[ad_1]

The market is experiencing a sharp decline and the current value of the total encrypted market is less than $ 150 billion.

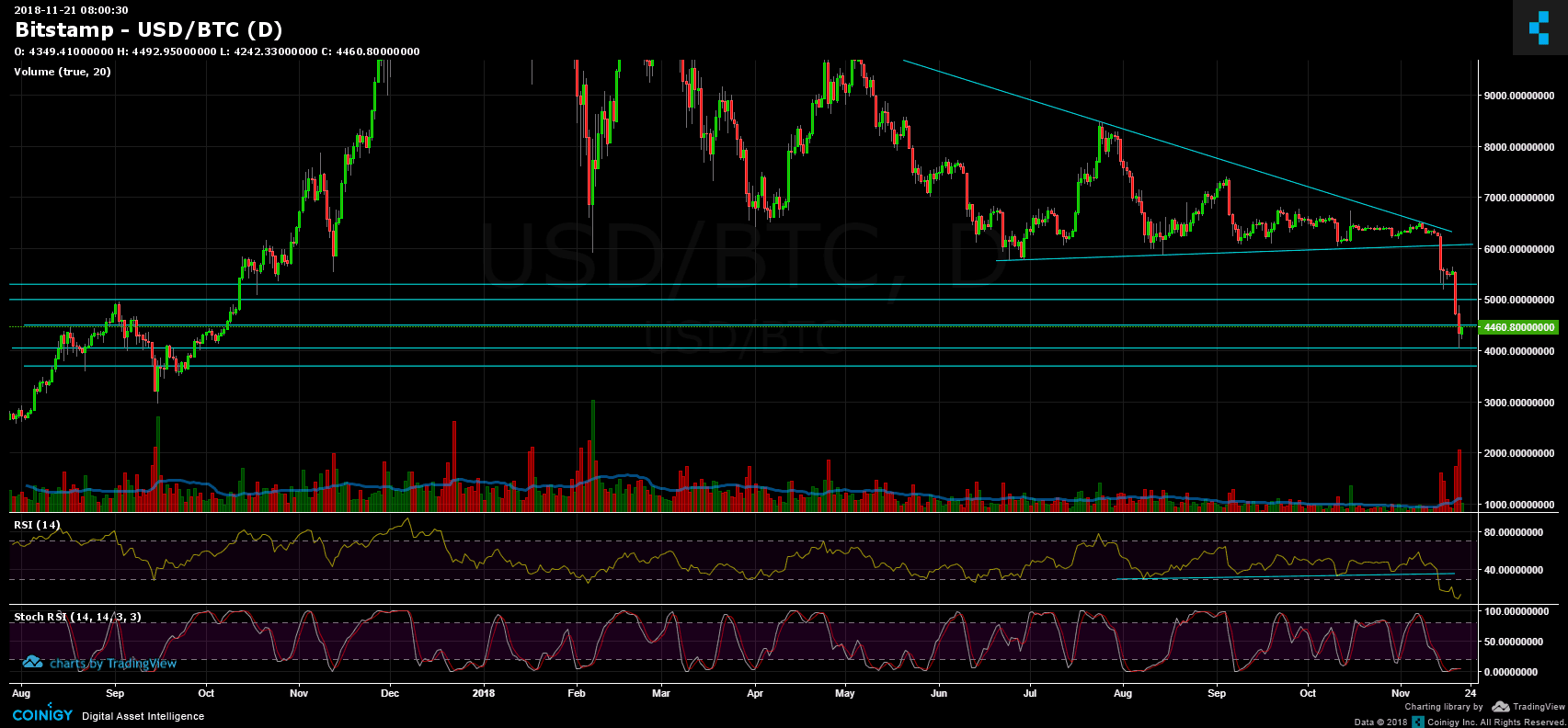

Bears have taken total control of the market and have pushed the price of Bitcoin at a low price like $ 4,000 – $ 4,200 (depending on the exchange you are looking at).

This is a 30% drop in a few days.

This lead was probably triggered by the enormous triangular formation that would have been seen on the daily chart for months. The time required to develop these types of consolidations directly affects the number of limit orders that are set below or above the break points of the formation, and more orders are set at these break points a stronger rally is triggered.

When these types of consolidation are interrupted, all traders come together on the same side.

– If the training breaks at the minimum:

Short limit orders are initiated + uninterrupted long positions that cause stop-losses, which adds more firewood to the fire.

