[ad_1]

[ad_1]

Top 5 Cryptocurrencies by market capitalization

2018 for many, was characterized by the almost annual decline in cryptocurrency prices. However, those who actively work in the cryptography industry have been mostly optimistic and believe that real progress has been made in terms of development and adoption during the year.

Many stakeholders in the industry also believe that the cryptocurrency bear market is a good thing, because it empties weak hands and helps to mature the market.

When it comes to the largest cryptocurrencies in existence, the top 5 by market capitalization today at the start of 2019 is very similar to that of the beginning of 2018, with 4 of the 5 cryptocurrencies remaining unchanged but with some changes in the rankings.

On January 7, 2018 the first 5 cryptocurrencies according to CoinMarketCap were:

# 1 Bitcoin, # 2 XRP, # 3 Ethereum, # 4 Bitcoin Cash, is # 5 Cardano

On January 7, 2019, the first 5 cryptocurrencies for market capitalization are:

# 1 Bitcoin, # 2 Ethereum, # 3 XRP, # 4 Bitcoin Cash, is # 5 EOS

So, what's in store for these leading cryptocurrencies in 2019? We take a technical and fundamental aspect of the first 5 cryptocurrencies by market capitalization to provide a forecast for 2019.

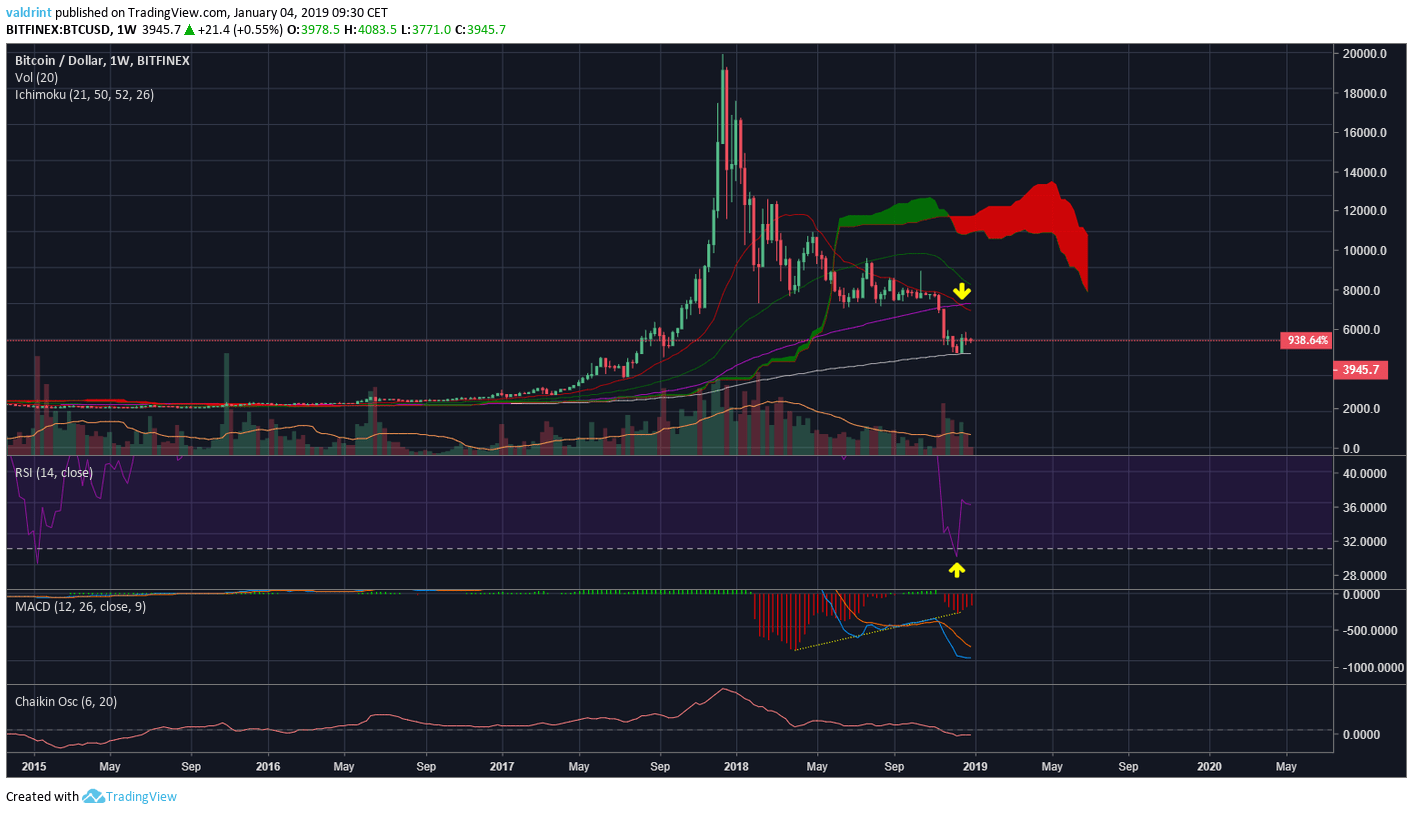

Bitcoin price analysis

Let's first take a look at the weekly table to try to give a diagram for the future price for Bitcoin.

The price found support in the 200-week moving average close to $ 3000, and a small rebound followed after touching it.

However, the price is facing the MA resistance of 7, 21 and 50 weeks and the 7 and 50 MA have just made a bearish cross (yellow arrow).

Furthermore, the RSI is <30, indicating oversold conditions with ample room for future growth.

However, there is still no upside divergence.

The MACD is negative, but there is a bullish divergence in development from April 2018.

The main resistance area is the previous long-standing support at $ 6000, while the next support area is at $ 2000, formed by the lows of July 2018.

Early Bitcoin developments

