[ad_1]

|

According to the management sector on the 8th, most of the managers preparing for overseas real estate funds have recently been withdrawn from the currency hedging banks. The reason was the bank’s internal guidelines that all investors should write a capital request agreement that requires funds if necessary, if the underlying asset is not stocks or bonds but illiquid assets such as real estate.

Typically, currency hedging is done in units of 1 to 3 months. For funds with a maturity of more than 1 year, the currency hedging contract will expire periodically. When exchange rate volatility increases, it is a way to hedge risk by restoring requirements. At the time of conclusion, if it was “1 dollar = 1,000 won”, but the value of the dollar suddenly rose to “1 dollar = 1500 won”, the bank could ask investors such as institutions to adjust profits due to fluctuations in the exchange rate. This is the Capital Call Agreement.

The problem is the retail funds they sell to individual investors. Whether it is a public offering fund or a private equity fund with 49 or fewer investors, it is not easy for managers or sellers to obtain contracts from individual investors and it is not known whether it can actually be implemented. Therefore, in this case, the bank entered into a foreign currency hedging contract in the form of a loan of the amount necessary to the manager in place of the capital call contract. However, as the burden of related banks increased due to the subsequent private equity incident, there have been cases of denial of hedging against illiquid assets following the private equity fund lending “attack”.

A management sector official said: “Suddenly requesting a capital request agreement from retail funds means that we will not actually hedge the currency.” He stressed.

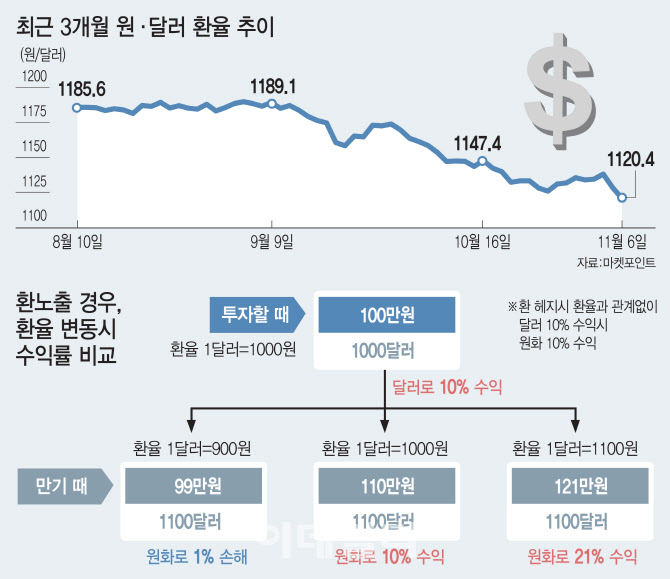

Unfortunately, the outlook for a weak dollar is dominant. If the value of the won increases, the share of the exchange rate for domestic investors during the recovery of foreign investment assets may decrease. As a result, the management sector says investor demand for currency hedging is strengthening.

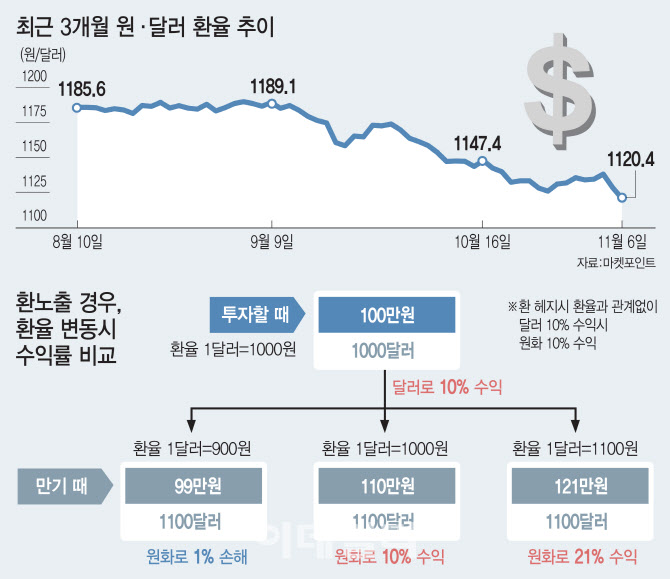

In particular, the US presidential elections aim for the victory of Democratic candidate Joe Biden. The Biden administration is emphasizing the expansion of fiscal policy. On the 6th, in fact, the won / dollar exchange rate on the Seoul exchange market closed at 1120.4 won, down 7.8 won compared to the previous day. This is the lowest level (based on closing price) since February 27, 2019 (1119.1 won).

Reflecting this trend, according to the classification of F & Guide, a financial information firm, the number of overseas property management funds excluding REIT funds nearly doubled from 14 at the end of 2018 to 27 at the end of 2019, but this year reached 32. It only increased by five. Although this was affected by the new coronavirus infection (19), it has been difficult to release due to banks’ refusal to protect the currency since last month. The most recent foreign real estate fund established on the 28th of last month is One Alternative Investment United States Real Estate Investment Trust 1[파생형]’It is a product that covers 100% of the investment capital, but this was possible because it was a fund that had been prepared before the move to refuse to cover.

Another manager in the management sector said: “If the current trend is the same, which manager will offer an AIF abroad for individual investors?”

.

[ad_2]

Source link