[ad_1]

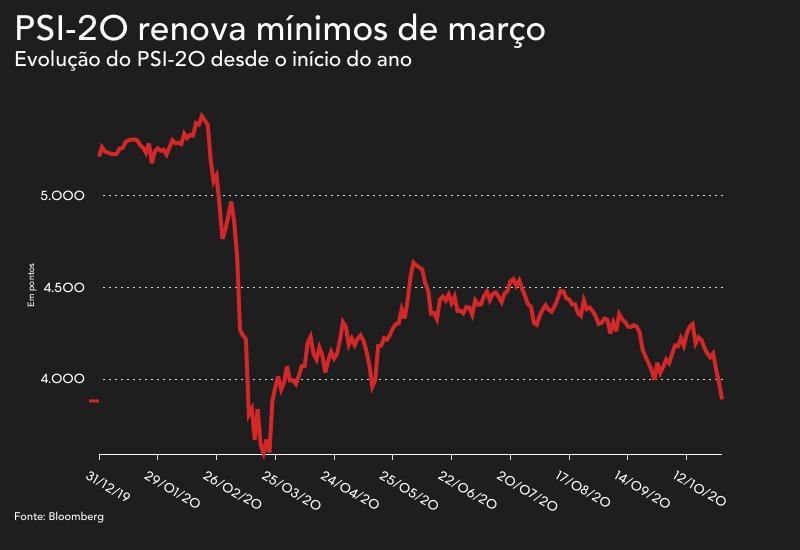

The Portuguese market index closed Wednesday’s session with a 2.23% drop to 3,888.82 points, in what was its third consecutive session to depreciate. Today, the new borders enacted in several European countries are lowering rates in the “old continent”.

After hitting yesterday’s May lows, this Wednesday the Portuguese index is trading at its lowest level since the end of March, when markets were under severe “stress” due to fear of the impact of the “great confinement”.

In a week in which the PSI-20 has already depreciated by around 6%, one of the highlights goes to Banco Comercial Português, which today renews historical lows for the third consecutive session. Tomorrow, the list shows quarterly results after the session closes. The bank led by Miguel Maya is testing the resistance of 7 cents per share. Today, BCP was down 3.43% to 7.03 cents per share – the highest since the end of September – meaning that a BCP stock has never been lower in value. Declines were also recorded in the rest of European banks, with the sector losing more than 3% in this session.

But the poor performance spread to the remaining stocks on the national stock exchange, with 13 companies ending the trading day in “red”.

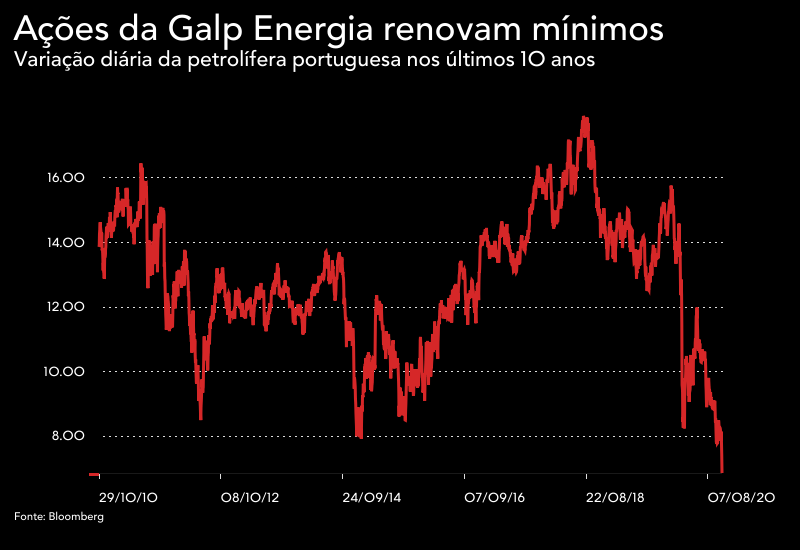

The biggest drop was recorded by Galp, with a 7.27% devaluation to € 6.862 per share, the largest daily decline since March of this year, when the pandemic sank financial markets around the world. Since the Portuguese company showed results last Monday, they have not yet managed to appreciate.

Results for the third quarter of this year showed that the company headed by Carlos Gomes da Silva reported a negative TPL net result of 23 million euros in the third quarter, compared with a positive 101 million euros in the same period last year.

The scenario for companies in the “oil & gas” sector was also negative in Europe, with a cumulative decline of over 4%. One of the few companies that managed to escape the falls was Navigator, which climbed 3.55% to € 1,924 per share. The company reacted positively to the

One of the few companies that managed to escape the falls was Navigator, which climbed 3.55% to € 1,924 per share. The company reacted positively to the

the results for the third quarter, which Caixabank BPI analysts consider “comforting”.

The paper manufacturer posted a net profit of € 75.2 million, down 49% from the same period last year. But a resumption of activity in the last quarter gave strength to the listed company.

.

[ad_2]

Source link