[ad_1]

It was found that two out of three people who were notified of the global housing tax this year pay less than 1 million won.

It is estimated that most of the people who just paid the tax this year due to rising public prices are at this level.

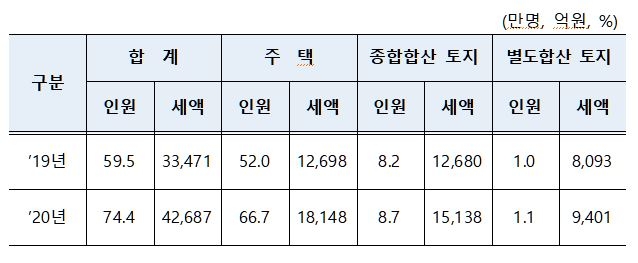

According to the Ministry of Strategy and Finance on the 29th, there are 667,000 people subject to housing tax this year, and the amount of the high land tax is 1.84 trillion won.

The number of subjects increased by 147,000 compared to last year.

This is the result of the increase in the published price due to the increase in house prices, the realization of the published price and the effect of an upward adjustment of the fair market price ratio.

The government raised the realization rate of quoted prices for homes with a market value of 900 million to 1.5 billion from 66% to 69%, from 67% to 75% for 1.5 billion to 3 billion won. and from 69% to 80% for those above 3 billion won.

The fair market value ratio went from 85% last year to 90% this year.

Of the 667,000 people who are subject to the final housing tax, 376,000 people have two or more multi-family households and the amount of tax imposed on them is 1.49 trillion won.

This is equivalent to 82% of the total amount of the invoiced tax.

319 billion won was imposed on 291,000 homeowners.

In terms of the amount of taxes, 432,000 people represented 64.9% of the total, with less than 1 million won.

Many of them are estimated to be single.

The government estimates that homeowners who are recently subject to the housing division tax will pay 100,000 to 300,000 won this year.

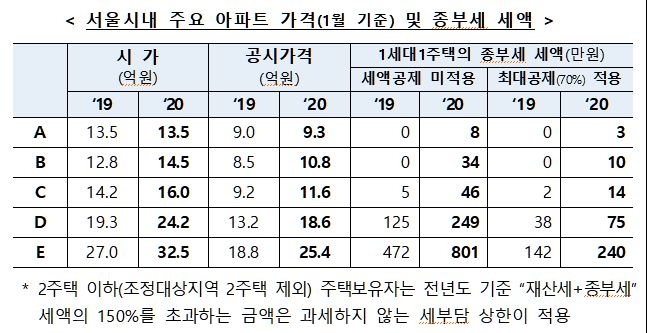

For example, assuming a house called A, where the price of the house last year and this year remained the same at 1.35 billion won, the publicly announced price would increase from 900 million to 930 million won.

In this case, for the first time this year, it is subject to taxation, but the amount is approximately 80,000 won (hereinafter based on 1 family and 1 home).

Here, if the maximum deduction for seniors and long-term storage is applied, it is 30,000 won.

The official house price, which went from 1.28 billion won last year to 1.45 billion won this year, will rise from 850 million won to 1.08 billion won.

If the owner is a single-family home owner, the tax burden is 340,000 won.

However, if both elders and 70% of the long-term deduction were received, it would be reduced to 100,000 won.

The published price trajectory of 34 pyeong from Raemian Prugio, Mapo, Seoul, is similar.

In other words, people who own homes of this balance are subject to new taxation this year and will pay around 340,000 won.

If you go to an expensive house, the tax burden increases dramatically.

If the real estate market price went from 1.93 billion won last year to 2.42 billion won this year, the official price went from 1.32 billion won to 1.86 billion won.

For first generation single family owners, the tax tax has increased from 1.25 million won last year to 2.49 million won this year.

In the case of receiving the maximum deduction, it will go from 380,000 won last year to 750,000 won this year.

If the official price rises from 1.88 billion won last year to 2.54 billion won this year (from 2.7 billion won to 3.25 billion won at market price), the final tax will pass. from 4.72 million won last year to 8 million won.

If the maximum deduction is received, it will increase from 1.42 million won last year to 2.4 million won this year.

/ news yunhap

Source link