[ad_1]

US President Biden elected Impact of Korean industry

Joe Biden elected

According to US President-elect Joe Biden’s green and green energy policy, Korean automakers and battery companies are expected to have a wider range of operations. Elect Biden is focusing on eco-friendly policies, such as submitting a $ 2 trillion investment plan for eco-friendly infrastructure. Biden announced on his social media (SNS) on the 4th (local time) that he would be returning to the Paris climate treaty, which the Trump administration had withdrawn if he became president.

Committed to investing $ 2 trillion in a green environment

Expected rapid growth in the electric and autonomous vehicle markets

China’s battery is on the ankle, opportunity for 3 Korea companies

Auto parts and steel will continue to suffer

However, as President Donald Trump’s anchorage of protecting his industry is expected to continue, the auto parts and steel industry will continue to struggle. Biden’s election slogan was “Made in All of America”. The intent is to use political measures to increase the number of products made by American workers in factories in the United States.

① Good for “K battery” companies= Biden’s green policy is good for so-called “K Battery” companies such as LG Chem, Samsung SDI and SK Innovation. The percentage of green car sales in the United States is relatively small. Electric vehicles sold in the United States in August this year were 28,317 units, or 2.1% of all cars sold. On the other hand, 5.4% (93,297 units) in China and 11% (97,482 units) in Europe. This means that the electric vehicle market is likely to grow in the United States.

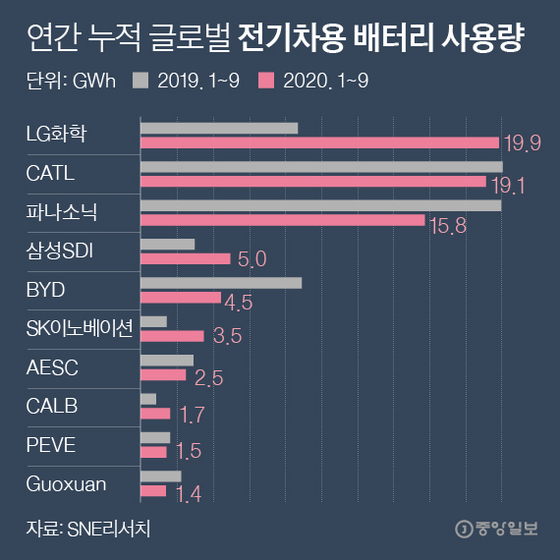

Total annual use of the electric vehicle battery. Graphic = Reporter Park Kyung-min [email protected]

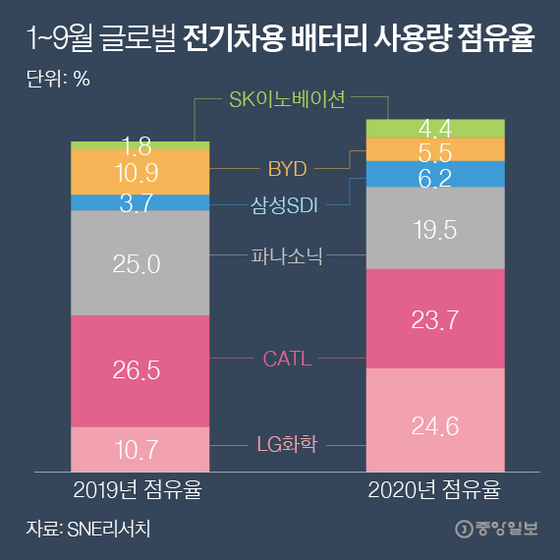

The companies that can build large-scale factories in the United States are three domestic companies, including LG Chem, Samsung SDI and SK Innovation, and Panasonic in Japan and CATL in China. However, Panasonic in Japan is focusing on deals with Tesla and CATL in China is held back by a trade dispute between the US and China. This is the biggest opportunity for the three Korean battery companies. This was also reflected in the share price. SK Innovation’s share price increased 15.5% from 122,000 won per share on the 2nd to 141,500 won on the 6th. LG Chem’s share price, which was 623,000 won in the same period, also rose to 720,000 won (15.6% increase).

② Electric vehicles also have a “If you get pushed into the US, it’ll hit you” opportunity= Biden-elect has pledged to “zero” carbon emissions by 2050. Hyundai and Kia Motors consider 2021 as the “ first year of electric vehicles ” and plan to introduce new cars that apply e-GMP , an exclusive platform for electric vehicles, starting next year. Lee Hang-gu, senior researcher at the Korea Automobile Research Institute, said, “This is a short-term opportunity. The market will grow as the demand for green vehicles such as electric vehicles in the US increases. “International trade attorney Song Gi-ho said,” It will be helpful for us to derive international standards in consultation with the US in the future. automotive sector such as electric vehicles and autonomous vehicles “.

Global EV Battery Usage Rate January to September. Graphic = Reporter Park Kyung-min [email protected]

There are also challenges that Hyundai and Kia Motors have to overcome. Researcher Lee Hang-koo said, “All carmakers around the world, including Tesla, a former electric car powerhouse, and GM and three German carmakers, will compete more fiercely in the US.” There is, ”he explained. Hyundai-Kia Motors sold 127,661 electric vehicles in the global market this year (January-September), but sold only 4,242 vehicles in the US market.

③Steel “Existing regulations will be maintained”The anti-dumping tariff on steel, which faced the Trump era, is expected to be effective in the Biden era as well. Last June President Trump imposed anti-dumping duties on Korean hot-rolled steel sheets based on Article 232 of the Trade Expansion Act. The reason was that Korea was being used as an exporter of Chinese steel bypass. Trade pundits believe the Biden administration and the Democratic Party are unlikely to review the bill in the short term.

Professor Hong Jong-ho of Seoul National University Graduate School of Environmental Studies said, “As the US energy and environmental market expands, opportunities for domestic companies will increase.”

Reporters Kim Young-joo and Lee Soo-gi [email protected]

[ad_2]

Source link