[ad_1]

[ad_1]

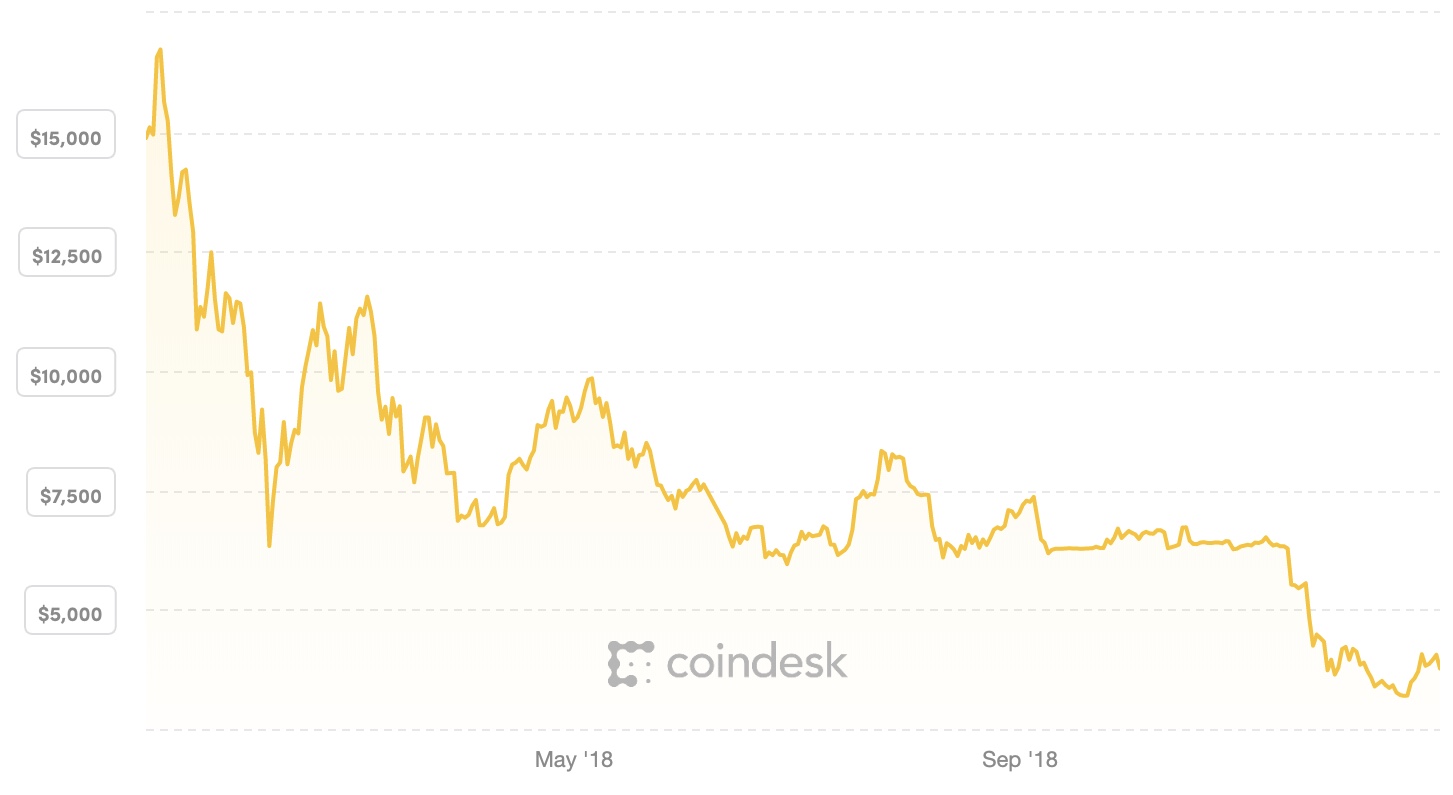

Around this period last year, the price of Bitcoin hit an all-time high of nearly $ 20,000. Cryptocurrency enthusiasts from all over the world boasted about the wealth that 2018 would bring, the first bids of coins exploded and startups continued to collect record amounts of venture capital. One year's fast-forward: Bitcoin is down 75 percent with a $ 3,700 lean, sinking rapidly as its meteoric rise, and industry start-ups are paying the price.

