[ad_1]

[ad_1]

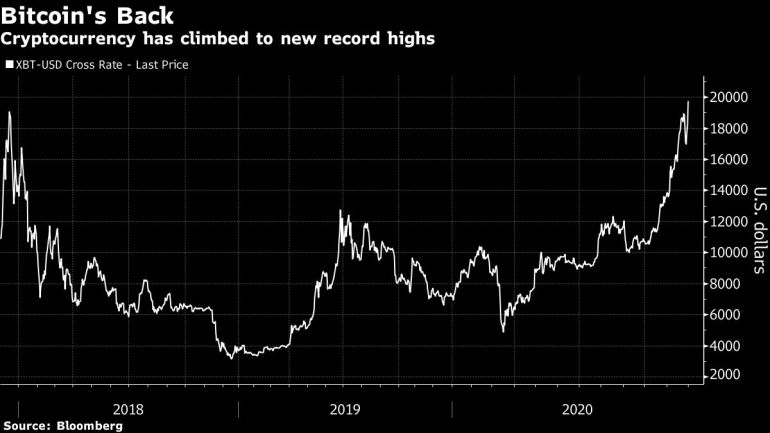

Bitcoin hits a new record, taking less than three years to replicate the meteoric rise that brought it into mainstream consciousness.

Bitcoin hit a record, taking less than three years to replicate the euphoric rise that catapulted cryptocurrency into mainstream consciousness.

According to data compiled by Bloomberg, the world’s largest digital asset rallied 8.7% to $ 19,857.03 on Monday, pushing this year’s rise to more than 170%. It was trading at pennies for several years after its launch in late 2008 by an unknown software developer in the wake of the global financial meltdown. Shares of companies with exposure to cryptocurrencies also rose, with Marathon Patent Group Inc. and Riot Blockchain Inc. each up by at least 22%. MicroStrategy Inc., a software company that bought Bitcoin, added 20%.

“The time for Bitcoin has arrived,” said Guy Hirsch, chief executive for the United States at the eToro trading platform, who cited institutional involvement as one of the reasons for his recent progress. “This rally may still have a long way to go.”

For Bitcoin and its fans, it is an important opportunity in a ten-year life cycle marked by periods of extreme volatility. The token reached a previous high of $ 19,511 in December 2017 amid widespread euphoria, only to lose 70% over the next year.

In some ways, 2020 has proved fertile ground for Bitcoin’s return, with global central banks driving lending rates to record lows and providing extraordinary stimulus due to the Covid-19 pandemic.

Proponents have harnessed the money printing narrative to promote the idea that Bitcoin is a store of wealth even though inflation remains mostly low. However, major investors including Paul Tudor Jones said they bought the cryptocurrency as a hedge against central bank and government shares.

Even with the latest price hike, Bitcoin ownership remains concentrated in the hands of a small number of investors who were among the first to adopt it. According to researcher Flipside Crypto, around 2% of anonymous owned accounts that can be tracked on the cryptocurrency blockchain control 95% of the digital asset.

With jaw-dropping earnings, traditional financial firms have been looking to capitalize on growing institutional demand, with Fidelity Investments launching a Bitcoin fund earlier this year. PayPal Holdings Inc.’s October decision to allow customers to use cryptocurrencies was seen as an opening to an even wider audience.

“You now have many ways for institutional investors to gain exposure to cryptocurrencies using regulated exchanges or instruments that they are comfortable with,” said Henri Arslanian, PwC Global Crypto Leader. “Most of these didn’t exist in 2017”.

Bitcoin remains highly volatile. According to data collected by Bloomberg, this year it recorded an average daily variation of 2.7%. This compares with fluctuations of 0.9% for the price of gold, which is at times at odds with digital assets and even hit a record high in 2020.

That volatility was shown during the week that included the Thanksgiving holiday, during which the coin came under $ 7 from its previous high only to lose $ 3,000 over a span of two days.

Matt Maley, chief market strategist at Miller Tabak + Co., says it could hit $ 22,000 before it peaks for a while. Technical indicators show that it has been overbought, which means it may soon retire. Any decline could be rapid but, he says, “it is very unlikely that it will be close to the 2018 decline.”

–With the assistance of Claire Ballentine, Elena Popina, Joanna Ossinger, Kenneth Sexton and Jeran Wittenstein.

.[ad_2]Source link