As for the new developments, now two exciting things are happening with Bitcoin: greater scalability / speed of transactions and greater interest from institutional investors.

Lightning network

Bitcoin transaction processing speed has a maximum of 10 transactions per second. The historical average is close to 3 per second. This gives an advantage to competing alternative coins.

The Bitcoin developers have announced the potential use of the Lightning network. The network uses the integrated functionality of the smart contract in order to allow exchanges through a secure network of contributors located off-line.

This would effectively allow transactions to happen on a separate blockchain compared to the main one. In short, this would make Bitcoin feasible for mass adoption.

Lightning Labs, a developer of the Lightning network, has shown its optimism for what is coming in 2019 via Tweet:

That year was for Lightning, and 2019 has so much in store: Neutrino, watchtowers, splicing, routing, privacy, mobile devices and more! 🚀📱⚡️

Happy new year, we're just starting! 🎆 https://t.co/0DjI9pk4eU

– Lightning Labs⚡️ (@lightning) January 1, 2019

Institutional involvement

Financial institutions are starting to heat up with cryptocurrencies and, in turn, releasing products to meet the increased demand.

The digital asset platform was launched by Fidelity at the end of 2018 and the FDD (Fidelity Digital Asset Services) platform should be released in the first quarter of 2019 in order to meet growing demand.

The launch would give their customers access to most of the major cryptocurrencies instead of Bitcoin and Ethereum.

Finally, the launch of Bakkt, which provides regulatory compliance and offers futures contracts for Bitcoin, is also expected.

The original release date was January 24, 2019, but has since been postponed to a later date pending CFTC approval.

Bakkt has completed its first round of financing on New Year's Eve $ 182.5 million raised by high-profile investors like Galaxy Digital, Microsoft and Intercontinental Exchange.

This certainly put Bakkt in a positive position to start 2019.

