[ad_1]

[ad_1]

Information on Lawyer: Diana Stetiu is a lawyer qualified in Romanian law, law graduate and LLM at the University of Paris I: Panthéon-Sorbonne, France.

Diana is a senior associate who leads the practice of technology law with Bulboaca & Asociatii is also a member of the Banking & Finance and Capital Markets team.

Legal Disclaimer:

This article is published as a general overview and is not intended to – and should not – be invoked as legal advice. My references to the United States, to Swiss and German laws are based solely on the consideration of legal principles and not on legal experience in the field of customer advisory services in the field of law in the United States, Switzerland and Germany.

Question 1: The buzz around the STOs is growing. What do you think their potential is?

ANSWER – Everything that is considered today by the applicable laws as security (for example shares, bonds, bonds, notes options, mandates [19659011]) can be therefore, the potential of security token ("STO") offers is enormous.

Tokenization is the process of converting the rights of any resource into a digital token on a blockchain and releasing it to the public.

From now on we will hear much more about STOs because they have the potential to become the standard form of market financing for both startups and established companies who want to tokenise their stock offers instead of listing them [19659015] Compared to traditional initial public offerings ("IPOs"), STOs could become the true competitor of IPOs because costs for a STO remain cheaper.

In addition, companies and investors may prefer digital tokens over conventional securities because trading security tokens in the secondary market through security platforms with security tokens granted may be much more tempting for investors who want to liquidate security token quickly [19659021] Legal: Comparison "width =" 215 "height =" 234 "/> Security tokens could allow a completely new world of finance where: taxes are lower, increased settlement times make business quicker, market friction is reduced and securities have more complex structure ANSWER – I would like to emphasize that today, in the world of criptova lute, perhaps one of the most urgent questions is how regulators will deal with various digital resources. It is really difficult to classify tokens from a legal perspective because there are different token economic realities. The characteristics of a token and the way in which the token is sold determine the possibility of applying the laws on securities of various jurisdictions. All regulatory authorities should be aware that the greatest risk is not the lack of regulation, but rather of overregulation or bad regulation that can kill the development of revolutionary products. Within the European space, the Swiss and German regulatory authorities expressed the strongest interest in providing token classification guidelines, however, clear guidelines on how to classify tokens or information on when a token [19659027] not can be considered as a security have not yet been provided. Reflexivity towards STOs increased in February 2018 when US Securities and Exchange Commission president Jay Clayton said, "I believe every ICO I have seen is a security ". Later in June 2018, the encrypted world was pleasantly surprised when William Hinman, Director of the Division of Corporation Finance of the United States Securities and Exchange Commission (the "SEC") commented on the mutability of the token treatment, clarifying that the tokens classified as securities when they were originally sold for the purpose of raising capital may later be considered as non-securities in certain circumstances, in particular if: (a) "the network on which the token or currency is to operate is sufficiently decentralized "and (b)" buyers should no longer reasonably expect that a person or group will undertake essential managerial or entrepreneurial efforts ". According to the Swiss Financial Market Supervisory Authority (FINMA) security tokens " asset tokens " represent a specific asset or credit, in particular a credit vis-à-vis the issuer or a share / company position directly in the issuer. This makes them substantially similar to traditional titles. In February 2018, the German Federal Financial Supervisory Authority (BaFin) issued a guidance note explaining the circumstances under which tokens sold through ICO are financial instruments. Like FINMA and many other regulators dealing with the ICO theme, BaFin also considered that an assessment was necessary on a case by case basis to determine what constitutes a token if it is: [19659027] (i) a financial instrument pursuant to the German Securities Trading Act or the Markets in Financial Instruments Directive ( MiFID II ), or (ii) a guarantee under the German Securities Prospectus, or [19659024] (iii) a capital investment pursuant to the German Capital Investment Act . BaFin confines itself to stating that any negotiable and negotiable token that is not to be regarded as a payment instrument is considered as a (transferable) security and, therefore, triggering the respective regulation represents one: (i) similar claims to shareholders, or (ii) contractual claims, or (iii) any other claim comparable to (i) and (ii). If tokens are financial instruments, this means that trading platforms, investment advisors, brokers, portfolio