[ad_1]

[ad_1]

Introduction

The cryptocurrency market is changing. The hype prize has been significantly reduced and I think we are approaching a Bitcoin fund (BTC-USD) (OTCQX: GBTC) (COIN), which could overturn the market. The SEC is ready to make a decision on two other Bitcoin ETFs this Thursday, August 23rd. I think the approval of the ETF is unlikely. If I'm right, this could drive prices to even lower levels.

Meanwhile, many sovereign nations are working on their cryptocurrency to avoid the US dollar. The stage is ready to boil the widespread tensions due to trade policy and sanctions that lead to a new generation of cyber war.

SEC decision coming up

The SEC has denied or delayed on every Bitcoin ETF so far. I think the next decision on the ETF ProShares Bitcoin will not be different and the reason is simple. Nothing has changed since the last decision.

The Wilklevoss twins decidedly refused, deciding to form a self-regulating organization to combat bad behavior in space. But how long will it take to see some significant results of this effort?

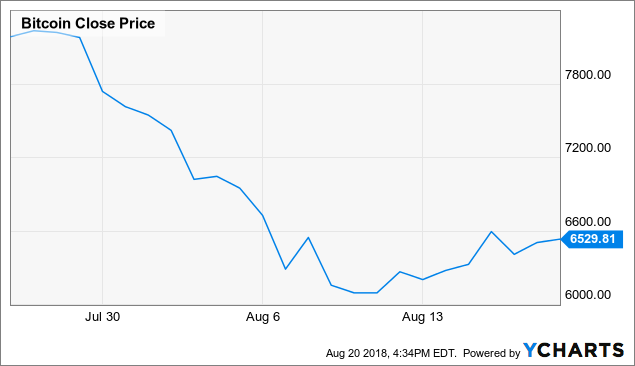

Since the ETF (COIN) was denied by the SEC, on July 26, the price of Bitcoin fell from the range of $ 8k to the $ 6k range that we are seeing now.

Bitcoin Close YCharts price data

Bitcoin Close YCharts price data

Recall that this ETF was also rejected in March, which caused a similar reaction from the market.

Bitcoin Close Price Data on YCharts

Bitcoin Close Price Data on YCharts

I see no reason to expect a different reaction from another ETF rejection.

The fund is close

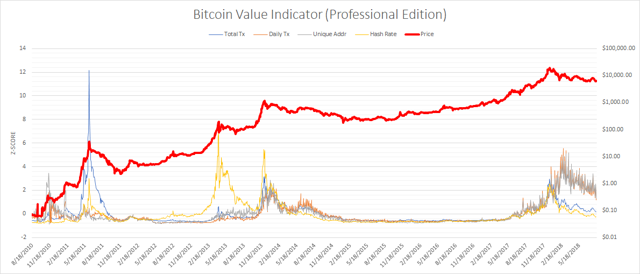

Some of you may be familiar with the Bitcoin value indicator; My humble attempt to place the current bitcoin price somewhere on a spectrum that varies from high to low, in order to possibly identify long-term buying and selling opportunities. I insert a new one every month, but I also worked on a more advanced version called BVIPE, Bitcoin Value Indicator – Professional Edition. Members of my new marketplace, Crypto Blue Chips will have access to this model, which is updated every week and operates on a larger data set.

I wanted to post a preview here, because when we take it in a more granular level version; things get interesting See below:

What you are observing here are four metrics of the Bitcoin network traced in time with the Bitcoin price. The price is on the right Y axis in the register scale. The four metrics are in standardized Z-score, drawn on the left Y axis. The four metrics are daily transactions, unique addresses, hash rate and total transactions. Each has a high correlation with the bitcoin register price.

What you are observing here are four metrics of the Bitcoin network traced in time with the Bitcoin price. The price is on the right Y axis in the register scale. The four metrics are in standardized Z-score, drawn on the left Y axis. The four metrics are daily transactions, unique addresses, hash rate and total transactions. Each has a high correlation with the bitcoin register price.

High Z scores indicate that the price of bitcoin has grown faster than expected. Similarly, a low Z score means that the network is growing faster than the price. As you can see, when the Z scores have gone in the past, it was a good time to leave the market. When they were low, it was a good time to enter.

