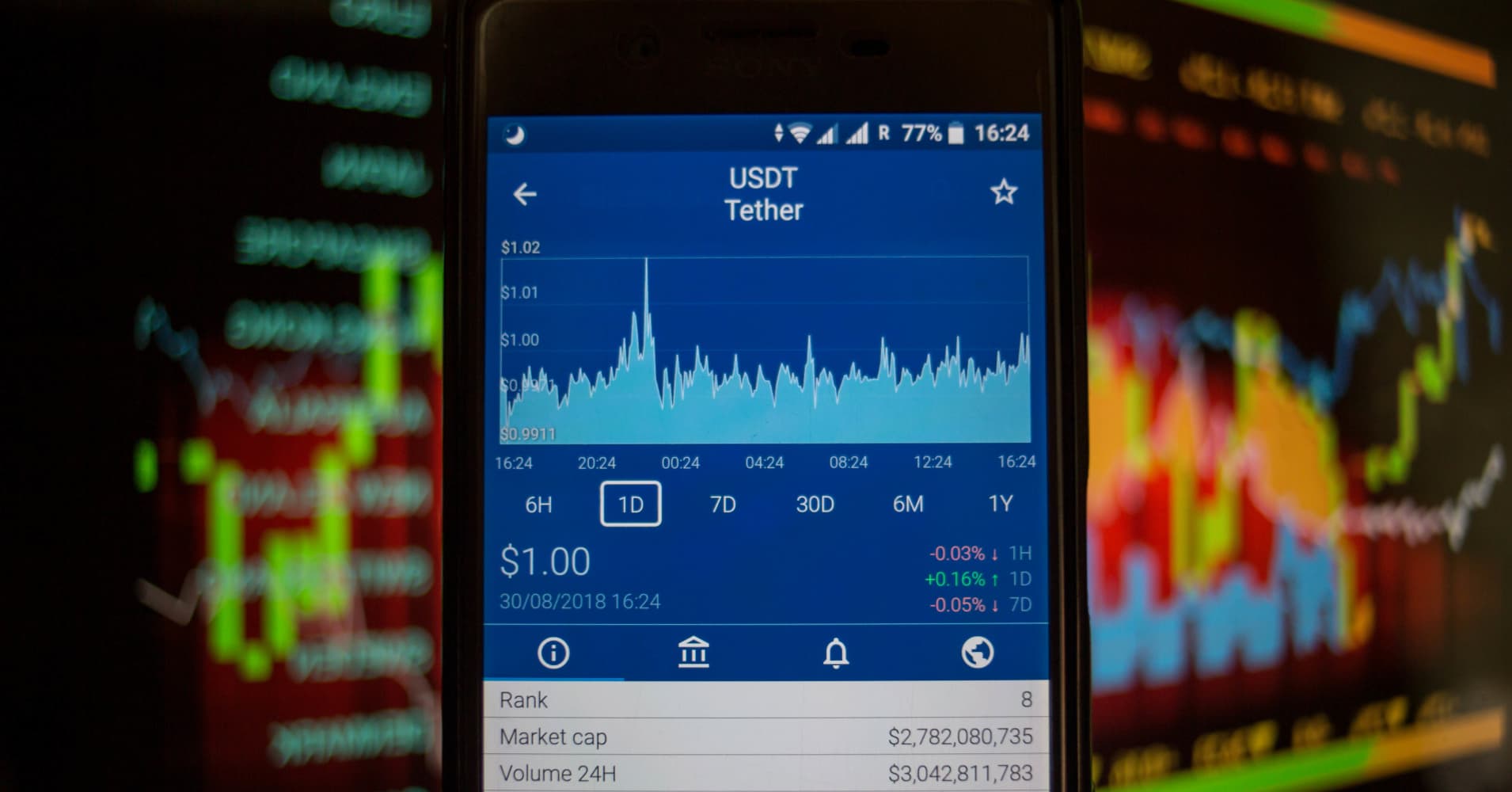

"There's concern about the thread and whether it's really supported by dollars and rumors that USDT (Tether) will be removed from various exchanges," said Charles CNT, the CEO of the CryptoCompare comparison site, in an e-mail.

Hayter also indicated a report from an industry publication that Bitfinex, a cryptocurrency exchange linked to Tether, had suspended deposits in US dollars, euros, pounds and Japanese yen.

"We would like to reiterate that although the markets have shown temporary price fluctuations, all USDTs in circulation are sufficiently supported by the US dollar (USD) and that assets have always exceeded liabilities," said Leonardo Real, Tether's chief compliance officer declaration to CNBC.

"In June 2018, a report by Freeh Sporkin & Sullivan, LLP (FSS), based on a random inspection of the balance of dates and a complete overhaul of the relevant documentation of bank accounts, confirmed that all batteries in circulation at that time data were actually supported with USD reserves. "

Bitfinex was not immediately available for comment when contacted by CNBC.

Tether is what is known in the industry as "stablecoin", a cryptocurrency linked to a currency supported by the government to avoid the common volatility in cryptocurrencies like bitcoin. The idea was also put into practice by the Goldman Sachs Circle company.