[ad_1]

Resolution in court for the “ class / credits susceptible to extinction ”

After the deliberation, the installation of managers or superiors and the compliance officer consultation process are also conducted.

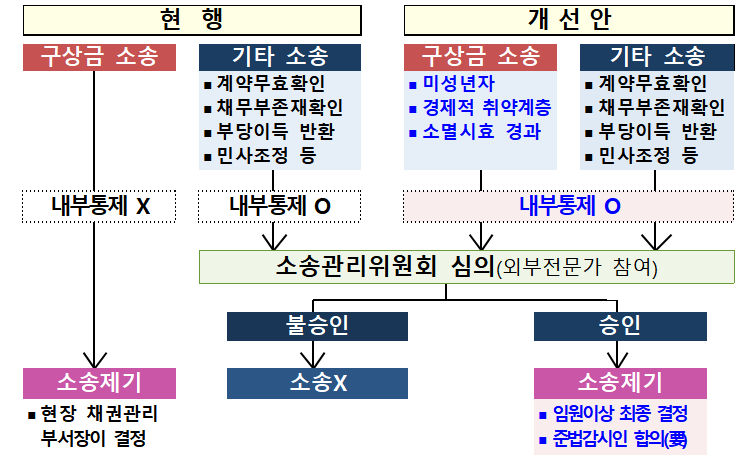

With the aim of protecting the rights and interests of financial consumers by insurance companies, measures will be promoted to strengthen the internal control function so that they can be prudent in legal actions that require compensation. In the case of a lawsuit for the claim against vulnerable groups or obligations that have exceeded the limitation period, the main objective is to go through the resolution of the Litigation Management Committee for each insurance company, then proceed with the resolution of more than one manager and consultation with the compliance officer after the resolution.

According to the Financial Services Commission and the Financial Supervisory Service on the 8th, the financial authorities have developed a plan to strengthen the internal control of insurance companies on compensation claims in order to prevent the abuse of legal actions by companies insurance.

Insurance companies are still using internal control mechanisms such as the Dispute Management Committee preliminary deliberation to prevent abuse of consumer disputes. In addition, the status of the insurance company’s lawsuits is compared and disclosed through the insurance association’s website.

However, insurers’ “claims” are excluded from internal control, comparison and disclosure and there is no internal or external management mechanism. Claim claim lawsuit is a lawsuit where an insurance company pays insurance money first to the policyholder in the event of an accident caused by the act of a third party in auto insurance or fire insurance, then retrieves it.

As a result, financial authorities plan to develop internal control measures for insurance claims and consult with individual insurance companies to take them into account in their review of internal regulations by the end of this year. Also, during the first half of next year, the review of the insurance industry supervisory regulations and detailed enforcement regulations and disclosure regulations of insurance associations is expected.

The internal control plan included the contents of the extension of the subject matter of the resolution of the Dispute Management Committee on the advisability of bringing a lawsuit against consumers, the cause for compensation against the vulnerable, such as minors, and the cause for compensation against the expired limitation period. Following the resolution of the Litigation Management Committee, the suitability to bring a lawsuit was sufficiently examined in advance through a transaction of more than one executive and consultation with the compliance officer.

The scope of comparison and disclosure by the insurance company, which is disclosed on the website of the Insurance Association, will be expanded every six months. The results of the deliberations, such as the number of litigation management committees and litigation resolutions, approval / disapproval cases and disapproval rates, are included in the scope of comparison and disclosure.

Additionally, efforts to protect the vulnerable will be strengthened when filing lawsuits and raising bonds. Currently, some insurance companies are implementing internal control measures to reduce their debts or exclude them from the extension of the statute of limitations, such as lawsuits, for debtors who are virtually unable to repay their debts, such as minors, persons with disabilities and beneficiaries of a basic life. Financial authorities are planning to uncover and share these cases and to induce insurance companies to make their own efforts to protect the most vulnerable.

Copyright © Shin-A Ilbo Unauthorized reproduction and redistribution is prohibited

Source link