[ad_1]

[ad_1]

"How many unspent bitcoins exist?"

"How many bitcoins have been lost?"

"How many bitcoins are left in the wallet, and how does this affect the price?"

If any (or all) of these questions have ever occurred to you, you're in good company: they have crossed the minds of analysts to Delphi Digital, the so-called "research and consulting boutique specializing in the digital goods market."

The company has just published a research on the current status of the bitcoin market and believes it has foreseen a potential fund for its declining prices (for them, it is expected to come in the first quarter of 2019, but we'll talk about this later ). Delphi Digital gave us a preview of the report before announcing it on social media on January 10th.

This relationship is not the typical "shot in the dark" price signal of an old bull, a Twitter trader or an encrypted businessman. They did not use the usual magic tricks of technical analysis or subjects of restitution of fundamental value. They are making the call by referring to the unspent transaction output data (UTXO).

Methods and results

The report, titled "Bitcoin Holder Analysis Through Cycles", is based on the analysis conducted by Delphi Digital for a previous report called "The State of Bitcoin". That is, it creates a price forecast by displaying the sales pressure through the lens of the UTXO.

Looking at the UTXO data, Delphi Digital was able to identify the accumulation and sale of models based on when the unspent bitcoin lay pending or had been moved to be sold. In his report, the company states that "there have been consistent trends in the distribution of the age of UTXO and how this distribution refers to time and price".

