[ad_1]

[ad_1]

For now, the regulatory environment in the crypto is fragmented: the CFTC supervises the two major, bitcoin and ether, and the Securities and Exchange Commission controls all other cryptocurrencies.

The SEC has silenced settlements on everything from fraud to failure to register initial money offerings as securities. The president of the agency, Jay Clayton, has repeatedly stated that the majority of cryptocurrencies are titles and therefore must be registered on the basis of these laws.

More clarity and global competition were the main themes at a round table in October attended by over 50 participants in the sector and Budd and Soto. Participants warned that if companies do not have a clearer idea of the legal foundation of the industry, the US could lag behind on innovation and on the path to potentially potentially lucrative blockchain reign.

The second bill, the virtual currency market law and the competition regulation of 2018, focuses on the fact that the United States remains competitive in the sector. The bill directs the CFTC to carry out a comparative study of cryptography abroad, then formulates recommendations for regulatory changes in the United States. It also requires alternatives to "current burdensome regulations that can inhibit innovation".

The legislators ask the CFTC to clarify which virtual currencies it sees as raw materials. It also calls on the agency to examine the costs and benefits of a new regulatory framework that could replace the current money transmission system, which some argue that the industry is inefficient.

Many of the consumer protection concerns stemmed from a report by the New York attorney general on the risk of manipulating virtual exchanges, the legislators said. The AG month investigation, published in September, found that cryptocurrency trade is vulnerable to market manipulation and lacks standard consumer protections that result from established financial markets.

The first bill, also sponsored by representative Bonnie Watson Coleman, D-N.J., Focuses on the results of the AG. The "Law on Consumer Protection in Virtual Currency" would ask the CFTC to create a report examining the potential for price manipulation in cryptocurrency and its effect on the economy.

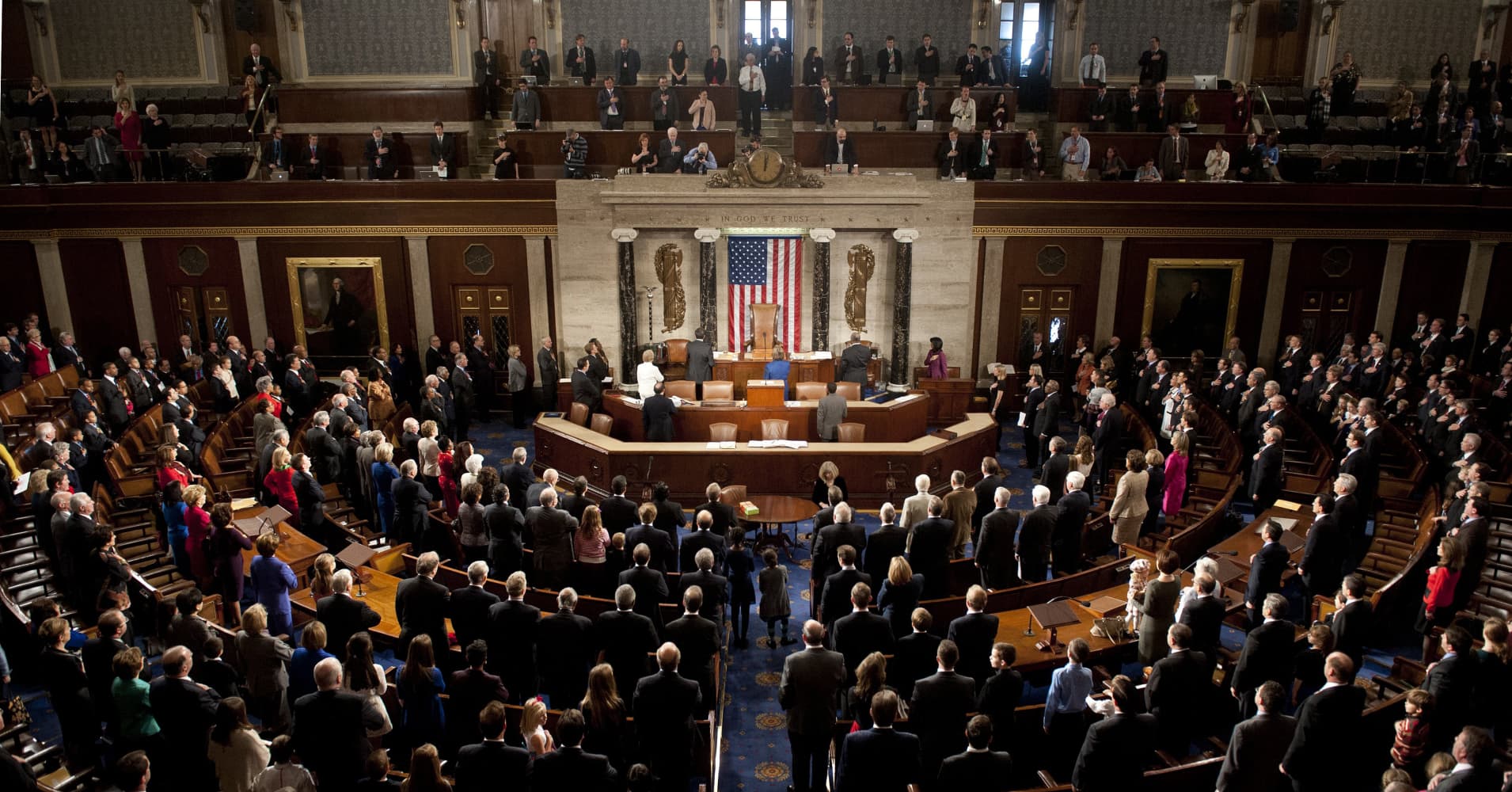

Others in Congress also recognized the need for additional rules regarding the digital asset class.

Representative Warren Davidson, R-Ohio, is drafting a bill on the encryption to be submitted by the end of this year, which has not yet "fully prepared" in October. In September, Representative Tom Emmer, R-Minn., Stated that he would also plan to introduce three coupons for cryptography and blockchain.