[ad_1]

Latest news on Ethereum

The fact is that blockchain-based projects should be just that, blockchain. However, a new WhiteBlock study sponsored by ConsenSys, whose founder, Joseph Lubin, is a wheel dealer at Ethereum, revealing otherwise EOSIO's claims. Although EOS is known for its incredibly fast speed thanks to its dPoS and block producer architecture, it is now emerging that it is not a blockchain for say but a "homogeneous" database.

EOS: follow-up analysis, pt. 1 of @Whiteblockio https://t.co/8hl4d6XvnH #blockchain

– mike d. kail (@mdkail) 6 November 2018

A deeper level and WhiteBlock have conducted benchmark tests demonstrating that EOS transactions are not cryptographically validated. What worries is that EOSIO, says WhiteBlock, can not process millions of transactions as previously marketed. Rather, EOS can process 50 TPS with optimum print speeds at the most when latencies and packet losses are taken into account.

We are excited to announce that our decentralized Cross-Blockchain liquidity network, #BancorX, was officially broadcast live, enabling automated token conversions between over 110 ERC20 tokens and EOS-based tokens. https://t.co/E54nlUElmG pic.twitter.com/NSocQZr11A

– Bancor (@Bancor) 5 November 2018

Meanwhile, Bancor, a decentralized on-demand liquidity network, launched BancorX making cross-interaction between ERC and EOS tokens possible through BNT tokens. This is incredible for both networks because it means more liquidity and security because tokens do not have to go through exchanges.

Analysis of ETH / USD prices

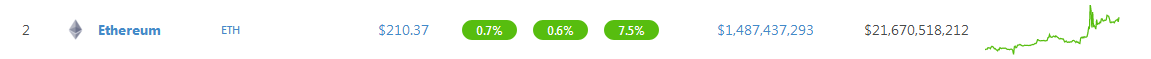

After weeks of reds, the ETH / USD performance is moderate and up 7.5% in the last week. On a daily basis, ETH prices are stable in the 0.6 percent print on the last day. However, we expect the ETH / USD to expand in the coming days, as the SEC plan is to publish an ICO guide for coin issuers and as the bulls try to reverse the losses of this year.

Trend: flat and bearish

Following the September 5 losses, ETH / USD moved in a narrow range of $ 110 with lows to $ 160 and immediate resistance to $ 250. While prices horizontally consolidate, calls to unless, of course, there are strong gains in both directions. This is because we have conflicting positions. On the one hand, losses have been steep – + 75% losses compared to the 2017 highs that position the bulls for further gains. Yet, on the other hand, we have the bear breaking pattern of September 5, supported by high trading volumes that represent the main obstacle against buyers.

Volumes: growing and bullish

Comparing the volumes of 5 September – 595 k and those of 15-967 K of October, there is a clear disparity. All things constant, this is bullish. And it is even stronger with the sellers' failure to close down, confirming the losses of 5 September and 11 October.

Candlestick Confirmation: Bear Break out, remote market

The lack of price movements in the last two months was mainly due to the consolidation of a market. Although on 4 November the bar indicates the bulls below, the ETH / USD market is largely in range mode. Because such a series of risky and prudent traders must wait for confirmation of the September 5 bear break pattern or the cancellation of this price model once the ETH / USD pair exceeds $ 250 and even the $ 300.

Conclusion

Regardless of the prevailing sentiment and the reversal expectation of ETH / USD due to losses this year, patience is key. In this case, an aggressive and risky series of traders can buy spot-ons with stops at around $ 190 or October lows. On the other hand, conservative traders should wait for prices to exceed $ 250. From then on they can start buying on dips with the first goals at $ 400.

All graphics courtesy of Trading View

This is not a trading advice. Do your research.

[ad_2]

Source link