[ad_1]

[ad_1]

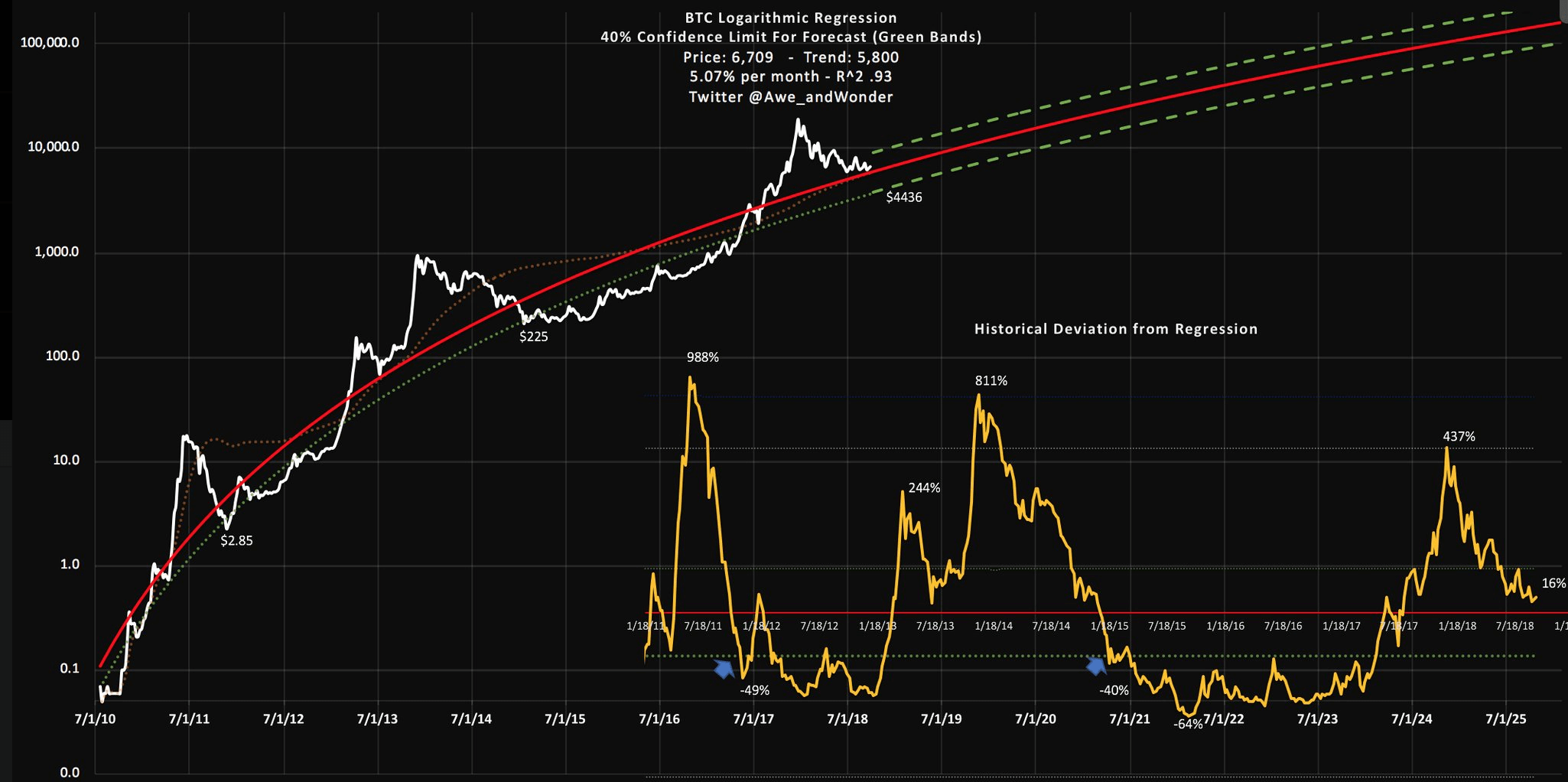

The chart, which dates back to 2010, evaluates the logarithmic regression of Bitcoin, covering three 80 percent corrections the assets experienced in the past eight years.

"Estimated BTC bottom via Logarithmic Regression analysis (below) to compliment Willy Woo's own analysis, asserting that" $ 4,400 is the next real line of defense, "Awe and Wonder Explained, adding, "the default assumption, takes on the meaning that nothing has changed and that is this fact in fact no different. For this model, the default assumption is that the market will be in the past.

$ 4,400 Support Level Does not Mean Bitcoin Will Test it

The price trend of an asset or currency is unpredictable and can not be accurately demonstrated by a single technical chart. It is not possible to create an equation to satisfy all the variables involved that affect the market and the psychology of investors in it.

But, the logarithmic chart of Bitcoin as the main component of the asset's growth rate, which increases the likelihood of the long-term price trend of Bitcoin.

The most important thing is the price of the digital asset since 2010, when the growth of the cryptocurrency was over the past nine years.

Bitcoin makes predictions on the asset more difficult but rates of adoptions are easier to predict. Since the logarithmic chart acknowledges the adoption rate as its main component, it is possible that the chart can accurately portray the trend of the asset in the years to come.

As Bitcoin undergoes its adoption S-curve it scribes to "Falcon-9 rocket trajectory" on the long range chart. We provide the deviation from this arc, it provides clues into where we are in the price cycle.[Chartby[Chartby@Awe_andWonder] pic.twitter.com/YQF2Oiocf9

– Willy Woo (@woonomic) September 29, 2018

This is the case for the long-term price trend of an asset in the cryptocurrency market.

He added:

"In this case, BTC is not your typical stock price. It's a speculative traders game on top of an adoption curve. The speculative game is complex, but rates of adoptions are more predictable. In my opinion, the chart runs on this thesis, mapping the deviation of between two. "

The chart has outlined $ 4,400 as the base support level of Bitcoin by early 2019. But, the range of the chart places the likely target price of Bitcoin in January of 2019 to be in the range of $ 4,400 to $ 10,000.

Bitcoin has increased from $ 6,000 to $ 10,000 within a 30-day period and as such, a high level of volatility for Bitcoin should be expected.

Where is Bitcoin Headed to?

Many prominent investors and analysts including ShapeShift CEO Erik Voorhees, billionaire investor Mike Novogratz, and Fundstrat's Tom Lee have said that the worst part of the correction is over.

XRP and Ethereum, which recorded 75 percent of the drops in the period of April to September, have been initiated with corrective rallies with strong volume and momentum.

Bitcoin, currently ranked # 1 by market cap, is down 12:42% over the past 24 hours. BTC has a market cap of $ 113.98B with a 24 hour volume of $ 4.02B.

Chart by CryptoCompare

Bitcoin is down 0.42% over the past 24 hours.

Cover Photo by Catt Liu on Unsplash

Disclaimer: CryptoSlate's opinion is our own and do not reflect the opinion of CryptoSlate. CryptoSlate should not be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

Did you like this article? Join us.

Get blockchain news and crypto insights.

Follow @crypto_slate Join Us on Telegram

[ad_2]Source link