[ad_1]

[ad_1]

In the early days, cryptocurrency enthusiasts used to laugh at the thought of a stable cryptocurrency anchored to a specific fiat currency like the US dollar. Although today things have changed and the Digital Currency Tether (USDT) captures more trade in cryptocurrency than most major currencies issued by the nation state such as USD and JPY. Moreover, last year or more "stablecoins" entered the crypt-economy, and some individuals think that stablecoin are necessary elements for the future of this technology.

Read also: Wormhole Mainnet and Developers & # 39; Guide Launched

The "second white paper of Bitcoin" written by JR Willett unleashes the idea "Stablecoin" in 2012

"Stablecoins" – se you hate them or love them have become extremely popular in the last two years, et ether (USDT) a digital currency issued on the protocol Omni Layer has become a bewildering phenomenon. Cryptocurrencies pegging on assets began to be heavily debated and were written in 2012 in the white paper of J.R. Willet on Mastercoin, and in 2014 the concept really started to take hold. There have been many attempts to create stable coins that have failed miserably at the peg. The cryptocurrency, nubits (USNBT), was to remain valued at one US dollar. Nubits has remained at around one dollar since it was launched until June 9, 2016, and then sank under that point until September 6, 2016. Once again, the currency remained stable for a while until as of March 21, and has not been able to maintain the 1: 1 ratio ever since.

