[ad_1]

[ad_1]

Bitcoin (BTC) is about to enter the overbought territory in the daily span of time, but there is still room for an aggressive upward trend in the short term. As often mentioned in our previous analyzes, Bitcoin (BTC) will have to retest the previous market structure sooner or later. This is the best time to do so considering that Bitcoin (BTC) is close to closing in the short term, but there is room for a rally towards $ 6,000. This is talking about Bitcoin (BTC) independently, but as we have seen in the past, Bitcoin (BTC) looks at the bigger markets at critical points. If EUR / USD had started a recovery instead of continuing to decline towards July 2018, we would have seen Bitcoin (BTC) do the same.

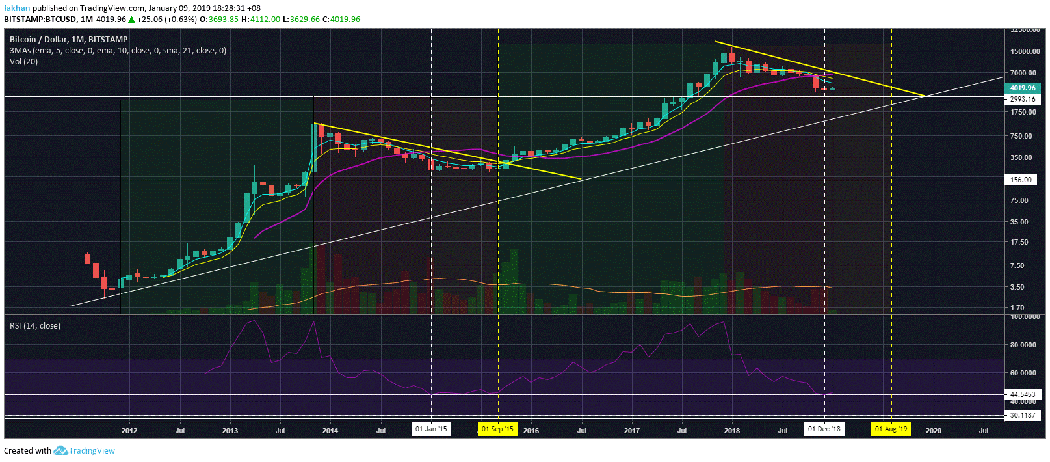

Just as the euro showed signs of a false recovery before the fall to its true fund, BTC / USD also gave false hopes to investors around July 2018. This is because Bitcoin (BTC) is paired with the US dollar ( USD) on most exchanges across the globe. If the EUR / USD pair goes up, this means that the Dollar (USD) falls and when the Dollar (USD) falls, the price of the Bitcoin (BTC) rises. The exact same thing is happening today. The positive price movement of Bitcoin (BTC) and other cryptocurrencies we have seen in the last 24 hours has more to do with EUR / USD than the cryptocurrency market. If we look at the BTC / USD chart, we see a year-long bear market that, if followed by schemes of the past, should see the Bitcoin (BTC) exchange sideways for a long time before the hopes of a recovery.

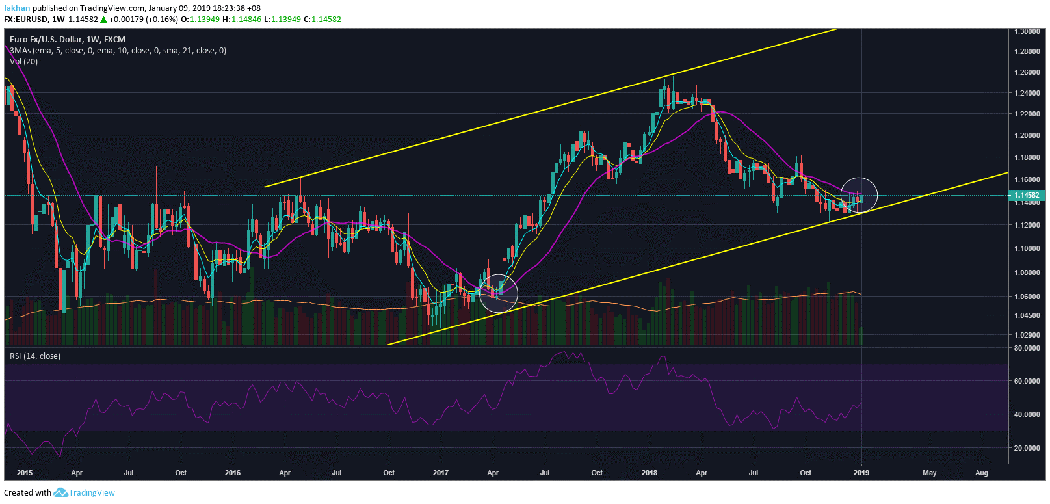

However, we have reason to believe that Bitcoin (BTC) may surprise us this time. To find out why, let's go to January 2017 on the weekly EUR / USD chart. We can see that the EURO has just reached the bottom of a rising channel and was consolidating before its next rise. This is the 2017 we are talking about, the year when Bitcoin (BTC) and most other cryptocurrencies were preparing for their most aggressive rally from the bear market in 2014-15. As soon as EUR / USD climbed to the top of the 21-week EMA EMA, the EURO skyrocketed in the coming weeks and so did Bitcoin (BTC) and the rest of the cryptocurrencies with the US dollar (USD). ) down.

Now, if we look at the monthly chart for BTC / USD, we would think that in no way something like this will happen again soon. The price of Bitcoin (BTC) took almost three years to start the next bullish cycle after the last bear market. So with this analysis this time we should also expect the price to aggressively strengthen somewhere in 2021, right? Well, we would be if the EUR / USD outlook was the same. However, things seem to be quite different this time and for all the right reasons. The global economy is in chaos and there are debates about the collapse of the petro dollar every other day. The next crisis will not be just a stock market crisis; it will also be a major currency crisis.

If we look again at the weekly chart EUR / USD, we can clearly see that the price is close to doing exactly the same thing it did in April 2017. You can see what happened to EUR / USD after April 2017 when it climbed to the top # 21 EMA EMA 21 weeks. You can also look at the BTC / USD chart after April 2017 and see that the price has started to rise aggressively to reach $ 20,000. Now, here's the thing. EUR / USD could do something out of the ordinary, but the most likely scenario is that it will continue to trade in this rising channel and get on top of the 21 weeks EMA in the coming weeks to start the its uptrend. When this happens, you can bet on your boots that Bitcoin (BTC) will follow.