[ad_1]

Latest news on Ethereum prices

That governments are optimistic about blockchain technology is true. In fact, we have seen several forward-looking agencies in progressive states like Singapore and Austria that use DLT technology at some point. Now, people familiar with state developments argue that the economic development and the Ukrainian trade ministry are serious about legalizing cryptocurrencies and similar activities, including coin offerings (ICOs).

This is huge. Austria will use the Ethereum blockchain to auction over $ 1.3 billion of government bonds. These are the kind of things we need for traditional adoption. pic.twitter.com/pCmfUIWOai

– Altcoin Thoreau (@cvrbonbased) September 28, 2018

To this end, the state intends to introduce and implement a favorable policy that promotes the development of blockchain activities and cryptocurrency at the legislative level. In a two-stage implementation strategy that will end by 2022, Ukraine will have to eliminate uncertainty, paving the way for blockchain companies to achieve the goals in "understandable conditions". This progress seems to confirm Alexei Mushak's post on Facebook that suggests their intention to formulate the right laws that stimulate mass adoption while restraining criminal activities.

In that case, Joseph Lubin's comments on digital resources are not at the limit are true. Speaking with CNBC, Joseph-who doubles as co-founder of Ethereum and founder of ConsenSys, remains optimistic about the potential of similar Ethereum and DLT. It indicates an increase in blockchain projects and the cyclical "boom and bust" that tempers the market.

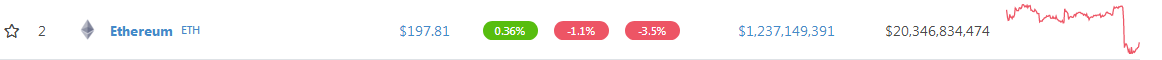

Price analysis of Ethereum (ETH / USD)

Despite the optimistic projection, ETH / USD is simply fading the herd as prices fall under psychological tags. In the last week and day, the price of Ethereum fell 3.5% and 1.1% respectively as expectations for the collapse in price action.

Trend: bearish

After 14 days of horizontal consolidation, ETH / USD broke down. But it seems that it was the path of least resistance. A simple trend line that connects recent highs is on a negative slope. In addition to this, there are other bear indicators. Note that in the last two months, bars 7-8 August, 5 September and 11 October stand out. All of them have strong volumes and vast commercial ranges that feed more culls.

Volumes: decreasing

Although sellers appear to be in charge, October 15 volumes are very high – at 967k. It is even higher than those of October 11 at 657k. Between October 16th and 29th, average volumes were around 55,000 spectators, only 172k yesterday while ETH / USD was down. From this, it is clear that our analysis is still high on October 15th.

Candlestick Training: Bear Breakout Pattern

Technically, the events of the first two weeks of September define the recent price action. On September 5, ETH / USD fell below $ 250 in a bear breakout scheme. Since then, ETH / USD prices have fluctuated within the narrow range of $ 120 between $ 250 caps and $ 160 support. While traders remain optimistic, bulls can only be confirmed if there are solid moves above the $ 250 support prior to resistance. Not even that printed.

Conclusion

In a nutshell, ETH / USD is in a precarious position in a market that varies widely between $ 250 and $ 160. Volumes are low and the spark plug is lower. For this reason, it is safe to take a neutral position while we wait for solid volume losses of less than $ 190, confirming the bears of October 11th. From there, traders can take sales of reduced positions. In addition, conservative traders should wait for outright breaks below $ 160 or SEP. If the ETH / USD pair falls below this, the first targets are $ 75. On the back, the peaks above $ 250 must be the revival of the market.

All graphics courtesy of Trading View

This is not a trading advice. Do your research

[ad_2]

Source link