Tether the King of All Crypto-Dollars

Tether the King of All Crypto-Dollars

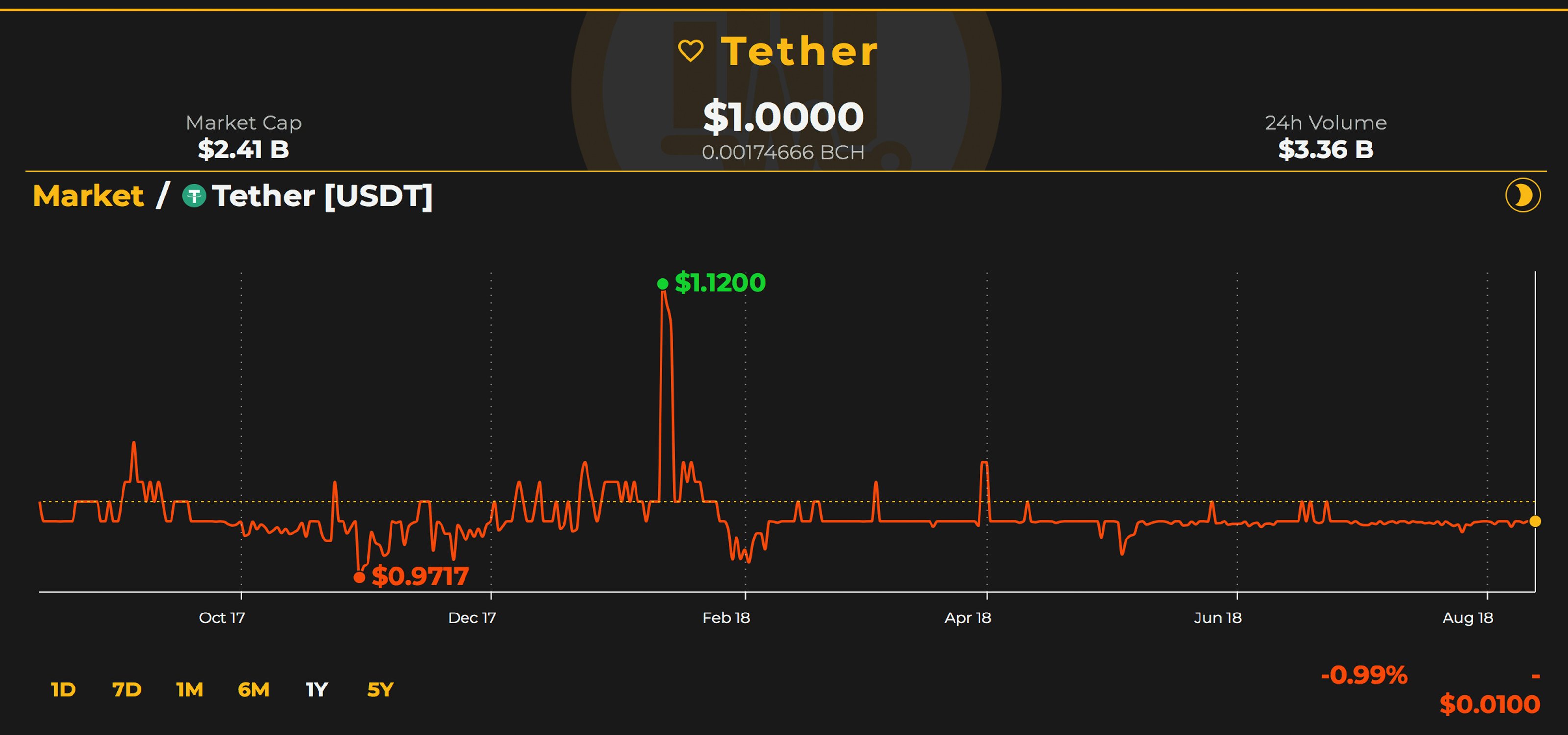

In November 2014, Reeve Collins revealed the "Tether" project a coin based on blockchain issued using the Bitcoin Core (BTC) network that uses the Omni protocol layer. The Omni network can grant and revoke the tokens created by the metadata embedded in the BTC chain and the prodigal son of the project is the USDT. Each USDT issued is presumably supported by a US dollar and the creators claim that all funds are held in reserves by the Tether Limited bank. This particular statement is extremely controversial and the USDT has been the focus of much attention.

In November 2014, Reeve Collins revealed the "Tether" project a coin based on blockchain issued using the Bitcoin Core (BTC) network that uses the Omni protocol layer. The Omni network can grant and revoke the tokens created by the metadata embedded in the BTC chain and the prodigal son of the project is the USDT. Each USDT issued is presumably supported by a US dollar and the creators claim that all funds are held in reserves by the Tether Limited bank. This particular statement is extremely controversial and the USDT has been the focus of much attention.

However, cables remained steady steadily since its price was [19659007] registered for the first time on Coinmarketcap in February 2015. The use of cable has become a popular vehicle for merchants seeking a safe haven during bear markets. Tether makes it easier for traders not having to convert back and forth in fiat and USDT is used by many popular trading platforms. Exchanges using USDT include Binance, Poloniex, Bitfinex, Okex, Huobi, Hitbtc, Bittrex, ZB.com, Bitforex, Fcoin and there are many others. Given that many cryptocurrency prices have turned a whim, Tether has managed to make its way into the top ten digital currency market capitalizations as the USDT is now in ninth position.