We are pleased to confirm that we have completed our first round of financing of $ 182.5 million https://t.co/Cc2EsoQMcT

– Bakkt (@Bakkt) December 31, 2018

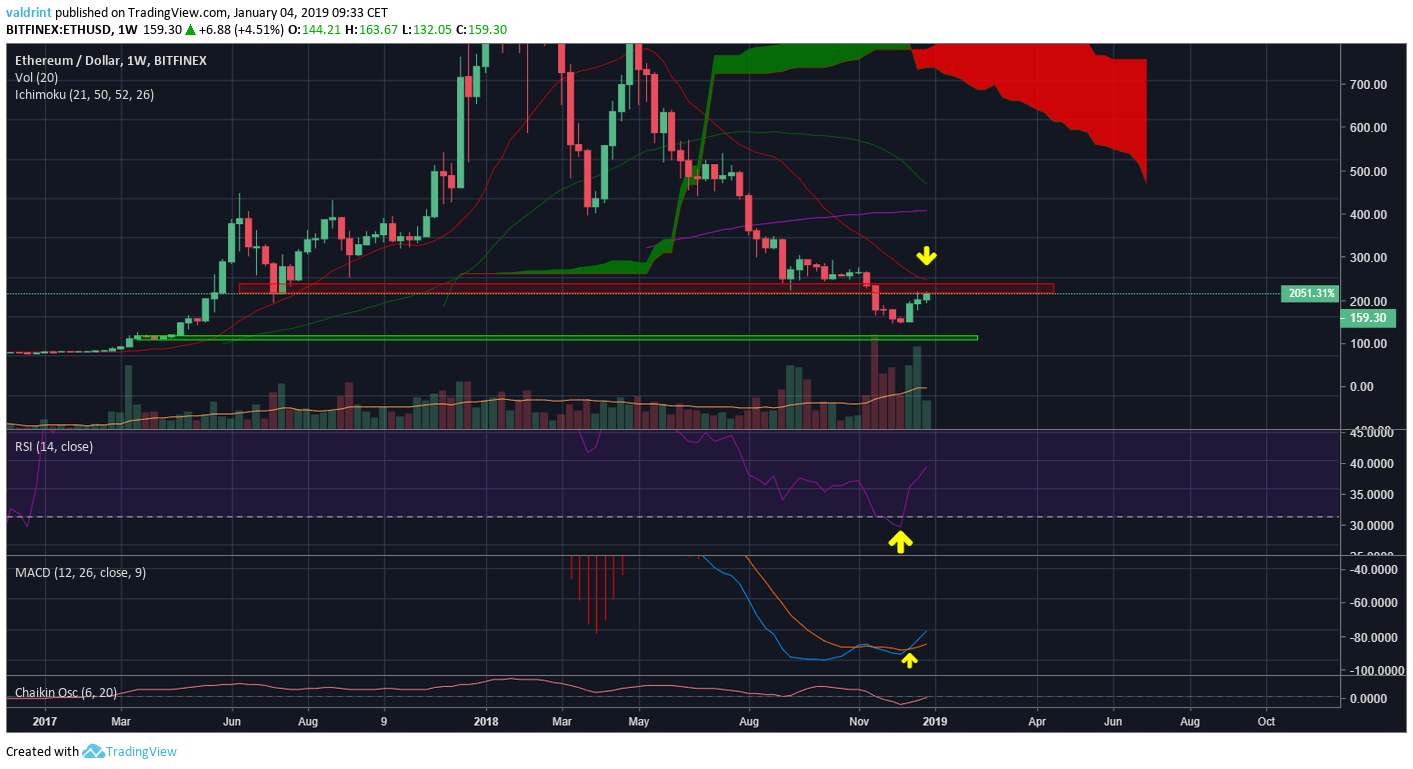

Price analysis of Ethereum

A look at the weekly chart of Ethereum shows that the price is facing significant resistance from both the moving averages and the resistance zones.

First, there is the $ 200- $ 220 area formed by the lows of August 2017 and August 2018. In addition, this area coincides with the 7-week moving average.

Finally, the MAs of week 7 and 21-50 formed bearish crosses.

The RSI was <30 for a short period of time that indicated oversold conditions before bouncing back to 38 along with the price.

