[ad_1]

HodlX Guest Blog Submit your post

Bitcoin

Institutional investors are said to be accumulating Bitcoin through OTC markets despite the bearish market sentiment. While retail investors are panicking, it is said that institutional investors are acquiring Bitcoin, a hypothesis that leaves many doubts as to why the markets have not yet shown many signs of recovery when smart money is flowing in the space.

Professional traders and institutional investors are very cautious about accumulating new assets and are experts in acquiring them without affecting the market. There are a variety of hedge funds focused exclusively on investment in Bitcoin and venture capital funds that have begun to provide the financial support necessary for the next startups that have been dedicated to building applications and services for the Bitcoin ecosystem. .

During bear markets, institutional investors prefer bitcoins to altcoins because of positive sentiment and because BTC is the most established cryptocurrency.

The SEC has denied multiple applications of funds traded with Bitcoin as cryptocurrency enthusiasts eagerly await the approval of the first Bitcoin ETF. Many bet on the institutionalization of Bitcoin once the new traditional investment vehicles are made available to investors.

Ripple

Unlike most decentralized projects, Ripple focuses on connecting banks, payment service providers, digital resource exchanges and companies through blockchain technology. Although XRP, the cryptocurrency used by Ripple's xRapid, is accused of being centralized, it remains popular due to the fact that investors recognize the convincing value proposition to link existing financial institutions and remittance services through generalized accounting technology.

Originally published in 2012, Ripple has succeeded in building a broad list of customers that includes public banks, central banks, technology companies and companies. The value here is the Ripple network that provides a reliable solution for moving goods quickly around the world, which is used by banks to move money between different foreign countries.