Maker Dao and Dai Tokens

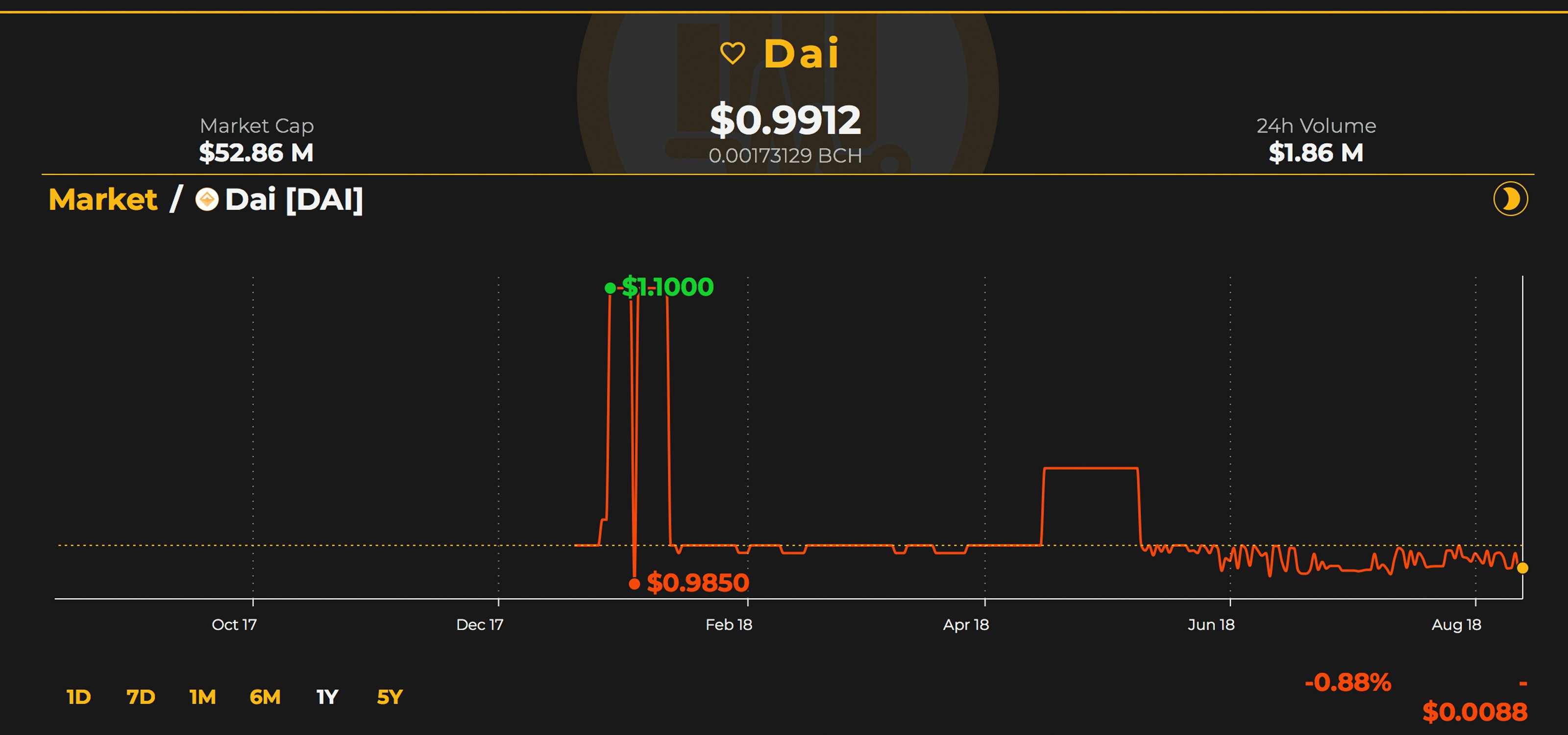

Another interesting stablecoin that has remained fairly consistent so far is the digital currency from, a token created using Maker Dao . Maker Dao is a protocol built on the Ethereum network and in practice uses the dollar conversion rate when it automatically blocks tokens. Essentially a user deposits a blockchain-based resource as a guarantee that, in turn, creates tokens from stable. Since the Dai tokens were first registered in the Coinmarketcap (CMC) historical index on on 27 December 2017 the price remained stable between $ 0.99 and $ 1.02 per currency . Dai tokens are not as popular as Tether (USDT) and the platform is relatively new. However, Maker Dao tokens are regularly traded on decentralized exchanges (DEX) and other token exchange platforms such as Bancor, Relay Radar and Ethfinex. Dai is used by these exchanges and by the general public to borrow and exploit the opportunities because the price of the currency remains constantly valued at $ 1

