[ad_1]

A look at the shareholders of YG-1 Co., Ltd. (KOSDAQ: 019210) can tell us which group is the most powerful. In general, as a business grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. Warren Buffett said he likes “a company with lasting competitive advantages, run by capable, owner-oriented people.” So it’s nice to see some in-house ownership, as it might suggest management is owner oriented.

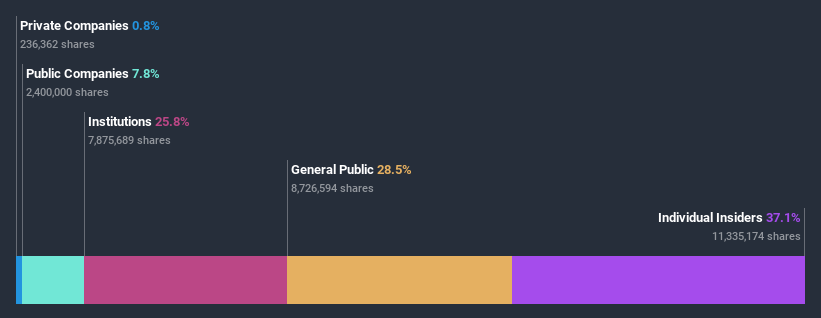

With a market capitalization of ₩ 154 billion, YG-1 is a small cap, so it may not be well known to many institutional investors. Our analysis of company ownership, below, shows that institutions are evident in the share register. We can zoom in on the different property groups, to learn more about YG-1.

Check out our latest analysis for YG-1

What does the institutional ownership of YG-1 tell us?

Institutions typically measure themselves against a benchmark when reporting to their investors, so they often become more enthusiastic about a stock once it is included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

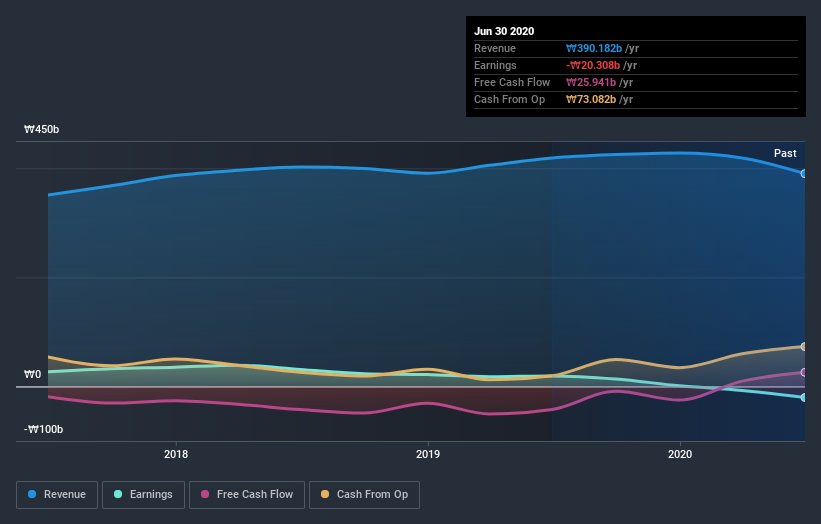

We can see that YG-1 has institutional investors; and they hold a large portion of the company’s shares. This suggests some credibility among professional investors. But we can’t just rely on this fact as institutions sometimes make bad investments, just like everyone does. When multiple institutions own a stock, there is always a risk that they find themselves in a “crowded trade”. When such a trade goes wrong, multiple parties can compete to sell stock quickly. This risk is greater in a company without a history of growth. You can see YG-1’s historical earnings and revenue below, but keep in mind that there is always more to the story.

We note that hedge funds do not have a significant investment in YG-1. With a 37% stake, CEO Ho-Keun Song is the largest shareholder. Meanwhile, the second and third largest shareholders hold 8.8% and 8.2% of the outstanding shares, respectively.

A more detailed study of the shareholder register showed us that 3 of the major shareholders have a sizeable ownership stake in the company, through their 54% stake.

While studying a company’s institutional ownership can add value to your research, it’s also a good practice to seek advice from analysts to gain a deeper understanding of a stock’s expected performance. We’re currently not seeing any coverage from stock analysts, so the company is unlikely to have a large holding.

Internal property of YG-1

While the precise definition of an insider can be subjective, almost everyone considers board members. Management’s response to the board of directors and the board should represent the interests of the shareholders. In particular, sometimes senior managers are on the board of directors.

I generally consider insider ownership a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that the insiders own a reasonable stake in YG-1 Co., Ltd .. It has a market capitalization of just ₩ 154b and the insiders are worth 57 billion shares to them. first name. It’s nice to see the insiders so invested in the business. It might be worth checking if those insiders have recently bought.

General public property

With 29% ownership, the general public has some degree of influence on YG-1. While this group may not necessarily call the shots, it can certainly have a real influence on how the business is run.

Owned by public companies

We can see that the public companies own 7.8% of the outstanding YG-1 shares. It’s hard to say for sure, but this suggests that they have intertwined business interests. This could be a strategic interest, so this space is worth watching for ownership changes.

Next steps:

While it’s worth considering the different groups that own a company, there are other factors that are even more important. Take risks, for example, YG-1 yes 3 warning signs (and 2 that are potentially serious) that we think you should know.

obviously this may not be the best title to buy. Therefore, you may want to see ours free collection of compelling prospects boasting favorable financial data.

NB: The data in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month in which the financial statements are dated. This may not be consistent with the full year annual report data.

Promoted

If you are looking to trade with YG-1, open an account with the cheapest * platform chosen by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds around the world from a single integrated account.

This Simply Wall St article is general in nature. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or financial situation. We aim to provide you with long-term focused analytics driven by fundamental data. Please note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

*Interactive Brokers rated as a low-cost broker by StockBrokers.com 2020 annual online review

Do you have feedback on this article? Worried about the content? Get in touch with us directly. Alternatively, email [email protected].

Calculation of discounted cash flow for each share

Simply Wall St does a detailed discounted cash flow calculation every 6 hours for every stock on the market, so if you want to find the intrinsic value of any company, search here. It’s free.

Source link