[ad_1]

[ad_1]

Crypto Market slows down after cheating

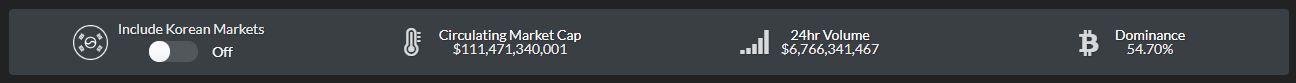

Although sales pressure has eased the cryptography markets over the weekend, Bitcoin (BTC) and altcoin are still in the midst of stormy seas. BTC found itself stagnant at $ 3,375, apparently captured at a point of decline between a short-term rebound and lower lows. With the slowdown of the main activity of this market, the market capitalization of all the cryptocurrencies in circulation has decreased. This relevant figure rose to $ 111 billion, just three billion less than the Ethereum World News Friday update.

Interestingly, trade has dried up over the past few days, with the 24-hour volume falling to $ 13 billion (adjusted $ 6.7 billion) from $ 20 billion (adjusted $ 10 billion) released between quick price action on Friday.

What would be a market update with BTC … right?

Over the weekend, BTC undertook a short-term upturn, from $ 3,300 to a maximum of several days to $ 3,650 over several hours. However, as the buying pressure quickly dissipated, the BTC began to return to Earth on Sunday, falling below $ 3.500, a key support level mentioned before falling victim to Monday's weekly crash.

At the time of writing, BTC stood at $ 3,375, down 4.25% in the last 24 hours. Altcoin also followed the example with XRP, Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC), Tron (TRX) and Binance Coin (BNB), all posting performances almost identical to the godfather of cryptocurrency .

Analyst: Bitcoin far beyond the ridicule of Tulip Bubble

In the midst of this seemingly endless tumult, Stephen Innes, head of the commercial arm of Oanda in Asia Pacific, has only doubled his hatred of BTC and other cryptocurrencies. Speaking with MarketWatch, the short-term skeptical cryptic has exclaimed that Bitcoin still has no viable case.

Innes added that "BTC has gone far beyond the ridiculous light bulb mania of tulips", evidently referring to the unpopular sentiment that the cryptocurrencies are the second coming of the "Tulipmania" of the past.

However, a multitude of industry insiders have openly stated that cryptocurrencies are not in the middle of a bubble, contradicting the relevant point of conflict. The CEO of Ambrosus, Angel Versetti, for example, recently declared to the Independent, a British broadcaster, that, while the lines can be traced between Dotcom Boom at the turn of millennia and crypto in 2017/2018, commentators do not they would classify this last as a bubble.

The head of startups explained that, given that cryptocurrencies have not yet mentioned the institutions, which has defined "financiers", en masse, a market bubble in good faith has not yet affected this budding asset class. Yet, as seen by the countless crypto-related raids of Wall Street participants, this bubble may be right at the horizon. In fact, Versetti explained that in due course, the aggregate value of all cryptocurrencies could eclipse the $ 15 to $ 20 trillion marks, cementing BTC and its brothers altcoin as a legitimate component of the vast complexities of the financial world.

However, the aforementioned head of the merchants of Oanda puts aside these arguments, recalling the attention on the disastrous year that have undergone cryptocurrencies, probably touching the decline of the 87% recorded by this ten-year market. Innes added that "the current bear market could go from bad to worse", arguing that at the moment there is no fundamental or fundamental motivation behind the purchase of BTC, especially when " the only support offered is a wavy line on an analyst's chart ".

Innes' most recent joke comes just two weeks after the trader has canceled the cryptocurrencies on Bloomberg TV. As reported by Ethereum World News earlier, the head trader of Oanda claimed that it is a "wild west show" in the crypto, before adding that mature investors are still reluctant to buy BTC, due to its status of " falling knife ".

Yet, by posting a comment on Twitter, Innes recently claimed to be "really very bullish [BTC] in the long run, not just today ", evidently referring to the fact that while the cryptocurrency is still overcrowded and overcrowded, it probably has long-term value as a means of boundless value, resistant to censorship, decentralized and efficient that transcends traditional boundaries.

Edit: Stephen Innes commented on the piece, Ethereum World News added it accordingly.

Title Image Courtesy of W A T A R I on Unsplash