Another interesting stablecoin that has remained fairly consistent so far is the digital currency from, a token created using Maker Dao . Maker Dao is a protocol built on the Ethereum network and in practice uses the dollar conversion rate when it automatically blocks tokens. Essentially a user deposits a blockchain-based resource as a guarantee that, in turn, creates tokens from stable. Since the Dai tokens were first registered in the Coinmarketcap (CMC) historical index on on 27 December 2017 the price remained stable between $ 0.99 and $ 1.02 per currency . Dai tokens are not as popular as Tether (USDT) and the platform is relatively new. However, Maker Dao tokens are regularly traded on decentralized exchanges (DEX) and other token exchange platforms such as Bancor, Relay Radar and Ethfinex. Dai is used by these exchanges and by the general public to borrow and exploit the opportunities because the price of the currency remains constantly valued at $ 1

The Trust Platform Token Asset Tokenization

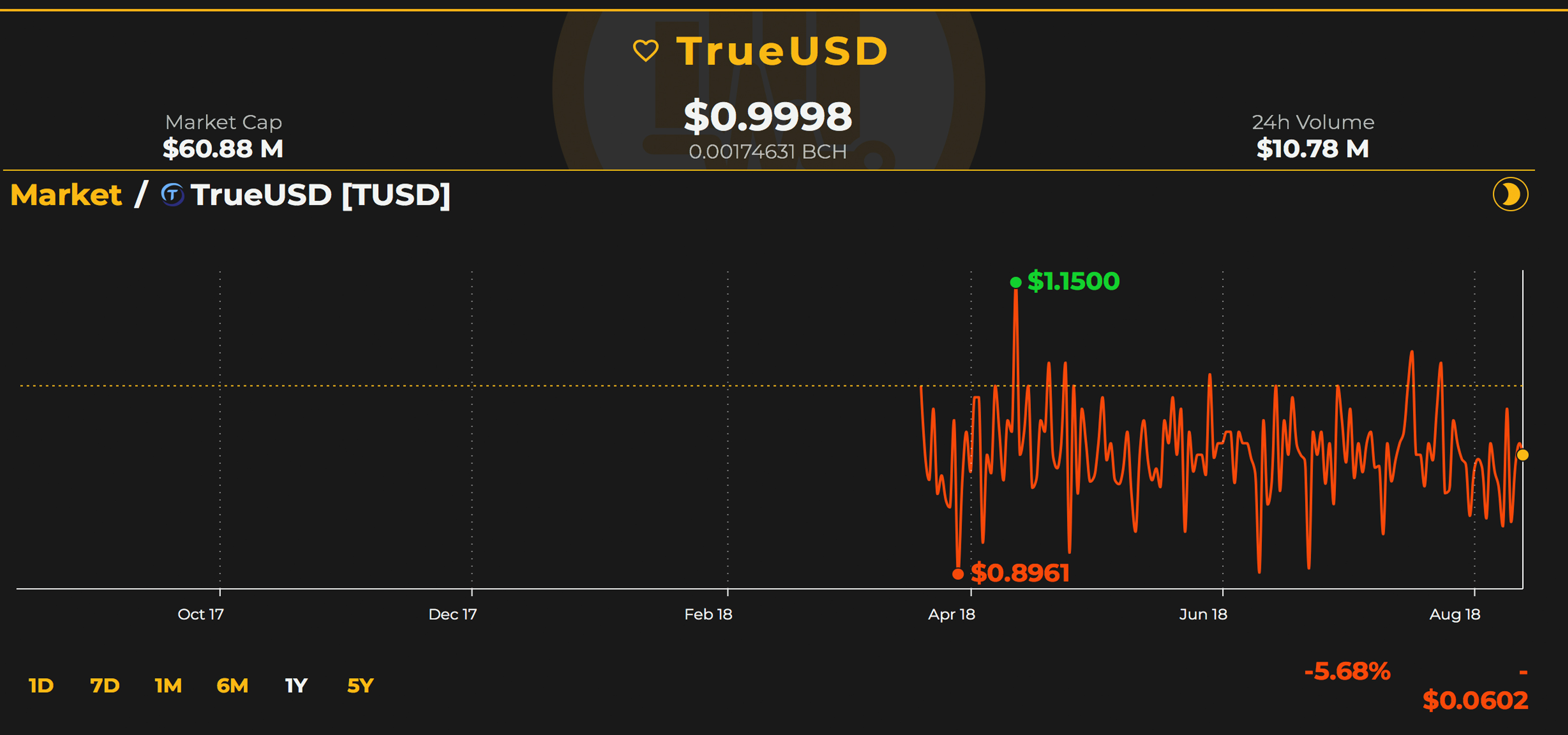

Then there is the stablecoin called & # 39; t rueusd & # 39; – a currency issued by the trust token Resource tokenisation platform. The creators of trueusd (TUSD) argue that each token is backed by collateralised dollar resources dispersed across various escrow accounts in the Trust token platform based on Ethereum. Like the tether (USDT), trueusd tokens are supported 1: 1 with the US dollar, and at the moment the currency has a market valuation of $ 60M. Exchanges have started using trueusd for stablecoin pairs, just as they do these days. Just recently, the Indian exchange Zebpay announced the use of trueusd and the Bittrex trading platforms, and Binance also listed the currency. Trueusd was first included in CMC's historical data on March 6, 2018 and the token remained stable between $ 0.99 and $ 1.01 for TUSD.

Then there is the stablecoin called & # 39; t rueusd & # 39; – a currency issued by the trust token Resource tokenisation platform. The creators of trueusd (TUSD) argue that each token is backed by collateralised dollar resources dispersed across various escrow accounts in the Trust token platform based on Ethereum. Like the tether (USDT), trueusd tokens are supported 1: 1 with the US dollar, and at the moment the currency has a market valuation of $ 60M. Exchanges have started using trueusd for stablecoin pairs, just as they do these days. Just recently, the Indian exchange Zebpay announced the use of trueusd and the Bittrex trading platforms, and Binance also listed the currency. Trueusd was first included in CMC's historical data on March 6, 2018 and the token remained stable between $ 0.99 and $ 1.01 for TUSD.

