[ad_1]

[ad_1]

Yet again, energy experts have gotten the oil market Wrong to the barrel, Brent crude was about $ 86 a barrel, and it was a return to ultra-profitable $ 100 oil. Today, Brent closed at $ 58.68, down 31% from the peak, after the industry's worst two months in a decade.

Oil's biggest kingpins are now at the G20 summit in Buenos Aires, where they will try to set things right. For trump-states and numerous other industries.

What's going on: In oil and gas, the last decade has been a series of bad calls – starting in 2008 with an oil price spike to $ 147 at barrel and consensus.

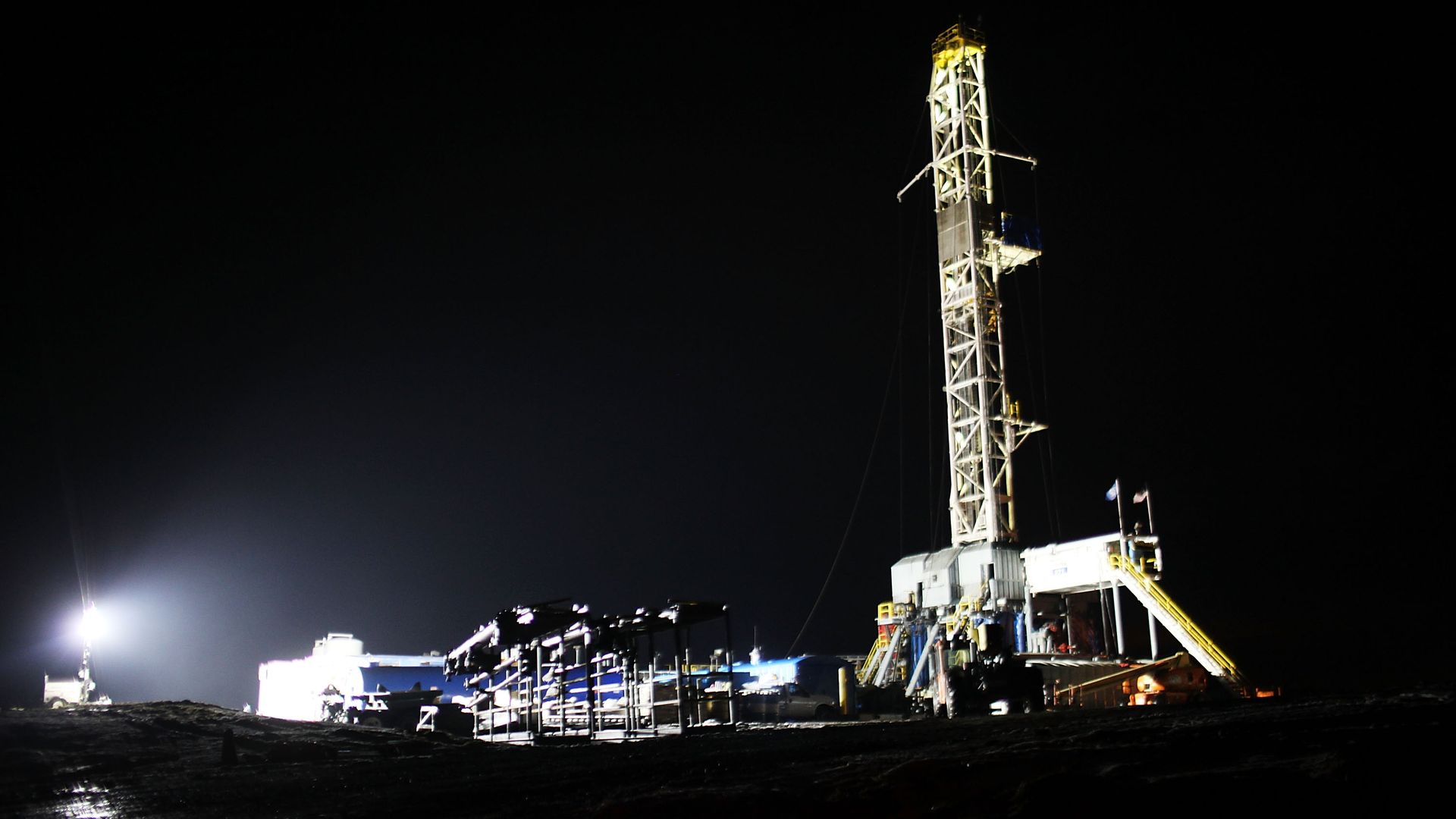

- Instead, shale oil and gas came along and, by 2014, the U.S. was suddenly awash in both.

- A platform for the U.S. that was depicted as incredibly good news for the U.S. to enter an industrial renaissance.

- Instead (another bad call) prices went into a spin, finally crashing below $ 27 at barrel. The mini-recession for several industries, and hundreds of thousands of job cuts.

"Analysts always tend to extrapolate current trends and miss turning points."

– John Kemp, senior energy analyst at Reuters, to Axios

In the latest chapter of this bad run of forecasts, analysts and traders watched as oil prices marched back over $ 80 a barrel in the last week of September, and that was the same revolution. This month, $ 100-a-barrel would be back soon, breaching a threshold that, during the rough patch, no one thought would ever be crossed again.

Instead, we have an eight-week-long crash of prices:

- In a report today, the U.S. Energy Information Agency said that, for the fourth straight month, U.S. oil drillers have produced record volumes, reaching almost 11.4 million barrels a day, almost 2 million higher than a year earlier.

- The August and September year-on-year additions are the largest in almost a century.

- Astonishing fact: For the first time since 1948, U.S. say oil and oil imports will drop to zero next year before stabilizing at about 320,000 barrels a day, analysts say.

As usual, analysts cite a dozen reasons why they could not be blindsided, even if that's what the oil is.

What they missed:

- That Trump would grant a slew of sanctions waivers to buyers of Iranian oil, said to be more than forcing the market immediately, said Amy Jaffe of the Council on Foreign Relations. Nor that Saudi – itself expecting Iran to record relatively little 11.1 million barrels of oil a day.

- That shale drillers would continue their deluge – to whopping 5 million added barrels of oil including this year and next.

- That the global economy would slow: Barclays gives a 20% to 25% chance of a U.S. recession by the end of the next year, and 25% to 40% in 2020, says Michael Cohen, head of energy markets research.

What's next: OPEC is to meet next week in Vienna to discuss a production cut. Vladimir Putin, Saudi Arabian Crown Prince Mohammad bin Salman, and the power of his tweets, Trump – at the G20 summit.

Saudi for one needs $ 73-a-barrel to finance the national budget, according to the IMF. Putin, with a break-even of $ 40, said Scott Modell, head of Geopolitical Risk at Rapidan Energy.

- In a meeting today, an OPEC advisory committee suggested a 1.3-million-barrel-a-day cut. That is precisely the 2019 oil surplus projected by the International Energy Agency, but it may be more – in recent notes to clients, for instance, Helima Croft at RBC, forecast at 1.4 million-barrel-a-day surplus next year with no cuts.

The worst off in a sustained low-price era, Modell said: Venezuela and Nigeria.