– If the formation breaks towards the top:

Long-term orders are activated + short positions in progress are stopped stop-losses (to close a short position that an operator has to repurchase). This adds more wood to the fire, and then we see a rally.

It is also important to note that the value of the RSI indicator of the daily chart of BTC has fallen to 10, which is a very low value for the daily RSI and should be taken into account.

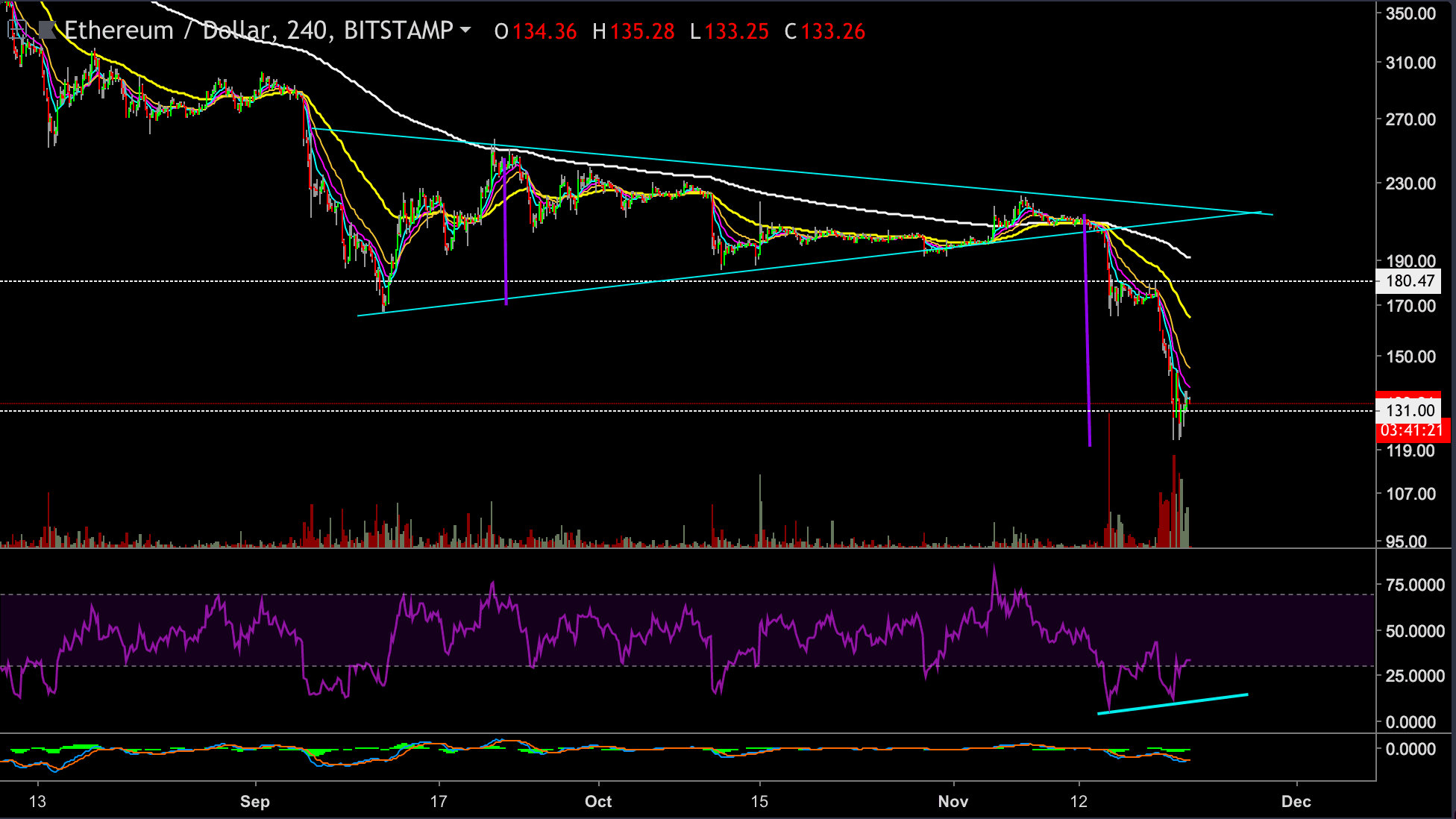

The price of Ethereum fell 25% from our last update (the lowest price of $ 121) and is currently traded at the price level of $ 131 (Bitstamp).

