[ad_1]

[ad_1]

Just six days after Bitcoin's tenth birthday celebration, I take into account how it was developed and adopted by users.

The ultimate goal is to empower their users and with this comes responsibility, as claimed by Jordan Peterson.

The proof of key events, which took place on January 3, is a way to ensure that more centralized players, such as exchanges, do not overstep their boundaries by investing what is not legitimate to them.

Bitcoin: The Early Days

Bitcoin Talk

Today's Bitcoin is considerably different from the Bitcoin published by Satoshi a decade ago. This is a good thing, which means that a large community of people has left this decentralized idea of money behind and has improved its functioning.

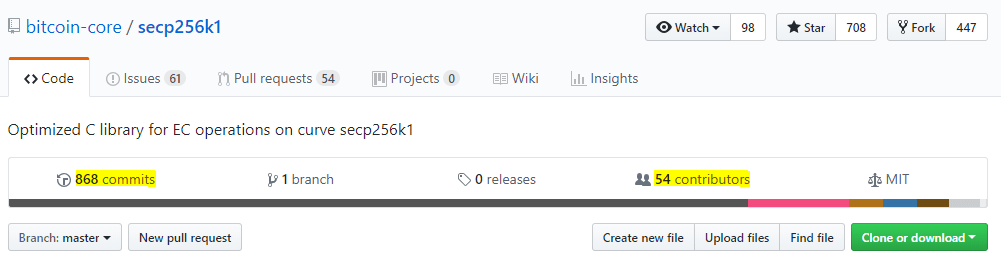

At the time of writing, more than 800 commits were made in the main Bitcoin Core repository, on github. Furthermore, 54 different people added value to the network.

Bitcoin Core on GitHub

Other crucial variables that we should consider are the transaction count and the number of miners that support the Bitcoin network, as both are essential to understand how far Bitcoin has arrived.

It is worth looking at the total hashing power to protect the Bitcoin network. When people say "more miners, the better it is", it's just because we (rightfully) suppose that more miners mean more hashing power, which is a good thing.

Increased hashing power translates into a safer network because more energy has been spent to protect each block.

The last decade saw the constant rise of Bitcoin's hahrate was constant, but there was the saturation of the miners left over during the 2018 bear market.

However, I foresee an increase in long-term hashrate. Another key metric is the number of Bitcoin transactions as a currency becomes more valuable and more transactions exist.

The more people carry Bitcoin, the more other people will want to follow the example, especially considering the likely medium-term price of Bitcoin above $ 10,000.

The long road to adoption

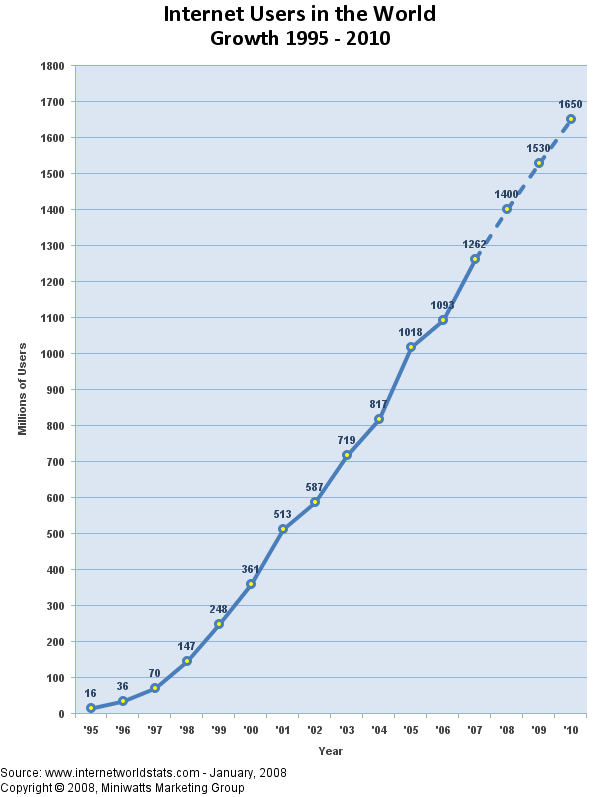

It has led the Internet almost 20 years to reach 1 billion people worldwide, since it began to develop during the early years & # 80; 80.

Right now, we are experiencing a terrible, but necessary, bear market. If you're worried about what will happen with the short-term adoption of Bitcoin, look what happened in terms of adoption by Internet users during the great crash of Internet Bubble. Between 2000 and 2001, the number of online people has almost doubled!

