[ad_1]

Crypto Buying Volume Boom, Bitcoin Heads above $ 4,000

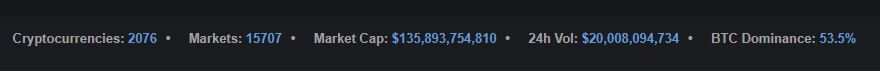

After an almost continuous increase in sales pressure, Tuesday, after an apparent change in the cryptography news cycle, Bitcoin and its brothers altcoin unexpectedly suffered a positive price inflow. And after a day of buy-side actions, the aggregate value of all crypto assets rose to $ 135 billion, 15% more than the $ 115 billion recorded from the start of the year to Sunday.

The most recent rebound from Crypto, which sent BTCs from $ 3,800 to a daily maximum of $ 4,375 (about 11% gain), was $ 20 billion in reported volume (24 hours), as claimed by # 39; CoinMarketCap data aggregator. Bitcoin's most recent move comes just days after the resource set a new annual minimum at $ 3,400, 40% less than the "home" in late summer / early fall of around $ 6,000.

Yet, as with previous crypto attacks on price action over the last 15 days, many investors remained speechless, wondering why and how BTC did what it did and, perhaps most importantly, where it could be headed the cryptocurrency market.

Analyst: pay attention to $ 3,500

As Mati Greenspan, eToro's internal crypt analyst / analyst, Alexander Kuptsikevich, a market analyst at FX Pro Insights, has examined the price of $ 3,500 / bitcoin as an area of interest, telling MarketWatch:

It is worth paying attention to market behavior close to $ 3,500. This is an area that has seen a drastic increase in September 2017, so the technical analysis drives us to monitor price dynamics close to these levels

This statement, as previously reported by Ethereum World News, has become an increasingly important support line for analysts. On Monday, Nick Cawley, also of a forex trading company, said at the same outlet that taking into account the lack of "news to drive the move", BTC is likely to fund the fund between $ 3,500 and $ 3,700, although it continues to sell the ramp volume.

Bitcoin Crash may have been an "overreaction"

But what caused the increase?

Well, as noted by Andy Bromberg, president of the ICO CoinList platform, "today's increase is primarily a reaction to the precipitous falls last week and people think it may have been an overreaction." He added that due to the low levels of liquidity seen by cryptographic exchanges, a single bullish whale can trigger a cascade of purchase orders, "an avalanche", as the CoinList executive said, further pushing prices.

Brian Kelly from BKCM also recalled the resumption of BTC, noting that now that the Bitcoin Cash hash wars are mostly over and have retreated from the limelight, the sellers have left the market.

Then again, it may have been a rebound from a dead cat

However, not everyone is convinced that the worst has passed.

Clem Chambers, CEO of One Blockchain online, noted that "this morning's move is a dead cat / crypto bounce", indicating that he expects the BTC to fall further, also taking into account Tuesday's strong move. Chambers claimed that $ 2,000 for bitcoins is in the realm of possibilities.

Title Image Courtesy of Jeremy Bishop on Unsplash

Source link