[ad_1]

[ad_1]

• Accounting industry disconcerted by the existential state of computer code

The cryptocurrencies force all of us, including accountants, to answer fundamental questions. Among them is the intrinsic nature of money. What is it? Throughout history, money was a currency or banknote backed by a trusted component.

In the last ten years, however, Bitcoin and other cryptocurrencies have turned this thought into the head. Because although they are the currency that you can not overturn, cryptocurrencies represent units of account or exchange that can function more or less in the same way as cash or its proxies.

Historically, the element of trust in money came from the fact that coins and banknotes were produced and guaranteed by a central authority or a state. But with a cryptocurrency, this trust must be set in another way. Cryptocurrencies achieve this through a distributed ledger or blockchain.

This registry generates trust by tracking all existing cryptocurrency units and is validated by an independent network of computers or nodes. These have so far proved to be resistant to external manipulation. These nodes come essentially to a consensus on which transactions are valid and which are not.

Of course, distributed registries have applications beyond cryptocurrencies, which makes it possible to have a blockchain without a currency, but impossible to have a currency without a blockchain. In other words: a cryptocurrency is a trust mechanism with an overlapping monetary exchange system.

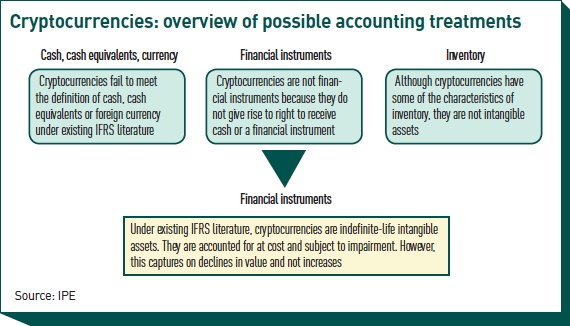

But those who believe that accountants consider cryptocurrencies as nothing more than cash should rethink. International Financial Reporting Standards (IFRS) – emerged from the December 2016 meeting of the International Accounting Standards Board (ASAF) advisory forum – are surprisingly quiet on the subject, despite having an important role in helping the half to get a generalized acceptance.

As the founder of the UK Cryptocurrency Association, Paul Ferris, he said at the meeting: "If the regulators can intervene, they can give certainties." The problem, he says, is that when legislators and legislators look at cryptocurrencies, they think in terms of illicit – despite every transaction, since their inception a decade ago, it is eminently traceable.

The hypothesis that they are in cash, poses a fundamental question: "What's the money?" Essentially, it is a means of maintaining value, even if the IFRS literature offers few indications.

International Accounting Standard (IAS) 32 Financial instruments: the presentation specifically includes the "cash" in the definition of a financial asset, with the cash and cash equivalents defined in IAS 7. According to paragraph 7: 6 of IAS 7, cash as cash and ask for deposits. As noted by Henri Venter, author of a document of the Australian Standarding Boards (AASB) presented at the ASAF meeting, IAS 7 does not offer further definitions of "cash" or "demand deposits".

In particular, Venter has identified a sentence in IAS32 that refers to money as a "medium of exchange", but which poses the question: what is a medium of exchange? After all, just because something can be exchanged does not make it cash.

Venter says: "If you explore the concept in a slightly larger context, it is reduced to whether entities accept it as a means of payment for goods or services." Now, some entities around the world accept cryptocurrencies, but they are not at all widely accepted … So I think there is an argument to say that a medium of exchange gets to the point where it becomes legal, or at least some sort of central authority [dictates] which is a valid means of exchange ".

But could cryptocurrencies qualify as cash equivalents? The author of the AASB document says no. In his opinion, a particular critical point is the level of volatility inherent in the cryptocurrencies traded on the stock exchange.

Meanwhile, the director of the International Accounting Standards Board (IASB) Peter Clark claims to have perceived that the cryptocurrencies were in cash, but saw the low trading volumes in the middle as an obstacle. He says, "I was personally attracted to seeing it in cash because it makes accounting matters easy enough … But … the place we think it fell off was if you look at the definitions of economists, one of the notions they have is that it's a 39; unit of account.

"And I think what we thought was supposed to be transactions denominated in Bitcoin – not that you would have valued them in pounds and converted to Bitcoins to put it back from the other side of the world and then reconvert it … If we saw a lot of quoted transactions in cryptocurrencies, which could make it look like much more money, but until we see it, I think we are hesitant. "In a sense, we have already been here, both with the European Currency Unit (ECU), a forerunner of the euro, both with the ruble convertible between the previous trading partners of the Soviet bloc.

Yet neither the ECU nor the convertible ruble were true currencies; instead, they were an accounting construct that allowed economies with different currencies to account for transactions on a common basis. The same could apply to a company that has to prepare its accounts with Bitcoin as a functional currency.

So, if cryptocurrencies are neither cash nor equivalent – at least not yet – are financial instruments? Probably not, because they fail to pass through the gateway that requires a financial instrument to give rise to a contractual right to receive cash flows.

The vice president of IASB, Sue Lloyd, however, says that the council could solve the problem. "What we could do," she says, "is to change the purpose of IFRS 9, in the same way we did for commodity derivatives, we thought they were a financial instrument through P & L [a profit and loss account]. We could say that they are currencies and [are] fair value through profits or losses. "

This fair value through the designation of profits or losses could prove difficult to achieve if the board were to treat cryptocurrencies as intangible assets in accordance with IAS 38, Intangible Assets.

IAS 38 states that if an item is sold in the course of an asset, it must be accounted for as an inventory in accordance with IAS 2. This means that it is valued at the lower of cost or net realizable value. A commodity broker dealer, on the other hand, can do fair value accounting. Here lies the problem: simply holding a cryptocurrency for investment purposes makes the holder a commodity trader? Probably not.

It means that the cryptocurrencies are in a land of none of the accounts. Despite the possibility that the IASB will know how it intends to deal with cryptocurrencies – as something different from intangible assets – the IASB's agenda leaves little prospect, the committee will begin to solve the problem within the next decade.

[ad_2]Source link