[ad_1]

For stocks, see Golden Unicorn’s authoritative, professional, timely and comprehensive analyst research report to help you seize potential thematic opportunities!

A shares continue to float, adjust low valuations or increase prosperity, shares attract institutional attention

Source: Securities Daily, the most profitable line in the stock market

Zhao Ziqiang Chu Lijun original

The A stock market began a rally on Monday and the next four trading days entered a shock adjustment. At the close on November 13, the Shanghai Composite index fell by 0.86% to close at 3310.10 points; the Shenzhen Component Index fell 0.27% to close at 13,754.55 points; the ChiNext index rose by 0.23% to close at 2706.81 points. The total transaction value of the Shanghai and Shenzhen exchanges on the same day was 727.163 billion yuan, slightly higher than the previous trading day. It is worth noting that Northbound funds sold 4.94 billion yuan net that day.

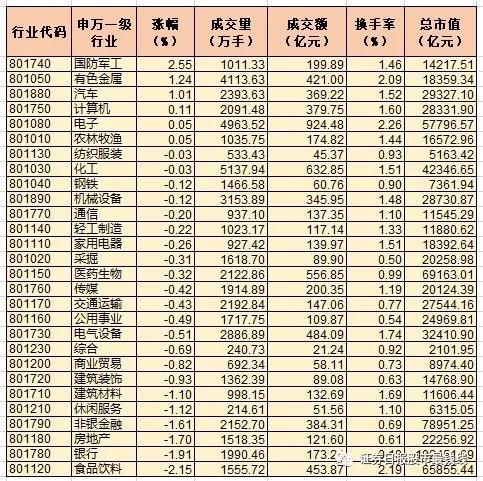

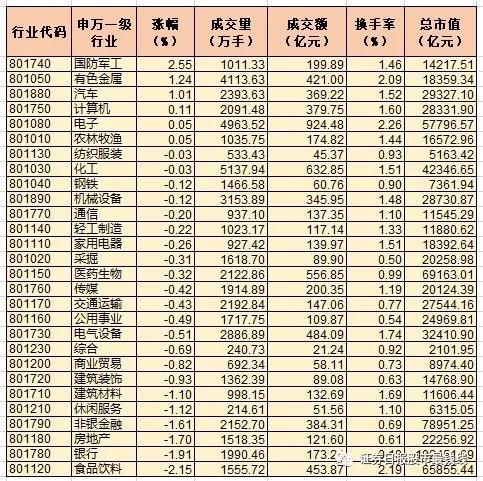

Regarding the performance of 28 sector indices at Shenwan Level 1, a Securities Daily reporter found that 6 sector indices were closed at the close of November 13, namely national defense, non-ferrous metals, automobiles and computers. , Electronics industry, agriculture, forestry, animal husbandry and fishing. Among them, the national defense and military industry index increased by 2.55%, ranking first in the list of increases; the non-bank financial, real estate, banking, food and other industries index fell by more than 1.6%.

Recently, the trend in the liquor sector, which has attracted a lot of market attention, has undergone a “reversal” from the sharp rise of the previous days and closed more than 5% on 13 November. between them,Elite、Jin Huijiu、Kouzijiao、Welcome drive wine、Ancient dry white wineCollective limit. By contrast, the titanium dioxide concept industry performed very well throughout the day.Jinpu Titanium、Panzhihua Iron and Steel Vanadium TitaniumThe daily limit was subsequently blocked, and the non-ferrous metals sector and cobalt stocks are also activeHengli Industrial、Western resourcesAnd the aluminum stocksHuafeng aluminumBoth daily closing limits.

As for the A stock market’s performance on Friday, Qianming Asset Management senior researcher Chen Wenjin said in an interview with a Securities Daily reporter that it is now the year-end trading period, between the three quarterly reports and year-end performance. During the period of the vacuum, the liquor sector, which had been oversold in the previous period, entered the historical high valuation range. The good earnings of the day were basically undervalued sectors with compensating gains, such as defensive sectors like the military industry, or titanium dioxide and cobalt sectors that entered the economic tipping point. Among them, the titanium dioxide industry benefited from the increase in volume and product prices in the third quarter; the cobalt industry has benefited from the dual support of the growing market demand for cathode materials for ternary batteries for new energy vehicles and the falling cost of cobalt materials.

Looking back at the A-share trend this week, Xia Fengguang, manager of the future star fund of the private equity ranking network, said in an interview with a Securities Daily reporter that the trend of the A-share market this week has been mixed. It went through a sharp rally on Monday and then fell for 4 consecutive days, mainly driven by market sentiment. It is worth noting that the “trampled” crash in the credit bond market on Thursday led to weak market sentiment on Friday morning. Some investors feared that the risk would shift to the banking sector, causing major indices like the Shanghai Stock Exchange 50 to be dragged heavily down. However, after years of “deleveraging” in the bond market, even individual risks are fully controllable. Overall, the disturbance in market sentiment is only a short-term factor affecting the performance of A shares. When market sentiment is released to some degree, the market will continue to follow its usual momentum.

“Recently, market trading has become increasingly slow, with significant differentiation between the strengths and weaknesses of the sectors, and the hot spots are ups and downs, making the market unable to form a synergy. Therefore, the market has always maintained a range-bound model. ” Fangxin Wealth Fund Manager Hao Xinming accepted the “Securities Daily” During the interview, the reporter not only analyzed the market trend this week, but also expressed his views on the market outlook. He believes that “if the trading volume cannot be moderately amplified and a joint force breaks the state of equilibrium, I fear that the market outlook will revert to a limited range pattern. In such an operational situation, once the index it is adjusted on the bottom rail of the box, it can intervene on the deal. Throw it away when it bounces on the top rail of the box. If the market outlook can be an effective breakthrough, investors can follow the market trend to increase and decrease their positions “.

Chen Wenjin reminded investors that recent market sentiment has been volatile and the funds are divergent. The market is likely to continue to be under pressure next week and keep a volatile operation. There are more short-term opportunities than long-term opportunities. Investors are advised to pay attention to major white horse stocks with reasonable valuations and growing prosperity and to check their positions.

Xia Guangguang also believes that the current structured market has become the norm, but it is not that the increase does not have a ceiling. Investors are advised to be cautious about consumer stocks represented by spirits and to pay some attention to the low valued sectors, pro-cyclical chemicals, non-ferrous and other sectors. .

Table: Shenwan Primary Industry Market Performance List on Nov 13

Watchmaking: Chu Lijun

Sina Statement: Sina.com publishes this article for the purpose of providing more information and does not mean that it agrees with your views or confirms your description. The content of the article is for reference only and does not constitute investment advice. Investors therefore operate at their own risk.

Disclaimer: The content fully provided by Wemedia is derived from Wemedia and the copyright belongs to the original author For reprinting, contact the original author and obtain permission. The views of the article represent only the author, not Sina’s position. If the content provides investment advice, it is for reference only and should not be used as an investment basis. Investing is risky, so be cautious when entering the market.

Massive information, accurate interpretation, all in Sina Finance APP

Responsible director: Chen Zhijie

.

[ad_2]

Source link