The last victim is Bitmain, a bitcoin mining hardware supplier who recently presented its IPO prospectus to the Hong Kong Stock Exchange. The company has confirmed to CoinDesk this week that the cuts will begin imminently: "There have been some adjustments for our staff this year as we continue to build a long-term, sustainable and scalable business," a spokesperson told CoinDesk of Bitmain . "Part of this is having to really focus on the things that are fundamental to that mission and not on those that are auxiliary".

Bitmain, based in Beijing, did not specify how many of its employees will be affected, even if the rumors – which Bitmain has since denied – on Maimai, a Chinese platform similar to LinkedIn, suggest that 50% of the workforce of the company could be placed off. This news comes after the crypto-mining giant has confirmed closing its Israeli development center, Bitmaintech Israel, firing 23 employees in the process.

Bitmain employs at least 2,000 people, compared to 250 in 2016, according to PitchBook, given that the company's growth has skyrocketed.

The decreasing value of Bitcoin.

"The crypto market has been shaken in recent months, which has forced Bitmain to examine its various activities around the world and refocus its business in accordance with the current situation," said Bitmaintech chief Israel Gadi Glikberg to his employees at the time of redundancies.

Bitmain raised over $ 800 million in venture capital funds from Sequoia, Coatue Management, SoftBank and more. With a valuation of $ 12 billion, it quickly rose to become the most important cryptic startup in the world, surpassing Coinbase, which in turn raised a $ 8 billion valuation this fall.

In its IPO deposit, Bitmain posted revenues of over $ 2.5 billion last year, almost 10x out of 278 million dollars incurred in 2016. As for the first half of 2018, Bitmain said it had exceeded 2.8. billions of dollars of revenue. These are amazing numbers, yes, but if Bitmain can sustain this kind of impulse it has been questioned, especially when it is about to become public in what would be the biggest encrypted IPO to date. The cryptographic market, by its nature, is unpredictable, a feature that is less favorable to investors in the public market.

Startups sacrifice staff

Meanwhile, Huobi Group, an encryption platform based in Beijing, is also firing a portion of its 1,000 employees, according to a report by the South China Morning Post.

Huobi, who is supported by Sequoia and ZhenFund, did not immediately respond to a request for comment.

In addition, ConsenSys based in Brooklyn previously this month confirmed that he was firing 13% of the staff of 1,200 people. The company, active in the cryptographic ecosystem, incubates and invests in decentralized applications based on the Ethereum blockchain.

"Excited regarding ConsenSys 2.0, our first step in this direction has been difficult: we are rationalizing different parts of the business including ConsenSys Solutions, spokes and hub services, leading to a 13% reduction of the mesh members" Founder of ConsenSy and crypto billionaire Joseph Lubin wrote in a letter to employees regarding layoffs.

Finally, Steemit, a distributed application designed to reward content creators, fired 70% of its staff a few days earlier, citing unfavorable market conditions.

"We still believe that Steem is by far the best and cheapest application blockchain protocol and that the improvements that will result from this new direction will make it far better for the sustainability of applications," wrote founder and CEO Ned Scott in a statement. "However, in order to ensure that we can continue to improve Steem, we must first monitor the costs to remain economically viable.There is nothing I want more now than to survive, keep operating steemit.com and keep alive the mission, to create great communities ".

The downsizing after the periods of rapid growth – which many encrypted startups have experienced during the Bitcoin boom – is natural, but can these companies continue to endure periods of extreme volatility without collapsing completely? One thing is certain: if the price of Bitcoin is reduced more and more, the "staff adjustments" to the large and small encrypted startups will be inevitable.