[ad_1]

Crypto Assets Stutter, Market Cap Falls By 5%

Previously, Bitcoin (BTC) and its altcoin brethren posted to strong performance in recent days, with BTC surging convincingly above $ 4,000 on Wednesday. While the asset held its value for over 24 hours, on a short stint of range trading between $ 4,100 and $ 4,300, BTC faltered, stumbling and falling under $ 4,000 for the third time in a few weeks.

In a matter of four hours, BTC fell from $ 4,225 to a daily low at $ 3,900, to ~ 7% decline, which seemingly came unprompted.

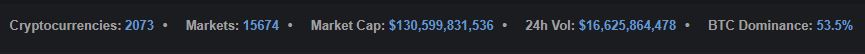

Altcoins quickly followed the market leader, with industry darlings, XRP, Ethereum (ETH), Stellar Lumenx (XLM), and dozens of others posting mid-single-digit losses around 5-6%. As a result of this sell-off, to common sight in recent weeks, the aggregate value of all crypto assets fell to $ 130.6 billion, down from the $ 140 billion weekly high established on Wednesday.

Interestingly, unlike the cryptocurrency market of Summer 2018, this move comes amid a spell of hefty volume levels, So, now, it seems that the crypto market is not ready to settle, nor will it be trading any time soon.

"New Wave Of [Bitcoin] Sales "Could Be Inbound

Bitcoin's most recent move under $ 4,000 comes just days after some optimists claimed that the worst was behind this asset class, recently called the best by Anthony Pompliano of Morgan Creek Digital.

And as such, analysts took to their usual soapboxes tout their most recent claims, some of which were foreboding and painted for dismal picture for Bitcoin.

Bitcoin back below $ 4,000 as selloff returns https://t.co/L83ZXOIjxQ

– MarketWatch (@MarketWatch) November 30, 2018

A series of analysts at U.K.-based FX Pro Insights, a market research firm, told MarketWatch that the move under $ 4,000 was catalyzed by short-term traders.

The forex-centric analysts went on to pose to rhetorical, yet intriguing million-dollar question, asking if Bitcoin truly bottomed at $ 3,400 last week, the lowest has been since mid-September 2017 post-China crackdown on cryptocurrencies.

Staying away from their own question in full, the analyzed analysts:

BTC's decline to $ 3500 was an important support point for the cryptocurrency. In this context, it should be noted as soon as possible to begin with profit from this trend, which may trigger a new wave of sales.

BTC has suffered, there was a problem with other industry insiders. Michael Bucella, an executive at Goldman Sachs' Canada branch turned into a BlockTower partner, recently took to CNBC to claim that while he was bittering near the end of its "distress cycle," the next phase will be a violent capitulation before a rapid rebound.

Short-Term Price Action Aside, Industry Insiders Remain Sold On Bitcoin

Although ironically enough, analysts have failed to consume on Bitcoin's bottom.

Speaking with Bitcoinist, Max Keizer, said to be popular, he expects it for "bitcoin" to "gobble up all fiat" into a black hole, pushed the price of BTC above $ 100,000 and beyond.

Title Image Courtesy of Arto Marttinen on Unsplash

[ad_2]

Source link