As you can see, even if the price of the bitcoin still looks higher than three of the four BVIPE metrics you think it should be, now we have one metric below the average and a second that flirts with zero on the Z score scale .

It is not possible to predict the absolute lower or upper part of a cryptographic bubble. However, using tools like BVIPE, I think we can get somewhere in the neighborhood. If you want to know more about how BVIPE works, take a look at Crypto Blue Chips on September 1st.

The Bitcoin conversation

In the last and last bitcoin bubble, the conversation focused almost entirely on price. However, when we enter the Trough of Disillusionment, this has started to change. Along with a noise reduction, there was something deeper, more fundamental in the game.

Money as a weapon

A recent article in The Hill was titled "While Iran is turning to Bitcoin and its cryptocurrency to avoid sanctions, perhaps it is time to build another Stuxnet."

For those of you unfamiliar, Stuxnet was an elaborate computer virus that had been used to cause a system failure in Iran's nuclear enrichment facility. The implication here is that as money becomes more and more digital, we can see a series of weapons that address the monetary system itself.

So far we have seen several countries talk, or take steps to try to take advantage of Bitcoin's technology to circumvent sanctions from the United States.

Venezuela

Venezuela created the "Petro" cryptocurrency, supported by the country's oil reserves in a desperate attempt to save the country from US sanctions and ultimately financial implosion.

Iran

In response to the sanctions imposed by Donald Trump, Iran is working on their cryptocurrency.

We are trying to prepare the reasons for using a national digital currency in the country. This currency would facilitate the transfer of money (to and from) anywhere in the world. Furthermore, it can help us with sanctions – Alireza Daliri, PressTV

Russia

President Putin has announced plans for a "CryptoRuble", a new national currency.

The BRICS

The BRICS are also considering the possibility of creating their own cryptocurrency for the same purpose, avoiding the power of US sanctions. It is not a small thing since the five countries that form the BRICS, Brazil, Russia, India, China and South Africa make up 41% of the world's population.

The head of the Russian Direct Investment Fund (RDIF) Kirill Dmitriev said that the BRICS could decide to create their own cryptocurrency for global trade purposes. – Mint Press News

What will the United States do if the sanctions stop working?

It does not take much imagination to understand this. If we can not push people around with our economy, then we will turn to our weapons as we have always done in the past. The difference now is that in addition to weapons, bombs and royal troops, the scope of possibilities includes cyber warfare. If the government supports digital currencies it will become the norm, so they will certainly be priority objectives.

What does this have to do with Bitcoin?

Some of you wonder what the hell this has to do with Bitcoin. After all, if each of these countries is implementing their own version of a pure digital currency, it may or may not have something to do with Bitcoin.

Here's the problem, we can create a purely digital national currency right now and we do not need a blockchain to make it happen. The problem lies in the fact that almost all the computer systems we have been compromised. The problem is security.

So if a country makes its own digital currency, it's great until it's compromised. But how can you avoid being hacked? Well, there are only two ways we know.

- You move away from you and restrict access based on concentric circles of trust. If the system fails, restore one of your many backups.

- Do you use a blockchain?

The promise of a national currency based on the blockchain is that you could have a system like Bitcoin that would be very difficult to attack. But how to do it? In a world where all money is digital, what prevents bad actors from simply hijacking the money system and transferring all the money to themselves?

This is the point where Bitcoin returns to the stage. How does Bitcoin offer such a high level of security? After all, Bitcoin has never been hacked. Maybe there is something in this Bitcoin project?

Conclusion

In the short term, the SEC decision on two other Bitcoin ETFs will be announced on Thursday 23 August (or earlier). If they are denied, the market may fall as it did with the denials of the ETF in the past. This could bring the price of bitcoins back into the purchase territory. If so, this could be a good place to start.

In the long term (general framework), the revolution in digital money has many far-reaching implications. One of these is that we could soon live in a world where economic sanctions become irrelevant. If the United States can not effectively assert its will by using the US dollar, then surely it will turn to other means. These can include traditional military actions, but also direct attacks on sovereign currencies (cyber warfare v2.0). This will force the issue of digital security to return to the forefront; and I think this will be good for Bitcoin investors, as they will retain the most secure digital asset in existence.

Disclosure: I am / we long BTC-USD, ETH-USD.

I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose title is mentioned in this article.

[ad_2]Source link