Ethereum

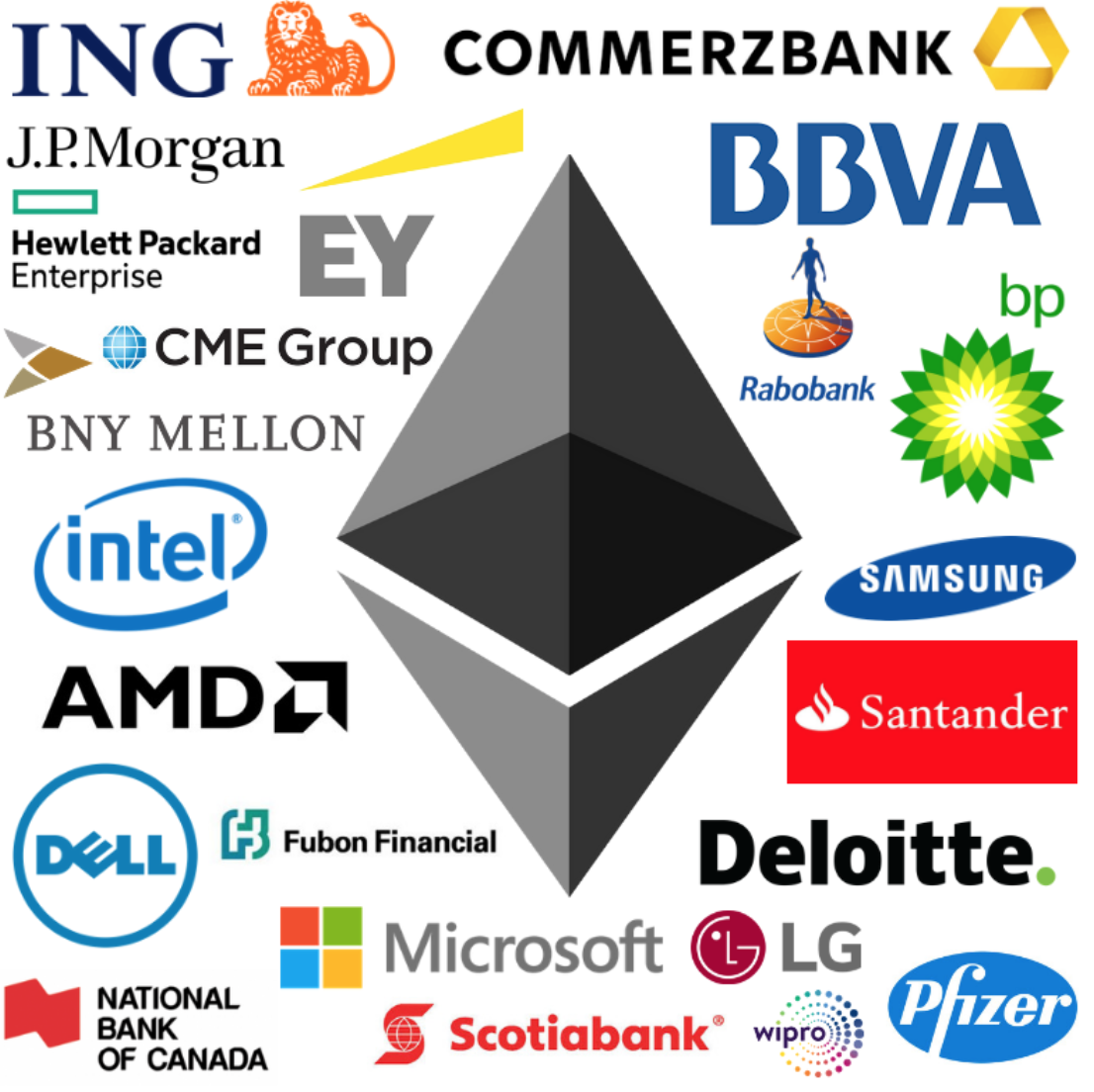

By far the most used blockchain protocol for companies to release their native digital currency token, Ethereum enables intelligent contract functionality that has managed to get the attention of large institutions and corporations. While Ethereum is classified as a decentralized project, it has succeeded in attracting companies such as Microsoft, Samsung, LG, Intel, AMD, BP and financial institutions such as JP Morgan, CME Group, Scotiabank and Commerzbank. Due to the great popularity of the project, the Ethereum Enterprise Alliance (EEA), composed of over 300 members, was formed to help connect established organizations with blockchain developers interested in creating applications on Ethereum.

Aergo

An upcoming fourth-generation blockchain project that plans to help businesses use generalized accounting technology, Aergo relies on proprietary software known as Coinstack. Aergo is a hybrid blockchain open to the public and designed to help large companies implement their favorite blockchain. Famous fund VC Sequoia Capital, known for focusing on the technology sector and supporting Forbes 500 companies, it is one of the many VC companies investing in Aergo, along with FBG, GBIC, Arrington XRP, Dekrypt, Rockaway, Neo Global and Divergence Digital.

The project will help companies adopt blockchain technology by facilitating the design and implementation of decentralized applications on private or public chains or a mix of both. Aergo plans to provide Blocko, Korea's leading blockchain infrastructure provider, with a more decentralized solution to serve its existing customers, including Shinhan Bank, Samsung, Lotte Card, KRX and the South Korean government.

OmiseGo

A decentralized payment solution provider and a banking, exchange and blockchain gateway for businesses, OmiseGo was created by the parent company Omise, a payment services company based in Japan, Singapore, Indonesia and Thailand.

Omise is a popular payment gateway solution in Asia, well established in Thailand and backed by major companies like McDonald's, Burger King, Allianz, Axxa and SCG. The company has shown impressive growth since its inception in 2013. It is expected that once OmiseGo is fully operational with its mainnet version, Omise traders will move to the decentralized blockchain network.

Vechain

A project that aims to disrupt the supply management sector by exploiting a blockchain-based platform that digitizes the supply chain and addresses the counterfeiting of goods, Vechain is essentially a Blockchain-as-a-Service company that plans to create a reliable network for companies to collaborate and track inventory in a decentralized ecosystem.

With the implementation of a distributed public ledger, Vechain hopes to improve supply chain management by combining the Internet of Things (IoT) with blockchain technology. Manufacturers can easily monitor and manage supplies, as all information is made available on the Vechain public blockchain. Consumers will also have the opportunity to determine the quality and authenticity of the products sold. The project has secured some high-level collaborations with PricewaterhouseCoopers, Gui's Government, Shanghai Waigaoqiao's direct imported goods sales center, DNV GL, BMW and China Unicom.

Icon

![]()

A project dedicated to helping companies to implement their books distributed master, ICON is an independent chain that connects multiple community sidechains, allowing cross-platform data and values to be communicated.

Located in South Korea, a country that is considered the most cryptic nation in Asia, ICON has established a series of strategic partnerships with major companies such as Line, Samsung Electronics, Smilegate and SK Planet. The project is diversifying its reach by collaborating with the Korean government on numerous initiatives in the health, education, insurance and customs sectors.

Vasilios Filip

Vasilios Filip joined Bitcoin in 2015, believing that the distributed ledger technology would have destroyed traditional financial services and banks. With a background in law and economics, he has since kept the blockchain applications eyeing while he spent his time writing about anything encrypted.

Join us on Telegram

Disclaimer: The opinions of our guest writers are exclusively their own and do not reflect the views of The Daily Hodl. These opinions expressed are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and operations are at your own risk and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of any cryptocurrency or digital assets, nor The Daily Hodl is an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Check out the latest news

Source link