[ad_1]

After lowering the $ 15,960 on November 6th Bitcoin (BTC) price vigorously defended the $ 15,000 support level. Based on four data points in a chain, analysts consider it the rally could continue beyond $ 16,000.

Analysts pointed to lower Bitcoin holding on exchanges, an offering that remains unchanged, an increase in “stronger hands” and unrealized profits as factors for the continuation of the rally.

According to Coinmarketcap, Bitcoin’s market cap is currently $ 286,937,402,262.

The number of BTCs on exchanges has decreased

Recently, Delphi Digital, an independent cryptocurrency research and consultancy firm, released a file Bitcoin Market Outlook Report.

Paul Burlage, Delphi analyst said so the on-chain metric generally shows good momentum for the price of Bitcoin.

Since February 11, the reserves of Bitcoin on the exchange have fallen from 2.96 million to 2.41 million. In terms of dollars, a decline of 550,000 BTC is equivalent to $ 6.36 billion.

The decline in Bitcoin shares on exchanges is an optimistic development because it means that fewer sellers deposit BTC on exchanges. Burlage She said what:

“On February 11, 2020, BTC on exchanges hit its all-time high of around 2.96 million. As of this writing, $ BTC on exchanges is at around 2.41M. This current trend has seen a divergence. between the availability and the price of Bitcoin, suggesting a more sustainable upward movement for $ BTC “.

BTC provides highs without movement

Although fewer sellers transfer their funds on the stock exchange, the real estate BTC offer remains high.

On September 9, Burlage explained that the percentage of BTC’s offer not moved reached an all-time high of 63.5%. Since then, it has dropped slightly to 62%, but considering the price has risen significantly, that’s a positive measure. She said:

“We have seen a slight decrease in the percentage of supply not moved over the past year over the past week. After hitting an all-time high close to 63.5% of supply not moved on September 9, we are currently close to 62.0. %. “

This shows that investors are increasing Bitcoin’s “HODLing”, despite the recent rally, and are not making big gains yet.

Still no clear sign of a cap

The number of “weak hands” or speculative buyers have fallen sharply in recent weeks, while stronger hands have risen.

Short Term Buyers Exit and Long Term “HODLers” Entry Indicates Bitcoin Might Show Prolonged Rally.

This trend coincides with Bitcoin’s resistance above $ 15,000 and proves it the previously very strong resistance level is close to becoming a support zone. Burlage noted that:

“Although the local highs for ‘weak hands’ tend to decline, we cannot confirm that the recent speculative rally of the base has formed a limit. That said, the broader trend suggests that stronger hands are populating the short-term bands in instead of speculators “.

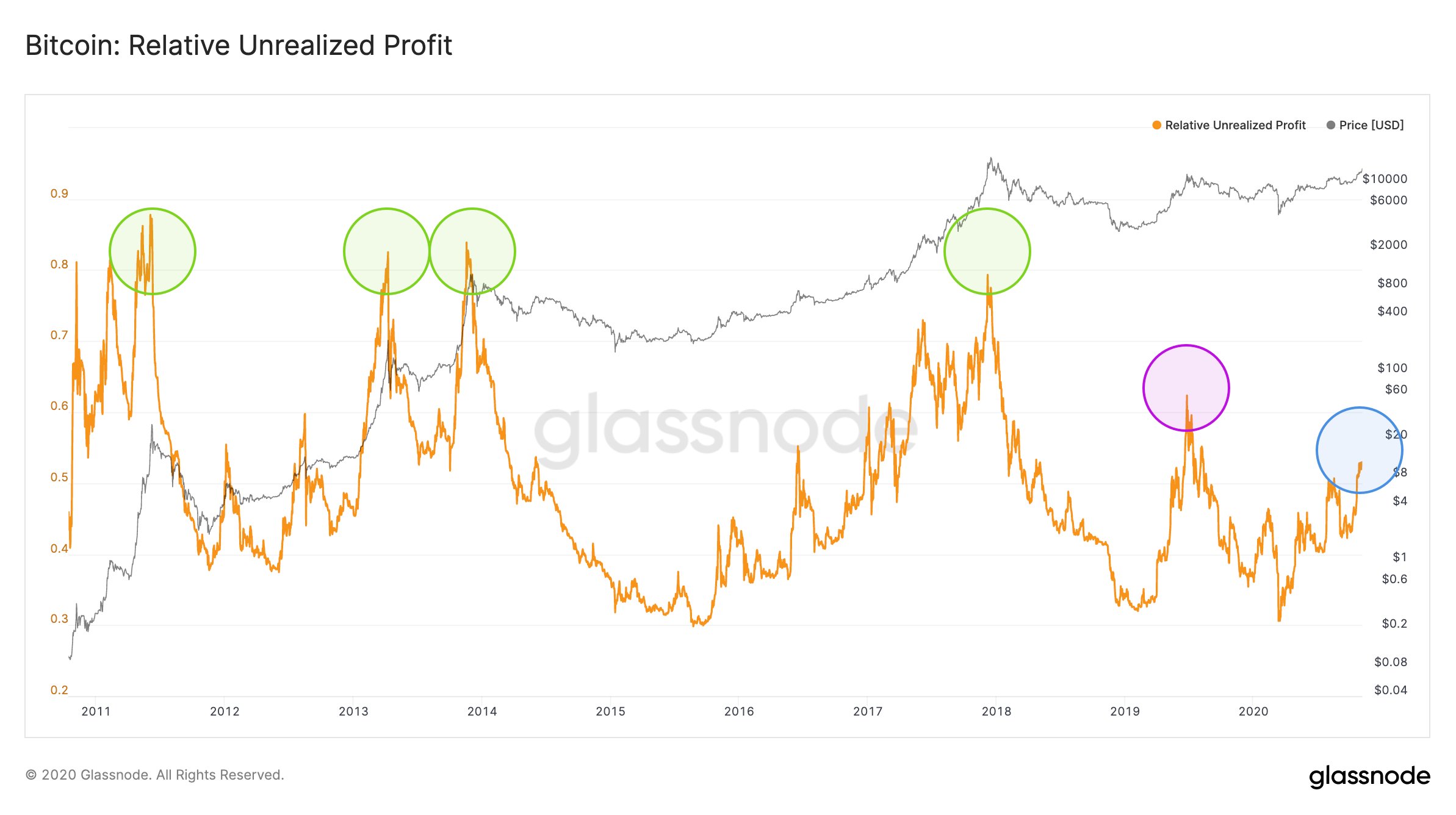

Bitcoin’s unrealized profits indicate that the rally could continue

In July 2019, the price of Bitcoin peaked at around $ 14,000. At the time, Glassnode Technical Director Rafael Schultze-Kraft, She said what Bitcoin’s Unrealized Relative Profit reached 0.64.

Currently, even though the price of Bitcoin is above $ 15,000, the relative unrealized profit is at 0.53. This shows that BTC has the potential to see a larger rally before a big pullback.

Don’t stop reading:

[ad_2]

Source link