[ad_1]

[ad_1]

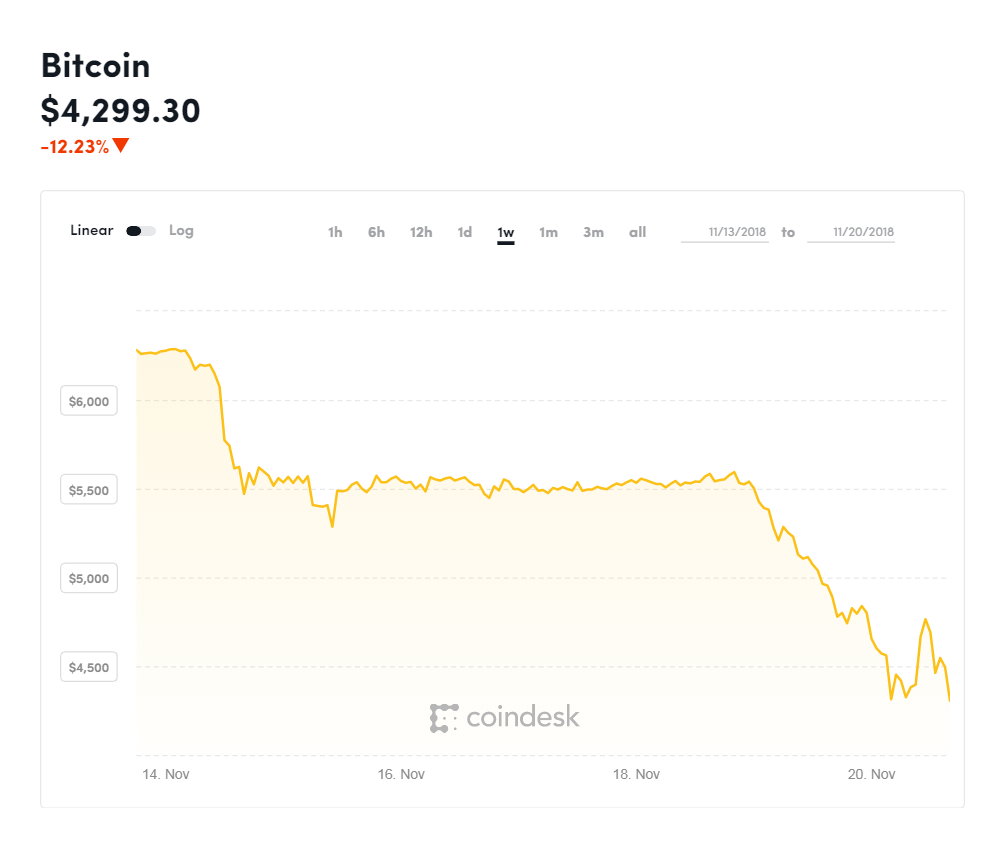

Bitcoin could feel the effect of other global markets slipping this week.

"Markets around the world are fragile and panic and sentiment are playing a disproportionate role right now," he told CNBC Tuesday, Tom Lee, co-founder of Fundstrat Global Advisors. "Does this mean that the bitcoin is broken? No. The case of use is still there, but in the short term, the panic is panic"

A fall below $ 6,000 before and other major technical levels this week have triggered "stop losses" for some traders and probably have exacerbated the sale. These technicians "deteriorated" when bitcoin support levels were interrupted and the cryptocurrency continued to hit the lowest lows, Lee said.

He also indicated the application of the Securities and Exchange Commission to several cryptocurrency projects last week due to the precipitous decline. The SEC announced its first civil sanctions against the founders of cryptocurrency on Friday as part of a comprehensive regulatory and legal crackdown on the abuses and definitive frauds in the sector.

Even reports of possible manipulation of the cryptocurrency market have accumulated on negative sentiment. The US Department of Justice is considering whether traders used another cryptocurrency called tether to raise bitcoin prices during its rally last year, Bloomberg News reported, citing three people who familiar with the question.

Lee, former chief strategist of J.P. Morgan, and others have indicated a "fork" in the bitcoin cryptocurrency money. That digital currency split into two versions last week – "Bitcoin ABC" and "Bitcoin SV" – and hijacked what is known as "hash power", which analysts hit the broader crypto markets.

"The 'war hash' between Bitcoin Cash ABC [and] SV continues to have an impact on the market, "said Brian Kelly, CEO of the founder of BKCM." Both sides seem to sell bitcoins to finance mining activities to win the battle. "

The decline also comes as a result of a warning from the member of the Executive Board of the European Central Bank Benoit Coeure at the Bank for International Settlements in Basel. According to Bloomberg News, Coueure called it "the evil progeny of the financial crisis" and said it agreed with the head of the BIS Agustin Carstens, who in June defined the cryptocurrencies "in a nutshell, a bubble, a Ponzi scheme and an environmental disaster ".

Clarification: this story has been revised to clarify the summary lines that the bitcoin has reached at the lowest level since September 2017.