[ad_1]

[ad_1]

96 new cryptographic funds founded in 2018

96 new cryptographic funds founded in 2018

In a year of downward prices across the board, persistent bearish market trend and persistent regulatory uncertainty, one might think this may not be the moment best to dive deep into cryptography. Some, however, see opportunities. Recently published data show that 96 new encryption and venture capital funds have been founded by July 31 of this year.

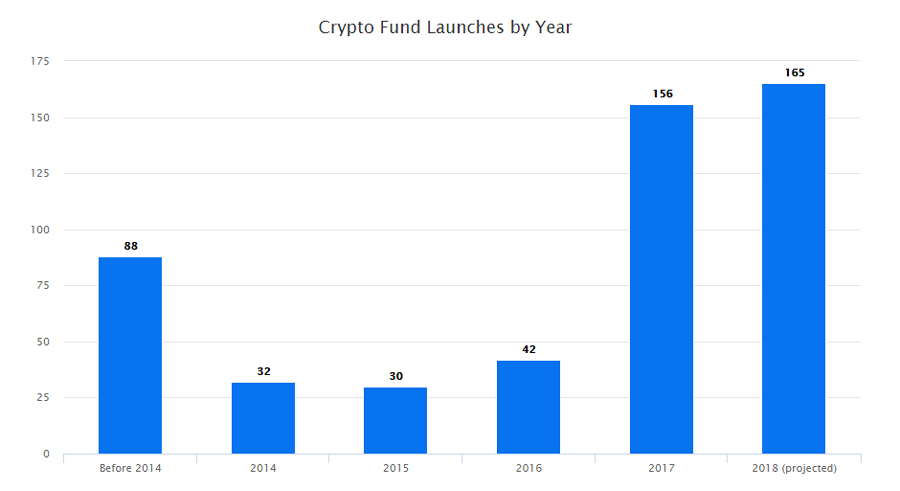

According to a study conducted by Crypto Fund Research, a provider of market information on investment funds in cryptocurrency, 2018 is about to pass 2017, "The Year of Bitcoin ", when it comes to the number of launches of encrypted funds. If the current rate of opening up new encrypted investment funds is maintained, their number should reach 165 by the end of the year, compared to 156 launched last year.

The cities that have hosted the most new cryptographic funds are San Francisco – 9, New York – 6, Singapore – 5, and London – 4. Cities like Austin, Dallas, Hong Kong, Philadelphia, San Diego, Tokyo and Zug, where the Swiss Crypto Valley is based, have also seen more the fund was launched this year

[19659009] More than half of all existing cryptic funds have been set up over the past 18 months, according to another finding in the report. Their total number in the world has reached 466, says Crypto Fund Research. Mentioned in a press release, company founder Josh Gnaizda commented:

[19659009] More than half of all existing cryptic funds have been set up over the past 18 months, according to another finding in the report. Their total number in the world has reached 466, says Crypto Fund Research. Mentioned in a press release, company founder Josh Gnaizda commented:

We expected a large number of new cryptographic funds to be launched in 2018 to meet the growing demand for investors. However, the pace of new fund launches is somewhat surprising given the double wind of depressed prices and unfavorable regulatory conditions in many regions.

C & # 39; is enough space for all of them?

The authors of the study note that if 2017 were "The year of Bitcoin", 2018 promises to become "The Year of the Crypto Fund". They also point out that while investors await regulators' decisions on new investment vehicles such as the ETC bitcoin Vaneck Solidx, crypto fund managers are creating new funds in hopes of exploiting what they perceive as an unsatisfied demand for crypto investments.

In further comments, Mr. Gnaizda expresses doubts about the ability of cryptographic space, in the current circumstances, to receive so many funds: "While volatility in the markets Crypto can attract some investors to sophisticated encrypted funds, it is not clear if the industry is able to support such a large number of funds, with a limited track record, if we experience an extended bear market, "he quoted from PRweb .

In further comments, Mr. Gnaizda expresses doubts about the ability of cryptographic space, in the current circumstances, to receive so many funds: "While volatility in the markets Crypto can attract some investors to sophisticated encrypted funds, it is not clear if the industry is able to support such a large number of funds, with a limited track record, if we experience an extended bear market, "he quoted from PRweb .

Despite the impressive growth in the number of crypto funds, the controlling capital remains limited – about $ 7.1 billion, and the researchers point out that this is much less than they manage many of the best hedge funds. traditional. At the same time, most institutional investors are still waiting and many cryptocurrency managers hope they will change in the near future.

Do you think that the growing number of encrypted funds indicates optimism expectations about the future of the crypto industry? Share your thoughts on the topic in the comments section below.

Images courtesy of Shutterstock, Crypto Fund Research.

Make sure you do not miss any important news regarding Bitcoin! Follow our news feed in any way you like; via Twitter, Facebook, Telegram, RSS or e-mail (scroll to the end of this page to register). We have summarized daily, weekly and quarterly in the form of newsletters. Bitcoin never sleeps. Not even we have .

Tags crypto funds issue study Trends uncertainty