Furthermore, the MACD has made a bullish cross and is climbing. The high March 2017 form the next support area at almost $ 50.

Developments of Ethereum in sight

Regarding its developments, the next update of Ethereum is scheduled for release in January 2019.

It's called Constantinople and aims to improve the efficiency of the blockchain and make it more resistant to the ASIC (which means that there will be no substantial increase in speed if the algorithm is implemented in ASIC rather than CPU) .

The upgrade is a difficult fork and will eventually generate a new Ethereum blockchain that includes EIP implementations. However, it is assumed that the miners will move to the new blockchain without much controversy.

The smart contracts present on the current blockchain will be simulated on the new one. There will be no new updates scheduled for the original blockchain.

Later in 2019 on an unspecified date, Ethereum plans a second update. It will include the implementation of the Casper protocol and also the sharding.

The Casper protocol aims to increase the security of the blockchain and at the same time reduce the risk of centralization. Furthermore, it aims to eventually eliminate environmentally and financially unsustainable mining practice.

While the update indicates a transition to Game Proof, it will eventually begin as a hybrid with the current protocol.

Sharding will allow the blockchain to achieve greater transaction speeds by dividing network resources such that a single node is not required to process every single transaction in the blockchain history in order to create a new transaction.

With numerous cryptocurrencies in a battle for the place with the highest alternative currency (altcoin), Ethereum will have to make the most of next year if he wants to keep his first place.

ConsenSys, a blockchain technology solutions company focused on Ethereum founded by Joseph Lubin, co-founder of the Ethereum project, reflected on 2018 and looked to 2019 in a recent article.

Get information from @ConsenSysMesh on the discoveries, challenges, expectations and goals they face #Ethereum is #blockchain technology as we get to 2019. #ConsenSys https://t.co/VRjOa6yXRZ