The technology, even if it has developed quite well, is not ready for mass adoption because there is still lack of development around all the key dimensions: infrastructure, understanding and applications.

We are coming, however, slowly but inexorably, with the increase in the adoption of Bitcoin novelty technology.

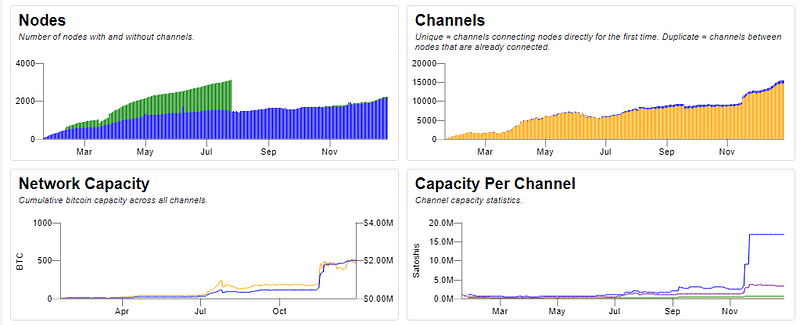

The Lightning network, for example, which was successfully launched thanks to Lightning Labs and their incredible efforts, already has over 2,000 active nodes and around 15,000 channels!

Bitcoin Visuals

Other projects such as the Lightning Node House, which has created a small hardware device so that users can easily configure an LN node (just as you set up internet via a modem), and the Open Node team, which received a huge investment from communities the Bitcoin favorite supports Tim Draper, they are also promoting better use cases and implementations for these decentralized P2P payment channels technologies, built together with the Bitcoin level.

We hope that the LN will help a lot in the mass adoption of Bitcoin.

Other advances such as Schnorr's signatures, which guarantee greater privacy to transactions as multi-signature hashes become indistinguishable from traditional txhash, will most likely lead to further adoption.

Companies would benefit directly from the implementation of this technology, as they would ensure greater privacy when creating approval workflows for bitcoin transactions: we would never know if a given transaction was the result of a multisig or not.

As highlighted in Delfr, a resource for the technical content of Bitcoin:

"It turns out that it is similar to the Schnorr scheme, a variant known as Elliptic Curve Schnorr […] it benefits from the linearity property that allows multiple private key holders to jointly sign a transaction in such a way that the resulting signature is not a naïve concatenation of individual signatures, but rather a non-trivial aggregation that is reduced to a monosignment. We will discuss the multisignature and explain the advantages of the Elliptic Curve Schnorr variant in a separate post. "

How to resize Bitcoin

The two main concerns of the community over the last 5 years have concerned the downsizing of Bitcoins and other currencies.

Alternative solutions have been proposed and some are even live, although the general feeling is that no Holy Grail will ever be found and we may have to face the fact that we will need a multitude of applications to perform transactions in security, privately and permissionless.

So far, the most important solutions have bee:

- To increase the size of the block, a feat carried out by Bitcoin Cash, which recently split into two different cryptocurrencies, Bitcoin SV and Bitcoin Cash, due to governance problems;

- To reduce transaction data, implementing SegWit that removes parts of data from previous blocks, leaving only the header details that point to the previous blocks in the chain;

- To implement parallel processing, using side chains (such as Liquid Liquid from Blockstream) and P2P networks (such as the Lightning network).

All of the above solutions have their strengths and weaknesses, however, it is important that we can successfully implement as many as possible, in the event that one fails or becomes too centralized. By distributing the risk, we will also distribute prizes, as we will have to spend many hours developing solutions that will not be fully utilized.

However, as I have pointed out above, the goal of Bitcoin is to achieve decentralization, which usually means promoting effectiveness over efficiency.

We can leave it to all the Dapp running on all the main blockchain protocols. After all, it is right to have more degrees of centralization if we really want to achieve global adoption.

As far as I'm concerned, the future of Bitcoin and many of today's top-20 cryptodes is pretty bright. I would be quite surprised if in the next decade we will not have at least 15-20% of people around the world who use Bitcoin on a regular basis.

Disclaimer: this article should not be considered as financial advice; represents my personal opinion e should not be attributed to CoinRivet. I have some savings invested in cryptocurrency, so take everything I write with a pinch of salt. Do not invest what you can not afford to lose and read as much as possible about a project before investing.