managers, or custodians doing trades, advising, brokering, managing, or depositing tokens become subject to MiFID II. As a result, they will need a license and will be checked by the BaFin. In terms of investor benefits, if you compare STOs with IPOs, there may be some important benefits for an investor. Security tokens allow companies to divide underlying assets into smaller units, allowing fractional ownership that makes investment cheaper for retail investors and the token easier to transfer to the secondary market. STOs can facilitate investment for global investors seeking to make a good return investment with greater liquidity From another point of view, if you compare STO with tokens ( According to FINMA "utility tokens are tokens that are intended to provide digitally access to an application or service through a blockchain-based infrastructure". ) sold in an ICO, I do not think that STOs can provide much for token buyers but rather one (main) advantage: buying tokens from companies that adhere to all laws and regulations regarding securities in the jurisdictions where the tokens are sold security, ensuring better protection for buyers. During crowdsales, the prospect of a token buyer is pretty much the same when buying tokens, both security and utility, that is, most buyers look at whether: (i) the issuing company has a strong team can provide in its mission, or (ii) there is a market for the product and service of the project, or (iii) the company has competitors and how they can have an impact on the project of the issuing company. ANSWER – As a rule, if a token (also) represents a regulated security, then the offer, sale, promotion and listing of the same can be a regulated activity if you do not relies on specific exemptions. Under US law if a token is a security, it can be offered to US investors, provided the offer is registered with the SEC or exempt. In short, Regulation S provides an exclusion from the registration requirements of Section 5 of the Securities Act of 1933, as amended (the "Securities Act"), for offers made at outside the United States from both US and foreign broadcasters. Under Regulation S, issuers may offer securities to non-US investors in offshore transactions without registration, provided that the offer complies with the provisions of Rule 903 of the Securities Act. (a) I t is available only for "offers and sales of securities outside the United States" done in good faith and not as means to circumvent the registration provisions of the Securities Act; (b) The availability of the issuer (rule 903) and resale (rule 904) is safe and subject to two general conditions: (i) the offer or sale must be made in an offshore transaction; and (ii) no "direct sales" may be effected by the issuer, by a distributor, by one of their respective affiliates or by any person acting on their behalf. As mentioned above, on the token's characteristics and how the token is sold, a token sale could be a security offer that requires registration or an exemption from it. In fact, many companies that have launched ICO have used the exemptions from registration required by Regulation S and Regulation D (ie offers to accredited investors) to sell securities just because this is the market trend, neglecting that such exemptions they are subject to various limits. First, companies that initiate ICOs should consider whether the securities laws will apply to their token sales and, if so, which of the organizational structures meets their objectives. Secondly, they should analyze whether Regulation A (Regulation A is an exemption from registration for public bids.) Regulation A provides for two levels of bidding: Level 1 , for bids up to $ 20 million over a 12 month period and Level 2, for bids up to $ 50 million over a 12 month period.) or a & quot; registered offer is a better alternative in particular if their objective is to sell securities to a higher number of buyers with greater liquidity for secondary transactions. However, these companies must also comply with the safety standards of each country in which they offer their security. ANSWER – This question does not have an affirmative or negative answer. It requires an accurate analysis. In fact, different companies rather than face the uncertainty that their ICO exceeds the Howey Test, have simply chosen to completely exclude US investments. In my opinion, companies should conduct a legal analysis of their tokens and therefore, if the conclusion is that a procedure is required on the securities or another licensing process, choose the country in which they wish to start on the basis to the planned objectives. Although a token is not a security, depending on how ICO is structured, it could be qualified as an alternative investment fund to the extent that it is used to raise capital from a certain number of investors in order to invest it according to a defined investment policy. In addition, potential links to collective investment law may arise when the assets collected as part of the ICO are managed externally. ANS – When considering a cross-border supply in various jurisdictions, it is essential to establish whether this offer of securities is legal for all relevant recipients. In the EU, " qualified investors " in the Prospectus Directive ( Directive 2003/71 / EC of the European Parliament and of the Council of 4 November 2003 amended