– ConsenSys (@ConsenSys) January 3, 2019

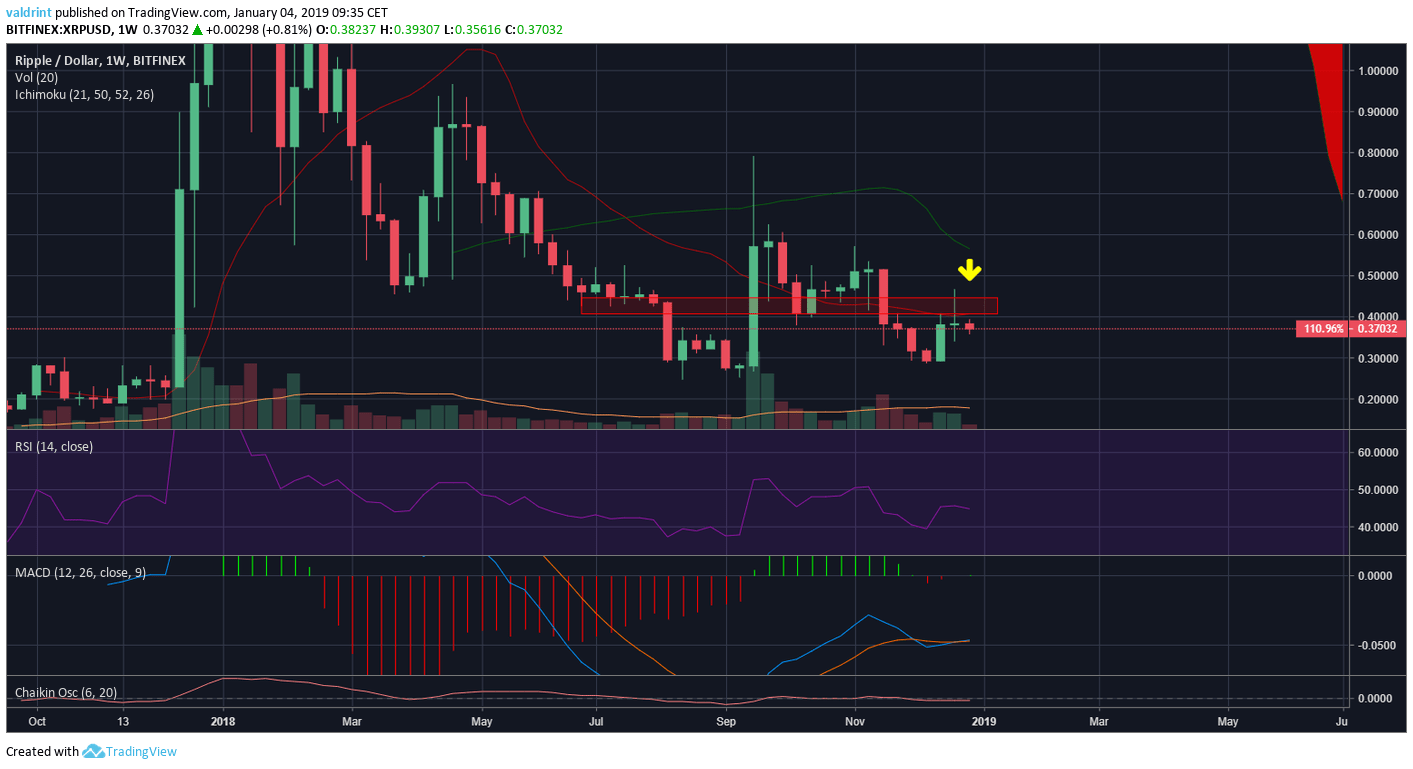

XRP price analysis

A look at Ripple's weekly chart shows that the price has increased very well close to 300% at the beginning of September, which has, in turn, traced almost completely.

Currently, the price is facing a lot of resistance from both the moving averages and the resistance zones.

First there is the resistance area of $ 0.4- $ 0.45 formed by the previous support in August and September 2018.

This area coincides with the 7-week moving average. Unlike most other alternative currencies, RSI for XRP has never entered oversold territory and is currently between 40 and 50 reporting indecisities.

There is a similar movement in the MACD, with both lines appearing undecided if they make a bullish or bearish cross.

Ripple early developments

Like many other alternative currencies, for Ripple there is no detailed roadmap available publicly.

Therefore, to try to understand what Ripple has in store for 2019, it is necessary to examine what the Ripple team has planned and any important new partnerships in place.

XRP has more use cases in real life than most other cryptocurrencies and on 2 January 2019 it was used to finalize the payment of an agreement linking BytePower, Soar Labs and the Australian ASX Crypto Exchange.

BytePower has reached an agreement with SoarLabs to make online payments using the payment service provided by Ripple.

In addition, Ripple reached an agreement with the National Bank of Kuwait in order to assist with the repatriation service provided by NBK.

The bank plans to use Xcurrent to make direct remittance transfers with the Jordanian country.

Finally, together with its partner American Express and the Chinese group LianLian, the company has successfully entered the Chinese market and the XRP token should soon be used in the currency exchange.

The Product at Ripple SVP has recently outlined some of what it has been expecting since 2019 in a recent video:

Clock @ashgoblue discuss how Ripple products including xRapid have evolved in 2018 and what do you expect from the new year. pic.twitter.com/3R4nttnbOa

