[ad_1]

[ad_1]

Cryptocurrencies have taken a place near the center of the stage for investors apparently overnight. The exchanges that manage the volumes of the cryptocurrency operations are not different.

Back to July 2017, Binance conducted an initial coin offering that raised $ 15 million in its BNB token. Today, just over a year later, Binance is the world's largest cryptographic exchange with a daily trading volume of around $ 500 million (compared to the $ 40 million CoinBase) and its token has a market capitalization of over $ 1 billion.

Faithful to the shape in the cryptocurrency space, Binance's growth has reached a vertiginous speed. And it's just getting bigger.

Binance is presumably one of the only exchanges that has never been violated, despite regular reports of other violations of the exchange and theft of cryptocurrency. To build the industry, Binance has also launched a venture capital investment arm, a research division, an educational portal and a charitable foundation this year.

Binance raised $ 100 million to support the UN's sustainable development goals with the launch of a donation portal based on blockchain, and is also working to increase the use of the crypt through an investment in TravelbyBit travel startup and the creation of a fiat-to-cryptocurrency exchange in Uganda. Far from a simple exchange, Binance has become an ecosystem for initiatives at the forefront of global blockchain technology and encrypted adoption.

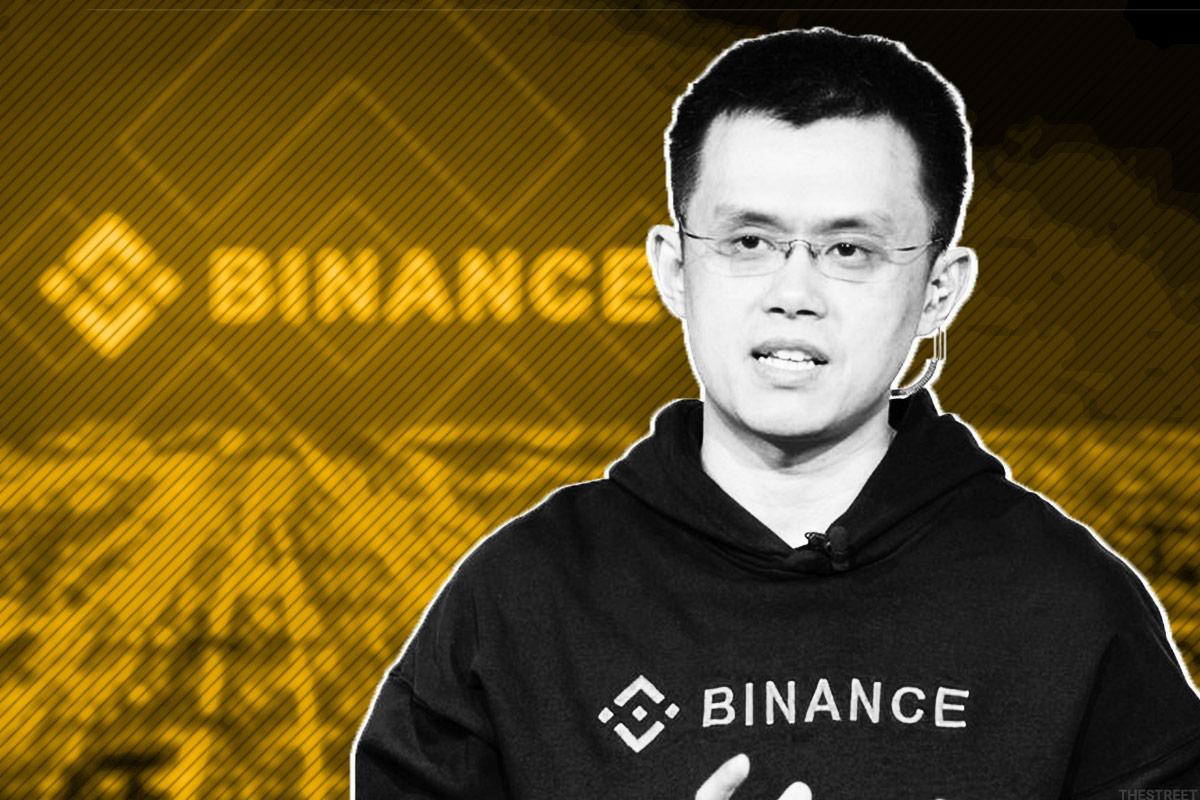

TheStreet recently collaborated with Binance founder and CEO Changpeng Zhao to discuss the latest announcements and what Binance will see in the future. What follows is a slightly modified transcription of our discussion.