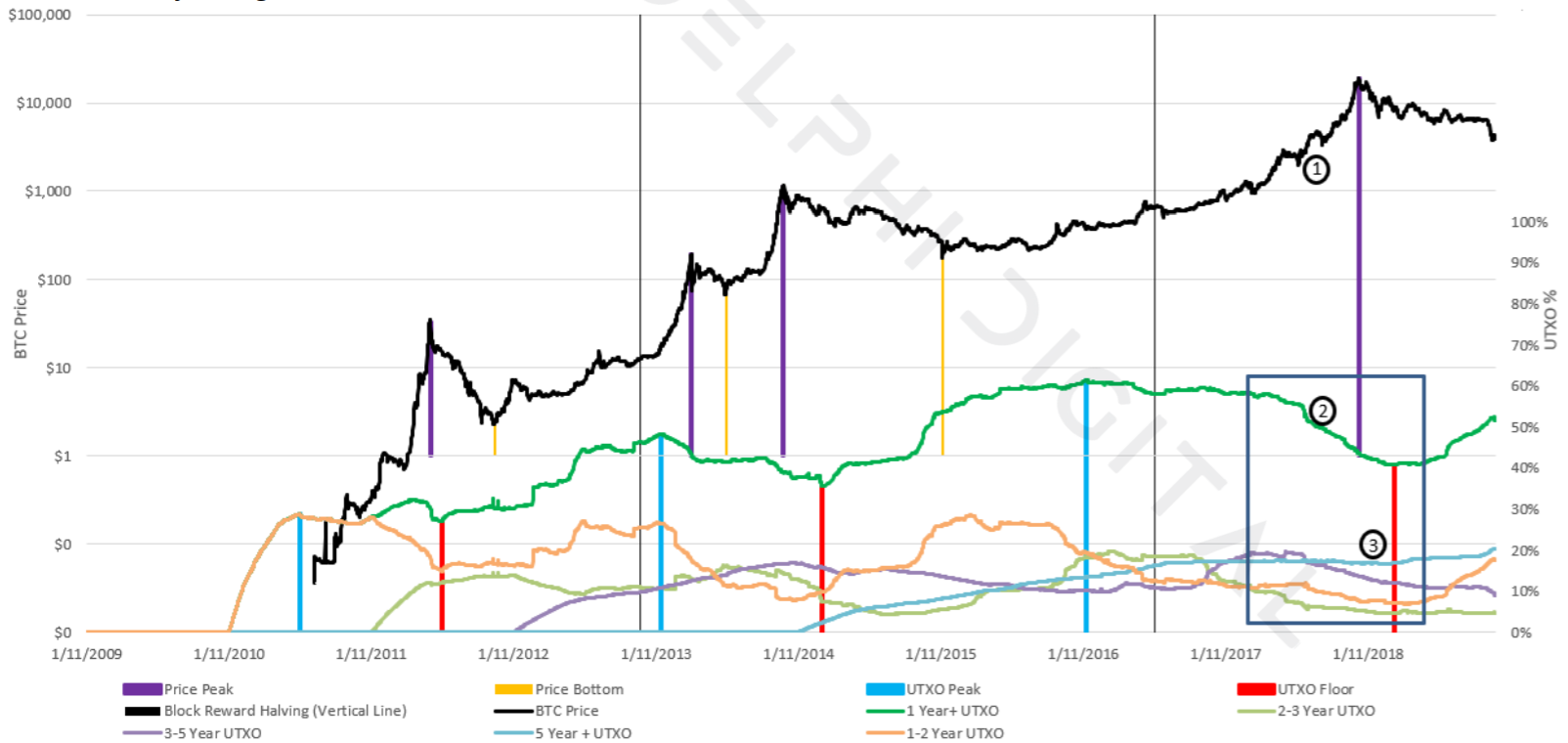

The Delphi Digital report comes with a handy chart to illustrate these trends. Placed under a bitcoin price table, the company monitored the percentage of unspent bitcoins in ≤ 3 months, 3-6 months, 6-12 months, 1+ years, 1-2 years, 2-3 years, 3-5 years and 5 + periods in a series of graphs. They cover all the major booms and busted in their analysis, with data dating back to the beginning of the network (although there was not much to do in the first year).

In short, the analysis finds a substantial correlation between an increase in the total number of coins that have not been touched in 1+ years (s) and a decrease in the number of UTXO 1+ year as prices fall .

This is not too surprising. As long-term holders and early adopters of each cycle see a quick appreciation of their investment, they discharge. And, as the report points out, this dumping creates a generation of backpacks at the other end of the transaction. The new money comes at the end of a cycle, investors buy the top and those late at the party are left with overpriced party favors.

Most of the report examines time slots to diagnose the most recent market cycle. Breaking down the 1-year band in 1-2 years, 2-3 years, 3-5 years and 5+ periods, company data indicate that the UTXO for the 1-year time band has found a half-year plan in 2018 and reversed to an upward trend. Delphi Digital concluded that this probably indicates that the long-term sales pressure (3-5 +) is almost exhausted, and therefore predicts that the market will reach a certain level during the first quarter of 2019.

The time slots can change only if a) the coins are spent and these coins fall back into the band ≤ 3 months or b) if the coins remain unlit and graduate in an older band. Given this logic, Delphi used the 5-year UTXO as a variable to measure the selling pressure of coins in the 3-5 year range, since most of the coins in the 5+ band are lost (Chainanalysis notes that about 2.77-3.79 million could be lost, about 1 million of which are probably Satoshi).

While the 5-year bracket remained static during the 2018 bear, the chart shows a sharp reduction in the 3-5 year range and an increase in the 1 year range, which means coins 2 to 5 years are spent, do not graduate in the 5+ range.

"We can safely assume that the main source of sales comes from currency holders who have held for 3-5 years," Delphi Digital speculates in the report.

"In the field of analysis, we are able to establish that the sales pressure of long-term holders has been exploited significantly and that the accumulation has begun, using the times of the previous lower prices. with respect to the different bitcoin accumulation points, we can use the current UTXO dynamics to predict an approximate date for a lower price, "said the company in correspondence of Bitcoin Magazine.

forecast

The discoveries of Delphi Digital will probably bring some relief to the hodlers who resisted the bear market 2018.

It also offers an optimistic look at what the trajectory of the next cycle might be like.

Using some static gymnastics exercises, the company "compared the width of the 6-12 m line to see which portion it composed from the 1st year at the bottom of the maximum width" ( that is, by observing the percentage (amplitude) of the 6 -12 month band compared to the lowest and highest point in the 1-year band for a cycle).

Demonstrating the 6-12 month band and the 1 year band for this cycle compared to the previous ones, Delphi Digital predicts that the peak of the next cycle will arrive around 17 April 2020.

Now do not go and get a second mortgage on your home / car / vintage doll collection. Delphi Digital admits that its data are limited, but also believes that the consistency of its data (that the peak of market cycles corresponds to the peak of about 63-68% of the UTXO time band of 1 year). However, the company warns that it is "difficult to be confident in a forecast for such a distant date".

"The purpose of this analysis is to provide information on bitcoin media models to improve our hypothesis about price fund times. As we say in the report, we do not believe that this analysis should work alone as an indicator, but rather should be used in conjunction with other relevant data to make the most informed decision possible, "said Delphi Digital. Bitcoin Magazine.

Numerous progress and industry events could interrupt the planned cycle, Delphi Digital continues to explain. In particular, we expect the maturation of the Lightning network and the general adoption to overcome volatility. Furthermore, it is also expected that the next period of inactivity (~ May 2020) will also dampen selling pressures.

Delphi Digital will continue to publish reports like this throughout the year.

Negotiating and investing in digital goods such as bitcoin is highly speculative and involves many risks. This article is for informational purposes and should not be considered an investment advice or an endorsement of any product. Statements and financial information on Bitcoin Magazine and on BTC Media sites do not necessarily reflect the opinion of BTC Media and should not be construed as an endorsement or recommendation to buy, sell or store. Past performance is not necessarily indicative of future results.