– Ripple (@Ripple) December 28, 2018

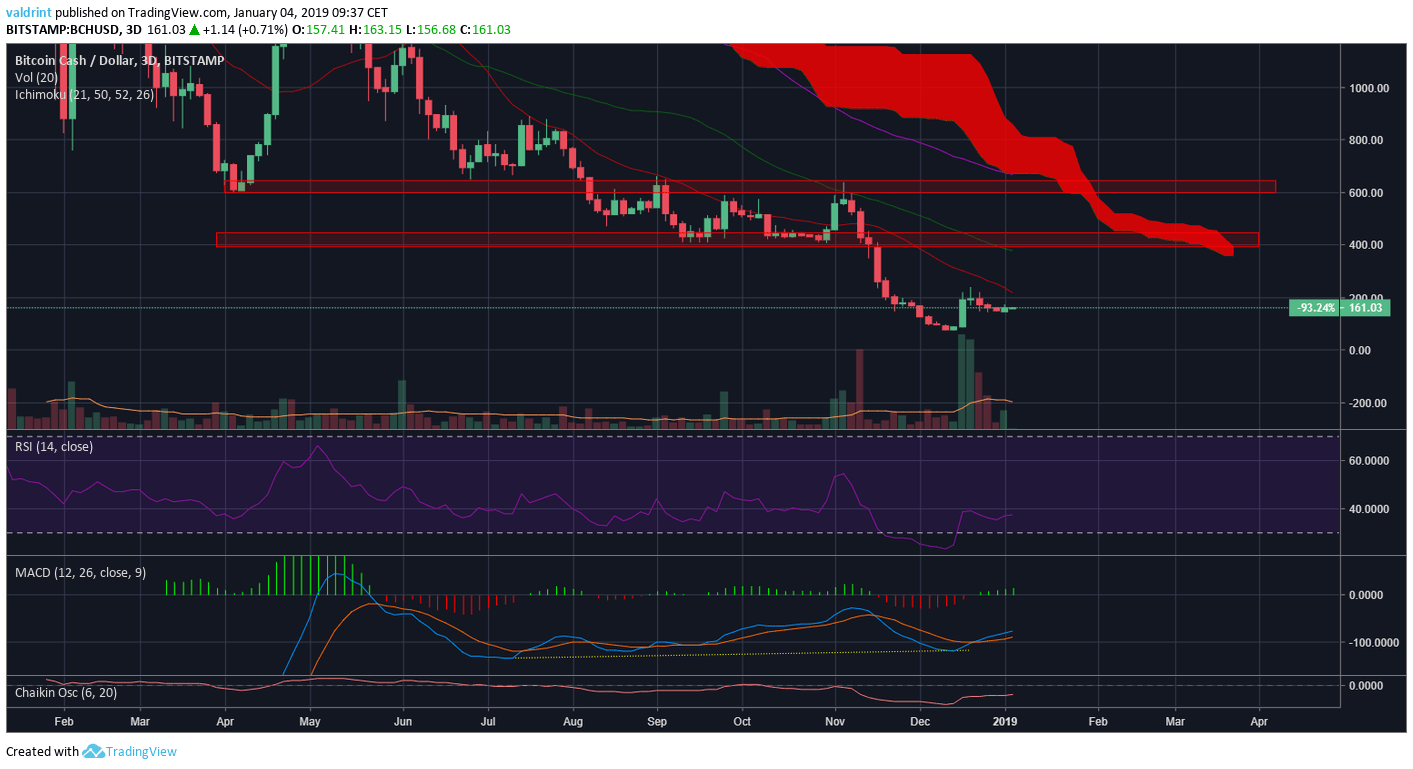

Bitcoin cash price analysis

A look at the 3-day chart for Bitcoin Cash offers a grimmer picture compared to other alternative coins. The price is facing more areas of substantial resistance.

Unlike most other cryptocurrencies, the price has fallen below all the main support areas and is currently in unexplored territory.

First, the price is facing the resistance of moving averages from 7-21 and the cloud.

The first main resistance area is located in the $ 400- $ 410 area formed by the previous support from September to November 2019.

The second main resistance area is in $ 600- $ 620, formed by the lows of April 2018 and subsequent highs in September-November.

The RSI went below 30 for a month, indicating oversold conditions, but there is still a bullish divergence.

However, since the month of July there have been significant bullish divergences in the MACD.

Liquidity developments in early Bitcoin

Bitcoin Cash remains the cryptocurrency n. 4 for market capitalization, despite the issues related to its hashing in 2018 and the difficult fork that divided Bitcoin Cash into two currencies, Bitcoin Cash and Bitcoin SV.