Other stable currencies Arrive

The three stablecoin cited above are probably the most popular so far, and each has seen a significant uptake. The controversial lapse (USDT) is the champion in charge of stable assets today. However, there are a number of other stablecoin who are making their way into the crypto-economy, or plan to join in the near future.

A stablecoin called kowala (KUSD) recently collaborated with the Ledger hardware portfolio company. Ledger devices will be able to send, receive and store KUSD. Another stablecoin in the works is called NUSD, which is an asset based block block EOS that was built by the development team Havven . Following this project, there is a platform of smart contracts that plans to put their tokens called Usdvault (USDVAULT) under guarantee, with gold bars that are said to be housed in Swiss vaults. The creators of the Vault argue that the stable currency will be based on a 1: 1 price ratio in USD, but the 1: 1 value of the resource is essentially backed by precious metals located in Switzerland. Also, not too long ago, the cryptocurrency company unicorn Circle Invest explained that it is also working on a stablecoin that will be tied to the value of the US dollar.

It seems that although some of these currencies are controversial and people need to put their trust in the claims that the activities are really supported by a certain guaranteed resource, so far they continue to grow very popular. Of course, the main concern will always be if these stable currencies are really anchored to real US dollars, and if they are not and are based on the price ratio, they can keep the values 1: 1 over time. [19659047] What do you think of the stable coins like the tether, dai, trueusd? Do you think this concept will continue to be popular in the cryptocurrency universe? Let us know what you think in the comments section below.

Disclaimer: Bitcoin.com does not endorse or support these products / services.

Readers must exercise due diligence before taking any action related to the company mentioned or one of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use or reliance on any content, goods or services mentioned in this article.

Images via Shutterstock, Satoshi Pulse, Tether Limited, Trueusd, Dai Logo and Pixabay.

Check and track bitcoin money transactions on our BCH Block Explorer, the best of its kind anywhere in the world. In addition, keep your holdings, BCHs and other currencies in our market rankings at Satoshi & # 39; s Pulse, another original and free Bitcoin.com service.