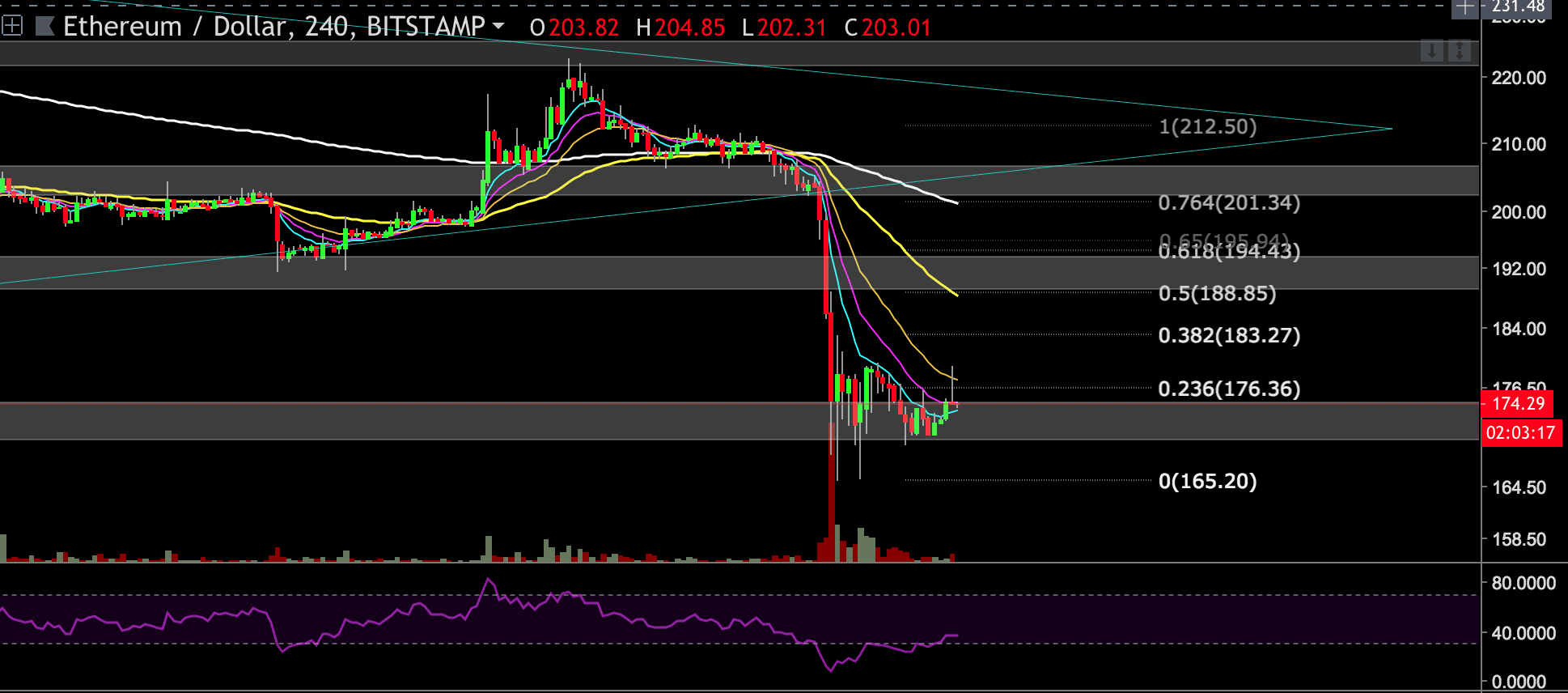

Looking at the 4-hour chart:

– The ETH chart is currently supported by the horizontal support levels $ 130- $ 135 from the daily chart. Notice the 3 candles that hit under those support levels and rise above them. This is a good temporary sign that shows that the bulls are fighting to keep the ETH price on these levels.

– Also, please see that the formation of the broken triangle on November 12th had a target area around $ 125, which is exactly where the ETH chart found the support that stopped freefall (the lowest price $ 121) .

– If this level of support is valid, we could see a rebound up to the price level of $ 146 (Fibonacci retracement level of 0.382) or even higher than the $ 153 (Fibonacci retraction level 0.5 and 200EMA) . The current positive diversions that can be seen in the oversold regions of the 4-hour RSI indicator support this view.

– However, if the bears manage to overcome the current level of support, the descending rally will continue with the next possible target at 100 $ (a mentally strong number in which the bulls might attempt to enter).

– If the price level of $ 100 does not hold up, the next level of support could be found in the price level area of $ 85 (historical support level from May 2017).

BitStamp ETH / USD 4-hour chart

CryptoPotato video channel

More news for you:

[ad_2]

Source link