Directive 2010 / 73 / EU of the European Parliament and of the Council, of 24 November 2010. ) / Prospectus Regulation ( Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market and repealing Directive 2003/71 / EC ) or " professional clients " and "eligible counterparties " under MIFID, are, we say, "synonymous" with the American term "accredited investors". These terms differ in relation to current rules, but all serve to protect investors from risky investments. According to the European Securities and Markets Authority (ESMA) for token offerings considered as transferable securities, compliance with the Prospectus Directive and / or the Regulation of the prospectus. These legislative acts are designed to ensure that investors provide adequate information to companies when they raise capital in the EU unless certain exclusions or exemptions are applied. In my opinion, token security issuers have to control the entire legislative scope of each targeted jurisdiction that may be relevant to the exercise of regulated activities, the publication of a prospectus and the realization of promotions. financial and anti-money laundering legislation and data protection legislation. In addition, ICOs regardless of the type of token should voluntarily ensure compliance with AML (Know Your Customer) and KYC (Anti-Money Laundering) regulations if issuers want to make their token buyers safe by putting their crowdsale in a legitimate light. ANS – The use of a simple Futures Token Agreement (SAFT) is a popular US strategy of companies attempting to mitigate the risk that utility tokens are considered securities. However, this risk can not be mitigated effectively by using a SAFT based on the belief that: (i) if prior to the development of the token market, a group of authorized investors (eg Accredited Investors or other investors who fall outside the disclosure of the prospectus) contributes to the raising of funds and (ii) once the token market is functional, tokens delivered to the same investors have acquired intrinsic utility and, therefore, tokens can be further sold on the stock market to non-accredited investors. If prospectus exemptions are subject to resale restrictions with respect to such restrictions should be observed. Simply using SAFT is not a secure way to comply with securities regulations. Attention should be paid to how to sell, token buyers' expectations and token consumer aspects. ANS – The legal industry can be changed substantially thanks to the blockchain technology. Many challenges that governments are currently facing in maintaining and protecting public documents could be solved by the blockchain. For example, in many emerging countries, land ownership is often an area of controversy due to the lack of conclusive evidence of ownership or the impossibility of establishing a chain of securities. The blockchain is an ideal technology for any industry that stores information, therefore also for the legal industry. In some legal systems of civil law, it is very important for the buyer of real estate to conduct due diligence on the chain of ownership of the title. The proof of perfect ownership that traces all previous transactions with the first owner is for the most part difficult or impossible, in reality a probatio diabolica . Blockchain-based land registries can significantly reduce the costs and time required to buy and sell real estate. In addition, currently, in many transactions, notaries must confirm and verify signatures on documents. Using blockchain technology, documents can be stored digitally as part of a digital ledger, applying "timestamps and fingerprints for multimedia files" thus eliminating the need for the signature wet ink or rubber stamp of the Notary of today. The blockchain will have an impact on how we do business. The law follows the economy. So, the disruptive effect of the blockchain will certainly have an impact on the legal industry in many other ways. ANS – There are pros and cons in the case of both the stellar consensus protocol and the Ethereum blockchain. Everyone has its downsides. Ethereum has an excellent intelligent contract programming language complete with Turing so it can do much more than Stellar. However, it can be assumed that complete complete Turing contracts prove to be more counterproductive than useful for those ICOs who do not need an intelligent contract language complete with Turing in the first place. " As almost always, the answer to these questions depends For example, if based on the exemption of regulation D, a company accepted in its buyers of ICO's token US, will have to ensure that buyers do not sell tokens in the first 12 months. In this case, perhaps the smart contracts of Ethereum could be more useful than the Stellar protocol. One of the most important requirements for issuing a regulatory token is able to control who can own that token at all times. I think investor confidence is probably based on other factors such as the adoption of a product ICOs have traditionally been launched with ERC20 tokens on the Ethereum network. For conservative buyers of security tokens, ERC20 tokens may remain their first choice. Image highlighted by Shutterstock. Follow us on Telegram or subscribe to our newsletter here. Question 2: security tokens are asset tokens backed and represent a claim to an asset.What benefits can an STO offer to investors?

