[ad_1]

Crypto Market sets the minimum since the beginning of the year: Bitcoin at $ 3,650, Ethereum Hits Double-Digits

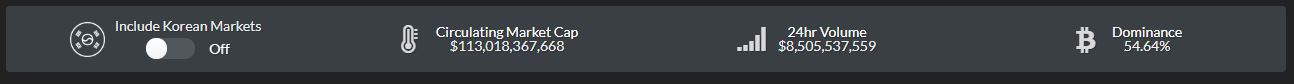

In the past day, the bears have not diminished their fury, continuing to place incessantly straws on the back of the crypto camel. Bitcoin (BTC), for example, continued its turmoil, stumbling under $ 3,500. Altcoins, as always, followed the example by sending the aggregate value of all cryptocurrencies below $ 120 billion. At the time of the press, the current market capitalization of this market fell to $ 113 billion, unless a new minimum has been set since the beginning of the year.

With decreasing cryptocurrencies, losing an average of 8% across the board, 24-hour volumes also saw a slight renaissance, rising to $ 16.5 billion (~ $ 8.3 billion adjusted), compared to $ 14 billion seen in the previous Ethereum World News market update.

Now let's talk about BTC.

On Wednesday, after falling below $ 3,800, the households' assets in the sector found themselves above the price level mentioned above for a certain number of hours, failing to bear a lower leg sufficiently. As the candle burned at both ends Wednesday evening / Thursday morning, BTC suddenly experienced an unexpected surge, pushing the $ 3,800 resource to over $ 3,925 in minutes. While this occurrence of unexplained multi-percent candles is common in crypts, especially with BTC, this recent move "Bart", like his brothers, can not be adequately explained.

Regardless, after this move, BTC started to stumble, starting a short downward path, supported by renewed volumes and a different market sentiment, most of which unfortunately fell.

At the time of writing this article, Bitcoin found himself at $ 3,500, almost revisiting his minimum since the beginning of the year as expected by Ethereum World News. It is interesting to note that a number of analysts aimed at $ 3,500 as interest, with Nick Cawley of Daily FX who told MarketWatch that with a "lack of news to guide the move", BTC could find some semblance of support for $ 3,500.

This call for such support echoes the sentiment held by eToro's internal cryptography expert Mati Greenspan, who recently noted that while $ 4,000 has near-zero resistance, there is a $ 3,500 and $ 4 buyback pressure. 3,000.

In this way, XRP underperformed the BTC by 1%, falling to $ 0.31. Ethereum (ETH) was found today under $ 100, falling to $ 91 for the first time in over a year.

While the altcoins, for the most part, closely followed the BTC, there were some notable anomaly values. Bitcoin Cash (BCH), which has recently been the subject of an innovative fork, has grown 20% above $ 100, approaching the value in dollars of Eth. BCH's strong downward move is in direct correlation with the 19% gain in BSV, with some analysts expecting Bitcoin Cash forks to turn in due course.

It is interesting to note that, in the midst of this continuous sale, an unexpected theme began to manifest itself in the underlying folds of cryptography. This theme, of course, is the discussion concerning the domain of the Bitcoin market, a historical topic of interest in this nascent market.

A. Kearney, a multinational management consulting firm, recently published a report expressing his sentiment that the dominant position in the Bitcoin market could "almost" reach two-thirds of the aggregate capitalization of cryptocurrencies. Citing the reasons for this 66% target, which is not out of the realm of possibility, the American company has said that the altcoins have "lost their luster" due to the growing risk aversion tactics enlisted by retail investors.

Despite the downward trend, the analyst expects "Tailwinds" crypto

Speaking with MarketWatch, Ian McLeod of Thomas Crown Art, a blockchain-centric art startup, said that in 2019 there could be a number of favorable winds for the cryptocurrency market. McLeod said:

"There is a growing list of investments to be taken into account for 2019. These include strong commercial tensions, rising interest rates, political uncertainties, including Brexit, and compliant financial markets … In this context, we can expect cryptocurrencies to be increasingly seen as investors "safe havens" in 2019 and beyond.

McLeod evidently touched on the sentiment that while the traditional market is faltering, consumers in general will shift to BTC and other digital resources to mitigate the risk of holding assets with centralized entities.

The aforementioned participant in the industry is not the only one to propagate such winds of advantage for cryptocurrencies. Anthony Pompliano, a beloved Bitcoin advocate better known as "Pomp," recently kicked off Off The Chain, a cryptographic publication focused on the institute he founded, to spread the boom in fundamentals in the industry.

Reminding readers not to be distracted by noise – the daily developments of the cryptographic market – Pomp noted that while BTC has declined, Bitcoin has increased in terms of transaction counting, average TX commissions, complete nodes and hashrates.

Title Image Courtesy of Marco Verch Via Unsplash

Source link