The roadmap is divided into three main sections: usability, scaling and extensibility.

The team wants to carefully implement several updates in order to achieve the goal indicated in the roadmap, that is "To become sound money that can be used by everyone in the world."

Their 3 main objectives are:

- Increases the capacity of Bitcoin Cash from 100 Tx / s to 5,000,000 Tx / s.

- Improve payment experience to make it reliable and immediate. A transaction must be blocked in a maximum of three seconds.

- Make BCC extensible. An extensible protocol will make future improvements less annoying and will provide developers with a solid foundation to build on.

In addition to the planned maintenance scheduled for May 2019, the other development update to be launched on an unspecified date in 2019 is called Coin Shuffle.

This protocol will increase privacy by adding an additional level of privacy, eliminating transactional data at no additional cost.

Roger Ver, an investor in Bitcoin start-ups, tweeted a link to the Bitcoin Cash roadmap in advance on December 22, 2018:

Bitcoin Cash is a technology that changes civilization that will dramatically increase human freedom and prosperity. Https: //t.co/g2px6Ey7Xi

– Roger Ver (@rogerkver) 22 December 2018

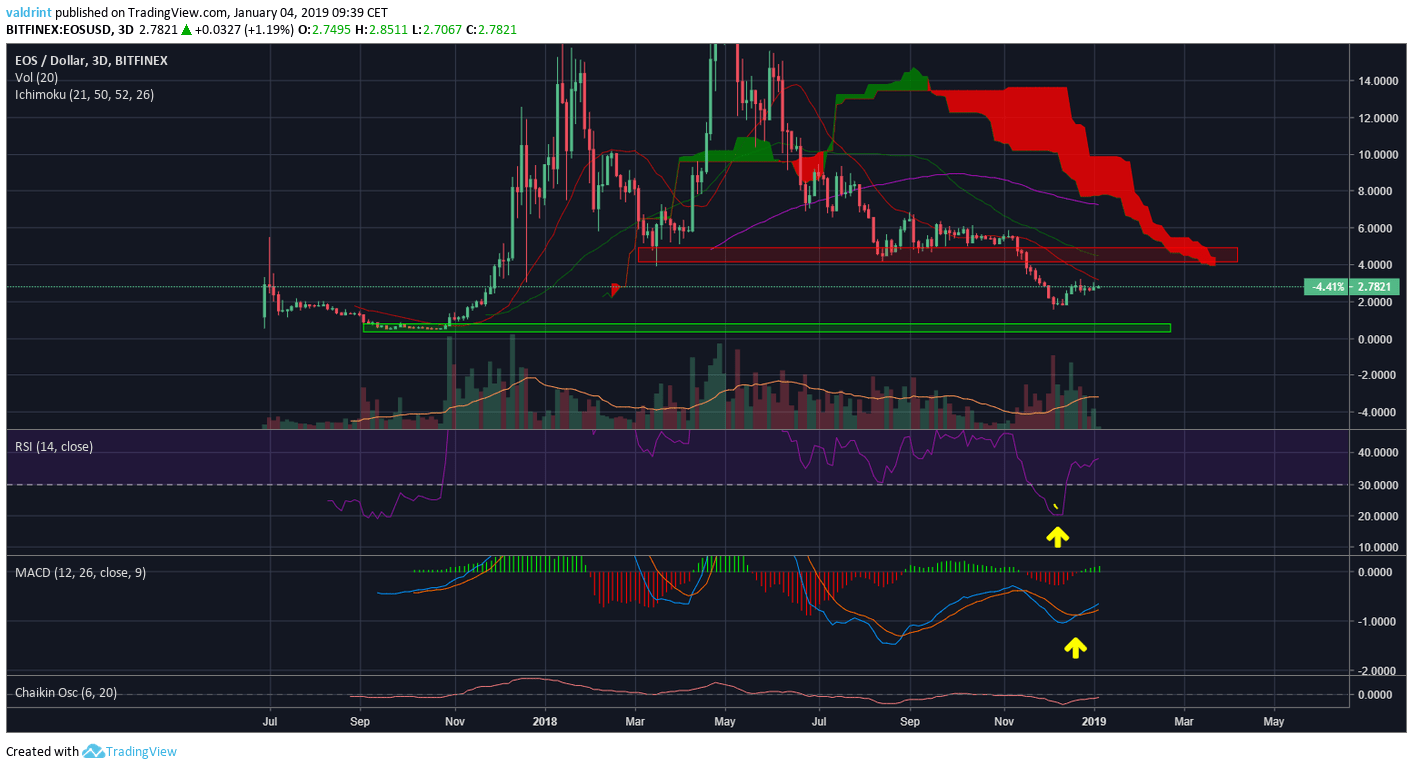

EOS price analysis

A look at the 3-day chart for EOS shows that the price is facing much resistance from moving averages from 7, 21 and 50 weeks and from the cloud.

The first area of greatest resistance is $ 4- $ 4.2, formed by the previous support in April 2018 and September 2019.

Furthermore, two downward traverses occurred respectively between the moving averages of the period between 50 and 7-21.

The RSI was in oversold territory at 20 before a slight rebound occurred, but there is still a bullish divergence.

There is a significant upward divergence developing in the MACD, which is trying to become positive for the first time since May 2018.

EOS developments in sight

The currently available EOS roadmap does not provide much detail in terms of dates; however, we can assume that the development of Dapps and the increase in funding within the EOS ecosystem will be a major goal.

A number of DApps are currently under development, falling into a number of categories such as: Voting and Governance, Gaming, Advertising and Media, Identity, Education, Health and Fitness, Social Networks, Exchanges, Privacy and Security and many others.