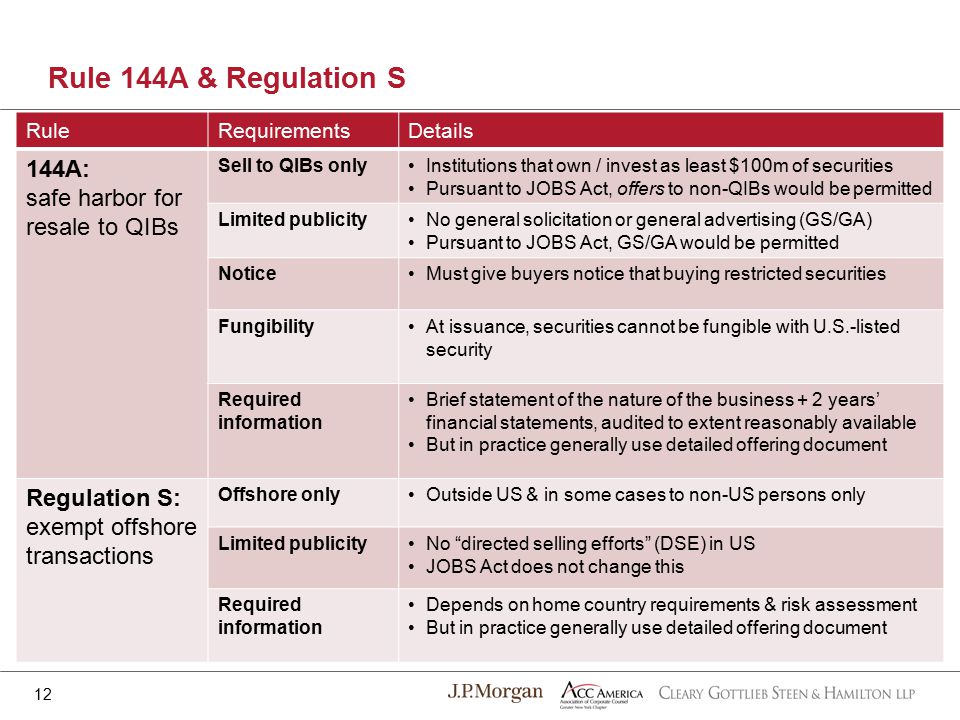

Question 3: There is a lot of excitement about US regulation S. What is your opinion on Regulation S as a fundraising route?

Some things must be clarified around Regulation S:

Question 4: Have we seen several ICO files for Regulation S exemptions. Should ICOs protect their bets and increase their compliance or should they follow the STO route?

Question 5: The definition of an accredited investor and the investor protection regime are different in many jurisdictions. How can an STO ensure KYC compliance in the light of different jurisdictions?

Question 6: SAFTs originated from SAFE and do not yet have any legal support. Do you think SAFT is a good path?

Question 7: How can Blockchain help to destroy the legal industry?

Question 8: Legal agreements can be amended but smart contracts are immutable. In light of this, will Ethereum Blockchain with its immutable smart contracts give more confidence to investors or should we move to Stellar for STOs?

• Join CCN Community Crypto for $ 9.99 a month, click here.

• Do you want exclusive analysis and in-depth analysis encrypted by Hacked.com? Click here.

• Open positions on CCN: sought-after full-time and part-time journalists.