[ad_1]

[ad_1]

After a hectic 2018 with plenty of FUD, it's time to take a look at the fundamentals starting positions at the beginning of 2019. Let's see if the loss in value of most coins matches the general state of the market and what could be the trends that change the game to come.

Stable coins

Perhaps more than an ongoing trend, but it seems that the stablecoin will continue to be one thing in 2019. Even more so with recent news confirming that Tether packs some solid dollar bags at their Bahamas bank or the latest reports on the Facebook launch of a stablecoin in India.

Read more: Tether has $ 2.2 billion in the bank as promised, says Bloomberg; The rumors are true! Facebook launches its cryptocurrency

scalability

Scalability limitations on cryptocurrency networks have become evident throughout the historical maximum of a year ago. With Crypto Kitties knocking down the tariffs of Ethereum and Bitcoin by tearing up the roof while the transaction confirmation times became excessively long, it was clear that something had to be done about scalability.

The Lightning network for Bitcoin has increased the block size for Bitcoin Cash, or Raiden Network for Ethereum and the ERC20 family, are all different solutions to avoid the blockchain consent bottleneck.

Read more: Bitcoin Lightning Network is improving, reaching its maximum historical capacity;

Since 2018 has seen many of these projects launched for the first time, one might expect that in the next year their pros and cons will be judged by the markets.

Will the STO finally take control of ICO?

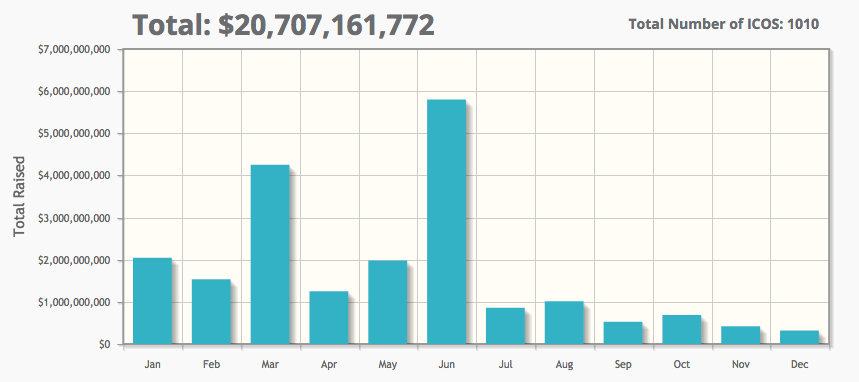

Funds raised through Initial Coin Offerings (ICO) decreased in 2018, as can be seen from the following chart extracted from CoinSchedule. However, the security token (STO) offering market seems to be gaining ground, although current year data do not allow for an appropriate comparison.

The underlying difference between STOs and ICOs is that tokens from the former can be redeemed for a tokenize asset, while ICO tokens are intended to be used as a means of exchange. For example, a current STO allows investors to take part in a Swedish real estate company that builds residential homes.

One of the main advantages of the STOs is that they mostly do not clash with existing legislation or require new ones, except the Chinese case. In the United States, they can be regulated by several existing frames, some of which are related to crowdfunding.

Read more: The Chinese central bank denounces the STO "You will be expelled if you do". Are the ICO dead? "If you are not a solid project, you are not raising funds"

Adoption

Regardless of (in many cases wild) downward price trends along the market in 2018, the number of cryptocurrency users and blockchain-related technologies continues to grow. For example, the number of wallet users has not stopped its growth, as the data available so far ensure:

BUIDL that changes the Alsogame goes in the direction of a growing adoption and has been mentioned a lot during the final year. Perhaps 2019 will be the moment when we will really notice its effects on the market, as CZ seems to believe:

What do you think will be the trigger for the next bull run?

(I am asked this question often, and honestly, I do not know the answer, besides continuing to build)

– CZ Binance (@cz_binance) December 8, 2018

Read more: CZ shoots Coinbase for the BUIDL deposit and ends up offering to pay for drinks

Regulatory and institutional standardization

Already in January it seems very promising in the field of the great player with the launch of Bakkt, regardless of the final date that could change.

Read more: Is Bakkt delaying the launch of its Bitcoin futures platform again?

The platform emerging from the partnership between Microsoft, Starbucks and NYSE's proprietary intercontinental exchange will not be the only breakthrough of traditional exchanges in cryptographic space: both the Nasdaq and the Stuttgart Stock Exchange operator will offer similar solutions to the public.

Read more: Nasdaq confirms the launch of the futures trading platform at the start of 2019; The German stock exchange Boerse Stuttgart is ready to launch the encryption platform

Regulators have also evolved in their positions, with institutions such as the International Monetary Fund now focusing much more on opportunities created by blockchain-based activities, and the SEC is taking a more active role in market moderation. The approval of an ETF, often delayed, could certainly take place next year and most likely would bring the price movements attached.

Follow Chepicap now chirping, YouTube, Telegram and Facebook!

[ad_2]Source link