The #EOS ecosystem of blockchain-based applications #BuiltOnEOSIO continues to grow. Do you have a project that you would like to share with us? Write to [email protected] pic.twitter.com/HL1xagUvw9

– Block.one (@block_one_) December 20, 2018

Gaming DApps are also a popular area with the likes of EOSbet, EOSpoker and EOSdice.

One of the most promising DApps under development is Sense, which is essentially a decentralized messaging service currently under development Crystal Rose.

In addition, further updates on the mainchain are planned in order to make it a more desirable option for blockchain technology developers.

The EOS roadmap specifies that the cluster implementation phase (step 5) will occur on an unspecified date in the future. In order to solve scalability problems, EOS plans to complete the Inter-Blockchain communication protocol to use sidechains.

In first quarter of 2019, the Meet.one team will publish a sidechain on the main EOS network. It will be a true side chain and will not require the registration of a new account.

Conclusion:

What will happen by 2019 is impossible to foresee and remains to be seen. However, what is certain is that the current 5 major cryptocurrencies for market capitalization have many important future developments.

As for their prices, everyone is coming out of the decline all year long seen in 2018. Will this drop continue through 2019 or will it be another big year for investors like 2017?

The first 5 cryptocurrencies for market capitalization will be very similar to those that are now at the beginning of 2020, just as 2019 is starting very similar to 2018? Or other prominent cryptocurrencies such as Tron or Stellar will rise in the rankings and will carry more rebounds in the top 5 positions.

Do you think Bitcoin will still be the biggest cryptocurrency by market capitalization at the end of 2019? Please let us know your thoughts in the comments section below.

| NOTE: Investing or negotiating digital assets, such as those present here, is extremely speculative and involves considerable risks. This analysis should not be considered an investment advice, use it for information purposes only. The historical performance of the assets discussed is not indicative of future results. Statements, analyzes and information on blokt and associated or associated sites do not necessarily correspond to the opinion of blokt. This analysis should not be interpreted as advice for purchase, sale or storage and should not be taken as approval or recommendation of a particular asset. |

RELATED ARTICLES

MORE FROM OUR PARTNERS

Advertisement

[ad_2]Source link