[ad_1]

[ad_1]

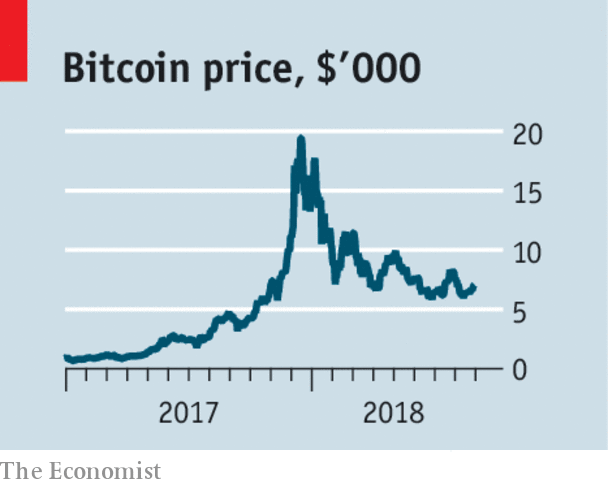

An old saying holds that markets are governed by greed or fear. Greed once governed cryptocurrencies. The price of Bitcoin, the best known, rose from around $ 900 in December 2016 to $ 19,000 a year later. Recently, fear has been responsible. The price of Bitcoin has dropped to around $ 7,000; even the prices of the other cryptocurrencies, which they followed during the ascent, have collapsed. Nobody knows where the prices will go from here. Calling the bottom in a speculative mania is silly as calling the top. It is particularly difficult with cryptocurrencies because, as evidenced by our technological quarter this week, there is no sensible way to achieve a particular evaluation.

It did not have to be this way. Bitcoin, the first and still the most popular cryptocurrency, was born as a techno-anarchist project to create an online version of money, a way for people to make transactions without the possibility of interfering with malicious governments or banks. Ten years later, it is barely used for the intended purpose. Users must deal with complex software and renounce all consumer protections they are used to. Few sellers accept it. Safety is poor Other cryptocurrencies are used even less.

With few uses to anchor their value and little in terms of regulation, cryptocurrencies have instead become a focal point for speculation. Some people have made a fortune while the prices of cryptocurrencies have enlarged and enlarged; many early bettors were cashed. Others have lost money. It seems unlikely that this last boom-bust cycle will be the last one.

Economists define a currency as something that can at the same time be a medium of exchange, a store of value and a unit of account. The lack of adoption and volatility loads mean that cryptocurrencies fulfill none of these criteria. This does not mean that they will leave (even if regulators' control over fraud and the acute practice that is common in the industry could dampen excitement in the future). But as things stand there are not many reasons to think that cryptocurrencies will remain more than a complicated and unreliable casino.

The blockchain, the underlying technology that powers cryptocurrencies, do they do better? These are thought of as an idiosyncratic database form, where records are copied between all users of the system rather than managed by a central authority and where entries can not be changed once they are written. The supporters believe that these characteristics can help solve all kinds of problems, from rationalization of bank payments and the guarantee of the origin of medicines for the protection of property rights and the provision of non-repayable identity documents for refugees.

Nothing to lose but your blockchain

Those are big statements. Many are made by cryptocurrency speculators, who hope that fueling excitement around the blockchain will increase the value of their holdings related to cryptocurrency. However, companies that distribute blockchain often end up eliminating many of the features that make them distinctive. Furthermore, continuous data transfer between users makes them slower than conventional databases.

As these limitations become more widely known, the hype is starting to cool. Some organizations, such as SWIFT, a network of bank payments and Stripe, an online payment company, have abandoned the blockchain projects, concluding that the costs outweigh the benefits. Most of the other projects are still experimental, although this does not stop the wild claims. Sierra Leone, for example, has widely reported that it conducted a "blockchain-powered" election at the start of this year. It was not like this.

Just because the blockchains have been overhyped does not mean they are useless. Their ability to link their users to an agreed way of working can be useful in arenas where there is no central authority, such as international trade. But they are not a panacea against the usual dangers of big technological projects: costs, complexity and expectations that are too crude. Cryptocurrencies have not been at the height of their ambitious goals. Supporters of Blockchain still have to prove that the underlying technology can be at the height of the big claims made for this.