[ad_1]

Bitcoin revisits the delay of YTD, Crypto In Turmoil

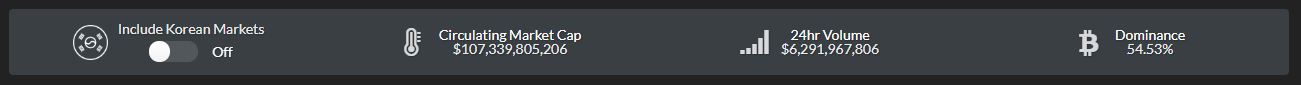

After holding $ 3,350 to $ 3,500 for a few days, Bitcoin (BTC) faltered on Thursday, dropping below $ 3,300 to stand at a low from the start of the year – $ 3,220. From the Wednesday market update of Ethereum World News, the collective market value of all the cryptocurrencies in circulation amounted to 107.5 billion dollars, approaching the historical lows since the beginning of the year, down from 111.4 billions of dollars yesterday. This difference represents a 3.5% loss in market capitalization, not the most promising sign for blockchain-based activities, such as BTC.

It is interesting to note, however, that volumes started to rise slightly to adapt to the market, with the 24-hour volume shifting to $ 6.25 billion for data compiled by Live Coin Watch. The same statistical data was just $ 5.94 billion yesterday.

In all this tumult of the market, with the displeasure of the maximalists and the analysts of Bitcoin, the dominance of the BTC market has maintained, barely passing from 54.5% of this figure. Still, some experts expect BTC to achieve a relatively better performance in the coming months, while ICOs and altcoin projects are collapsing due to increased financial and regulatory pressure.

After a period of series trading that spanned more days, Thursday finally saw BTC undergo significant price actions. The resource fell to $ 3,380 on Thursday morning, finding a short-term basis at $ 3,320 before capitulating further. After holding $ 3,260, the major cryptographic asset peaked at $ 3,220, presumably due to a large sales order. This marks the second, if not the third time in two weeks, that Bitcoin has visited the 3,200 lows, where is the minimum since the beginning of the year.

At the time of writing, BTC found itself at $ 3,250 on Coinbase (note: the global average is $ 3,330), making the asset down 4.19% in the past day. Curiously, the BTC actually underperformed today's altcoins, not a common sight in a dismal scrambled market.

The XRP, for example, has published a relatively low number 2.08% loss, while Ethereum (ETH) barely beats the BTC, finding itself down 3.76% in the last 24 hours. Yet there were still some goods that suffered, including the Stellar XLM (-6.72%), Bitcoin Cash (-9.31%)and Bitcoin SV (-10.43%). Most of the altcoins not mentioned in this article corresponded to Bitcoin's performance.

Analyst: the public wrote cryptocurrency as a craze

By issuing a comment to MarketWatch about the current status of the crypt, Jani Ziedins, a CrackedMarkets analyst, noted that the lack of action and the inability to break out of Bitcoin should be a concern for investors. He wrote that the longer these depressed price levels are maintained, the more the BTC becomes close, not undervalued, making it less likely that the cryptocurrency market will erupt.

The investor added that "the public has largely written cryptocurrencies as a passing fashion" and as such, retail money has been slow to flow – a "big responsibility" in the eyes of Ziedins. However, some may ask to disagree with Ziedins's statements.

Fervent crypto supporter Tom Lee, head of research at the Wall Street Fundstrat, recently told his clients in a memo, broadcast by Bloomberg, who still considers BTC undervalued. Lee stated that Bitcoin, with its "fair value", should have a valuation of $ 13,800 to $ 14,800 a piece, in particular due to the growing number of active addresses, increased transaction counts and the nature of the transaction. assets as a deflationary asset, or reserve of value.

And Lee is not alone, as there are a number of analysts who have maintained their confidence in cryptocurrencies, especially from a long-term perspective.

Full Moon Title Image Courtesy of John Silliman on Unsplash

Source link