[ad_1]

Original title: Guidance for multiple trusts! Some companies have completely suspended their financing activity and must complete the 20% pressure reduction activity throughout the year. How much will it affect?

Summary

[Molte guide finestra di fiducia! Alcune società sospendono completamente l’attività di finanziamento e devono completare un calo di pressione del 20% durante tutto l’anno]The end of the year is approaching and the drop in pressure from trust company financing has become a key indicator of regulatory considerations. The reporter was informed that a number of trust companies have recently received guidance from regulators to strictly reduce the scope of funding of trust businesses and ensure the completion of previously established pressure relief activities. (Trust Bailaohui)

The end of the year has comeConfidencethe companyDeclining pressure from financing activity has become a key indicator for regulatory consideration.

The reporter has learned that manyTrust CompanyRecently received by regulatorsWindow guide, Requiring rigorous funding for the pressure dropTrust industryCorporate ladder,GuaranteeComplete the previously set pressure drop activity.

It is worth mentioning that some trust companies have been asked to “completely suspend business financing” in the driving window due to the fact that the pressure drop in business financing is not up to par.

Urgent to complete the 20% pressure drop operation

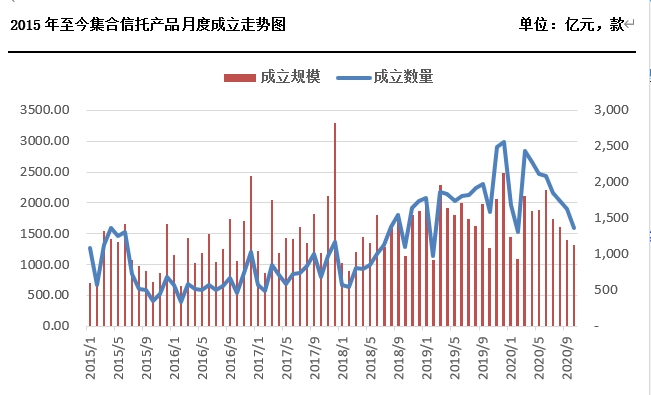

In March of this year, local banking and insurance regulatory offices communicated the 2020 regulatory trust requirements to trust companies in their jurisdictions. The key point is that continuous compression has a shadowbankcharacteristicFiduciary financingBusinessTrust financingCompression plan.

In agreement withplanning, Industry-wide pressure drop of 1 trillion yuan in 2020 has a shadowbankCharacteristic financingTrust the business。

In the middle of the year, many trust companies received window guidance from the China Banking and Insurance Regulatory Commission, making it clear that each company’s initiativemanagementClass fusionCreditThe specific scale of the support.

A source once revealed to a Bailaohui Trust reporter: “According to the proportion of the total volume of the sector occupied by the actively managed financing trusts of various trust companies, specific instructions have been issued. Based on the scale of the managed financing trusts active of each company at the end of 2019, the respective pressure drop ratio is around 20% and each company receives a specific pressure drop value. “

According to Trust reporter Bailaohui, it was lowered at the end of the year. To ensure thattargetsAchieved, many companies have received window guidance from regulators.

A number of relevant persons from trust companies admitted that the content of the window guidance received from their company was that “the annual pressure relief activity must be completed”.

“Two weeks ago, I received a regulatory request to estimate whether the financial trust’s pressure drop target can be met. Due to our company’s strong pressure drop, the data target can be completed.” An insider from a trust company said.

It is worth mentioning that some trust companies have been asked to “completely suspend business financing” in the driving window due to insufficient pressure drop in business financing.

Some people in the industry are not surprised by the regulatory requirements above, pointing out to reporters that the full suspension of trust business financing is aimed at trust companies whose business data is still high and does not meet regulatory requirements.

According to a reporter from the Bailaohui Trust, since the second half of the year, banking and insurance regulatory offices in many places have continued to monitor the reduction in pressure from funding trusts by trust companies in their jurisdictions. Some accelerating companies were audited and ordered to suspend their financing business several months ago.

“Our company’s financing activity has been suspended for four months.investmentThis business is expected to reopen next year. “An insider from a mid-sized trust company revealed.

The gradual pressure drop is continuousworks

Since 2018, the “de-channel” of the trust industry has achieved remarkable results, and the channel’s business scope has declined rapidly from its peak at the end of 2017. However, the rapid growth in the financing of the business volume of trust in the 2019 attracted the attention of regulators.

At the China Trust Industry Annual Conference held in late 2019, regulators clearly pointed out that the current financial business model of trust companies was confusing.Direct financingPerimeter with indirect financing; alienatedTrust plan, product “Rigid payment“; disturbedmarketAtmosphere, the “reputation risk paradox” has formed, which causes investor education to go in the opposite direction and ultimately disrupts the financial market and evensocietystable.

In the middle of this year, the head of the relevant departments of the China Banking and Insurance Regulatory Commission said that the transformation and development of trust companies is a gradual process and that reducing illegal financing of trust activities will also be an ongoing task. Therefore, regulatory policy will not prevent trust companies from carrying out financing activities across the board, but will gradually reduce the scope of illegal financial activities and urge them to optimize their business structure until the trust company can rely on its original activity to support it.Operatingdevelopment of. In the future, the financing of trust activities will be done more by trust companies with standardized management, strong risk control capabilities and strong capital strength to ensure that the tasks entrusted are carried out, the business risks are controllable and “the sellers are responsible and buyers are responsible “.

(Source: Trust Bailaohui)

(Responsible publisher: DF512)

Solemnly declares: The purpose of this information released by Oriental Fortune.com is to disseminate more information and has nothing to do with this booth.

.

[ad_2]

Source link