In the last year, Binance has evolved much more than a cryptocurrency exchange. What is the best way to describe Binance today?

At the moment, Binance is still an important exchange of cryptocurrencies and many people see us that way, but we are building the ecosystem. We want to be the infrastructure service provider for the blockchain space, so we have a number of different initiatives.

Many of them are still quite small, including the exchange (I think if we compare ourselves to the traditional one [market] exchanges, we are still rather small). I think the best way to describe Binance right now is: we are trying to be the infrastructure service provider for tomorrow's blockchain industry. Right now, our ecosystem consists of Exchange, a portfolio, Labs, Charity, Info, Academy and more. We hope that some of them will become the infrastructure for industry.

How would you summarize what happened in 2018 for Binance?

The year had started hot from the beginning. But then the cryptocurrency market has registered a slight decline, both in terms of the volume of trade and the number of people participating in the sector. But I think 2018 was also a year in which we keep our heads down and build.

We are working very hard to create our services, so we have made many improvements to our core services; we have acquired the portfolios and we have added many more services to our customers. So I think 2018 is a year of construction.

In fact, we were lucky enough that the market was falling slightly. If the market continued to grow this way, we would not have been able to keep up. It actually gave us the breath to build a firmer fundamental basis. Now, when the market takes off again, we will be ready.

You have keynotated the recent World Investment Forum in Geneva. What was the main point you want the audience to take from your speeches?

The main topic to take into consideration is: I personally believe that if we make 100% transparent charity using blockchain technologies, the charity space and the positive social space will be 10 to 100 times larger. Immediately. And we can do many more good things.

We are seeing an influx of institutional funds entering into encryption as in recent times. What is your opinion on this trend and how will it affect the blockchain industry and cryptographic markets?

In general, greater institutional participation is a very good thing. If you look at a large family of funds like Fidelity, only they manage over $ 2 trillion. In contrast, the entire cryptographic market capitalization is only $ 220 billion.

The fact that Fidelity is moving into space (launching digital asset trading services last month) suggests that the capital market cap will grow much more. When the market capitalization increases, the price will rise; when the price goes up, it will attract many more people. It is basically a very positive result.

Even with greater market capitalization and with the participation of institutions, greater stability will be achieved. When the market capitalization grows big, it will not change much and we will also see greater adoption. All of this I think is very positive. It is only a matter of time. I do not know how fast it will happen, but it will happen.

Where does the institutional capital currently active in Crypto come from?

In traditional financial markets, the United States has the largest volume of institutional money. Even in crypto today, it is more or less the same allocation. I think the United States has more. But even the United States had the most stringent regulations. For example, we are seeing a more rapid adoption of institutions in Europe and Singapore. Singapore is one of those countries where it is quite easy to go there and register a trading company. They are quite open about it.

Unfortunately in China, almost zero institutional investors participate in the cryptocurrency markets. Even in the broader stock market, there is not a lot of institutional investment. Everyone manages their own money. It's a kind of rough rift that we see.

What are the following objectives in Binance's agenda?

We do not really plan a year. We have a ten-year strategy, but when we really make plans, we are planning only three months in advance, at most. Usually like two weeks before. Overall, our 2019 will only be to increase the adoption of cryptocurrency. This is not just for Binance or Binance's money as a platform, but more generally we want to increase adoption for cryptography. Anything that helps the industry get bigger will be good.

We will try a number of different things but I can not put everything we will try in 2019. If you ask me the rest of 2018, I could give you some ideas, but even then, those ideas change very often.

What would you say is the basic strategy behind Binance's initial investments like TravelbyBit? What is Binance looking for in space startups?

We are looking for teams that share our vision; who want to build infrastructure for ten years along the road to this sector. If you see a guy who believes in this industry – who is willing to squat for the next ten years and build a solid service – those are the types of teams we want to invest or acquire.

How do you want people to think about Binance?

In the end, I want people to think of Binance as a verb. Just like Google. Google was a name; now I have "google" something. He should not really think of Binance; it should just think of something you do, and this should automatically be Binance.

An infrastructure service provider: this is our ultimate goal. Today, if you drive on the road, you do not think to drive on a road; you drive. Find a road and drive us on. We want to be the way.