[ad_1]

[ad_1]

In its recently published quarterly report, Square revealed that it is channeling Bitcoin trades from its Square Cash application to private brokers rather than public exchanges.

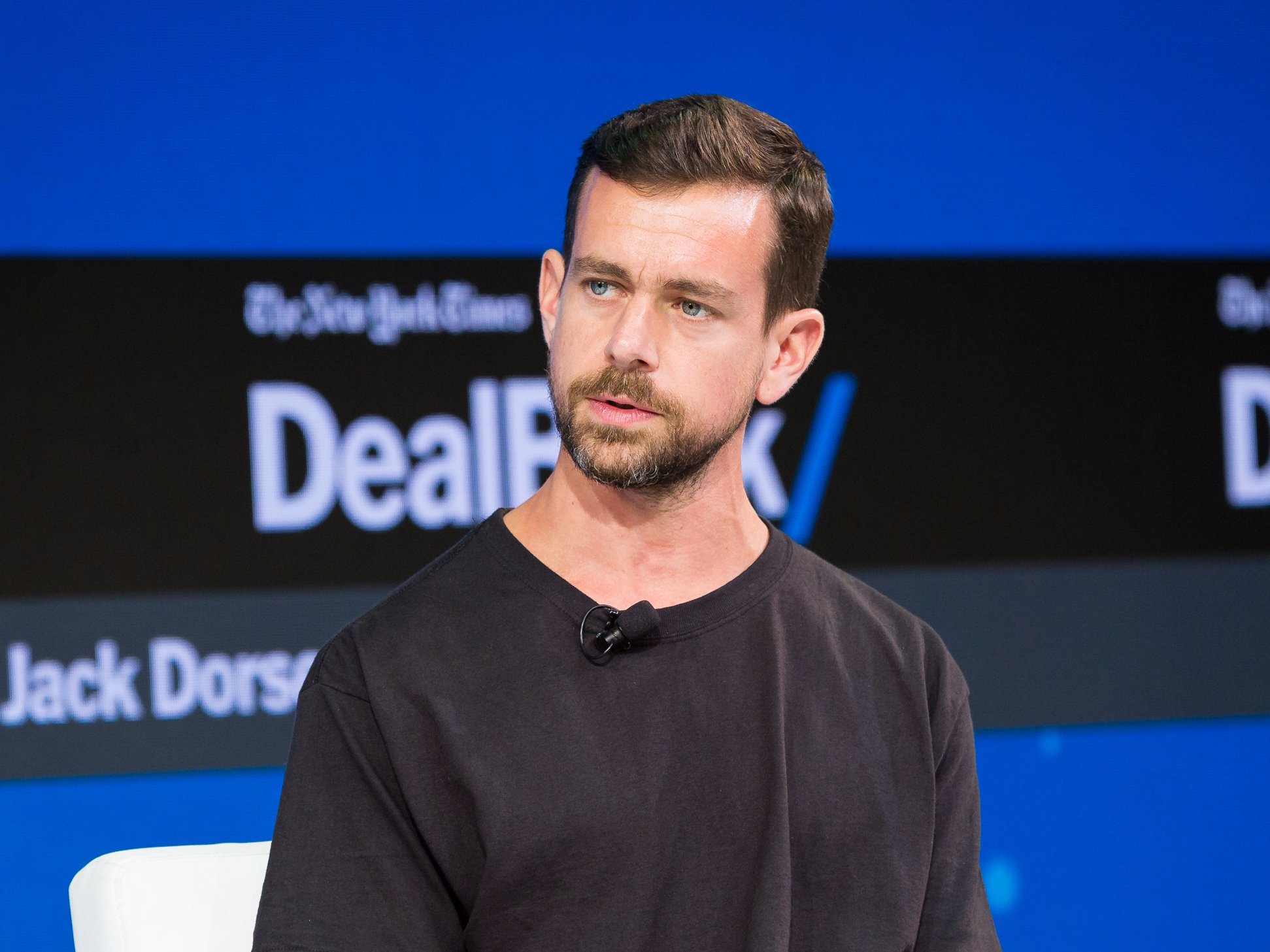

The Square Cash application of Jack Dorsey allowed the purchases of Bitcoin and sales for users at the beginning of 2018, adding to its suite of consumer payments. Although overall, Square's profits are substantial, it is not yet making good fortune on Bitcoin operations. Square recorded only $ 400,000 of profit on $ 37 million of revenue from Bitcoin for the second quarter of 2018.

Square has not announced that it has moved to OTC (Over The Counter) trading services for Transactions Bitcoin. The quarterly report published has quietly revealed that Square "buys bitcoins from private brokers", to facilitate Bitcoin operations for users of the application.

Why Over-the-Counter?

There may be several reasons behind the choice of Square, firstly protecting Square from Bitcoin's price volatility seen in public exchanges. The large and sudden exhaustion of important Bitcoin owners and the "whales" of the market, shift the price of Bitcoin much faster than the OTC banks. Meltem Demirors, CoinShares Chief Strategy Officer said CNBC :

Working with a broker probably gets better prices and better execution services than floating orders on the open market, as well as greater confidentiality.

Secondly, the company could try to avoid some of the security problems and the hacks associated with the exchange of public cryptocurrencies. Private brokers and OTC services can also provide Square with faster transactions with Bitcoin, concealing at the same time Square's market activity from competitors.

Potentially, the move also gives Square a more visible compliance from its use of institutional-style trading structures. Square has not yet commented on the matter.

Bitcoin OTC Trading Increase

A recent TABB Group study, if accurate, shows that Bitcoin OTC trading may have exceeded Bitcoin's daily trading volumes. Certainly the major Bitcoin operations by millionaires investors and institutional investors who move, together with the companies associated with Bitcoin, could fuel the demand for OTC services.

The TABB Group puts Bitcoin OTC trading at 12 billion dollars a day, but the study has been refuted by some . According to statistics from coinmarketcap.com, Bitcoin's daily trading through public grants is about $ 4.3 billion.

Do you think an increase in OTC Bitcoin transactions means cryptocurrency markets?

Images kindly granted by Shutterstock, Bitcoinist archives