[ad_1]

[ad_1]

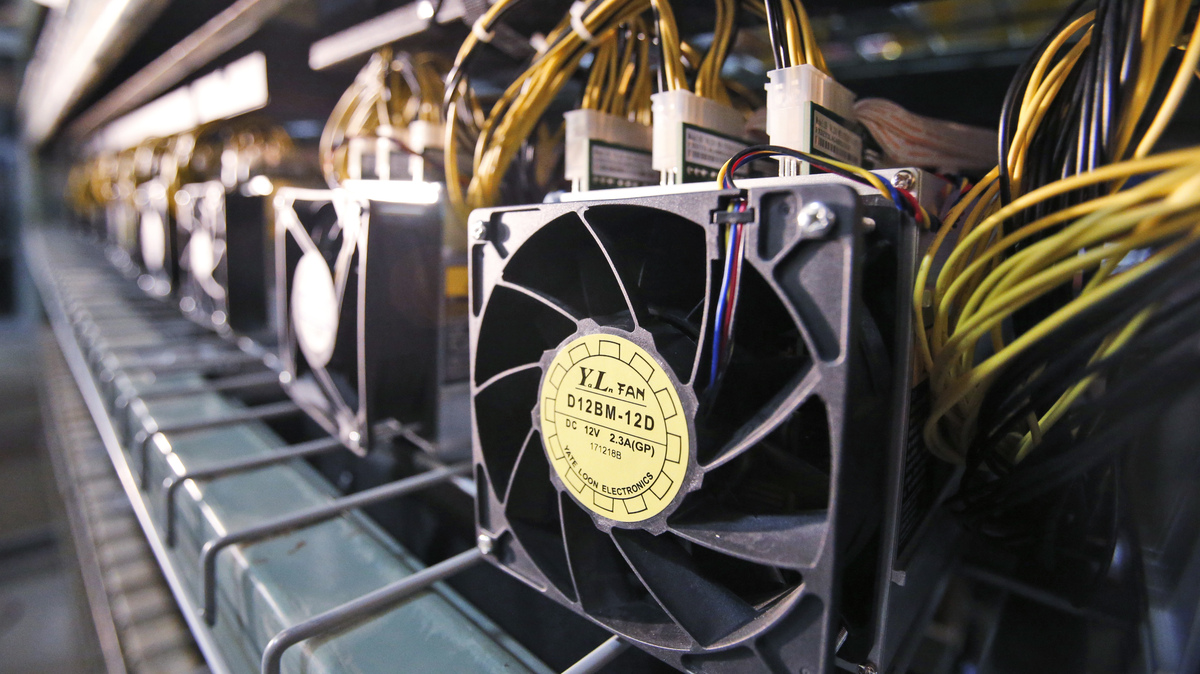

Fans used to refresh bitcoin data are connected to a bitcoin data center in Virginia Beach, Virginia, in February.

Steve Helber / AP

hide caption

activate the caption

Steve Helber / AP

Fans used to refresh bitcoin data are connected to a bitcoin data center in Virginia Beach, Virginia, in February.

Steve Helber / AP

Bitcoin has lost a lot of his value this month. Financial experts are not sure why. And I'm not sure where the famous cryptocurrency will go.

Prices fell last weekend, reaching under $ 3,600 at some point, about 40% less than two weeks ago. Prices continued Monday, but are slightly closed on Tuesday.

Then they climbed, surpassing $ 4,300 on Wednesday – although this is not close to $ 6,000 or more on the cryptocurrency commanded for several months until mid-November.

Bitcoins are not physical objects like dollars or gold. They exist only online. Bitcoin users are kept in line by a distributed public ledger called blockchain, which serves to verify transactions. Bitcoin is just one of hundreds of so-called cryptocurrencies, which have many of the same decentralized features.

Bitcoin in particular has gained a lot of attention over the years. It is the first and most popular of cryptocurrencies. The highlight was back in December 2017, when bitcoin prices rose to a historical high of nearly $ 20,000 each.

Do not you see the chart above? Click here.

Seeing prices rise, investors jumped on the wagon of the winners. The Bitcoin exchange site Coinbase reported "an explosion of interest in digital currencies" in that month. Another exchange, Binance, said it had registered 240,000 users in just one hour in January.

It is difficult to assess exactly how many people have money in cryptocurrencies, but a study last year from the University of Cambridge put the number between 2.9 and 5.8 million. In May, investor Chris McCann estimated the worldwide cryptocurrency user base between 20 and 30 million.

While prices were falling from the peak at the start of this year, financial experts have argued at various points that bitcoin was a bubble that had broken out.

Experts say the recession started two weeks ago could be related to several factors.

Some reports have attributed the scant attention of investors to a recent split between a bitcoin spread called liquid bitcoin, which has the fourth highest market capitalization among cryptocurrencies. Several bitcoin money advocates disagreed about the updates they wanted, leading to two distinct forms of cryptocurrency.

"Bitcoin cashcoin has been the catalyst for decline, but I do not think it's the only one responsible," Oanda's senior market analyst Craig Erlam told NPR.

"Bitcoin seemed vulnerable for months," he said in an e-mail. "Every big rally was weaker than what the suggested feeling was gradually becoming more negative."

The LongHash website blames much of the start of this month's decline on the problems associated with the Hong Kong OKEx cryptocurrency exchange.

Another possible clue is found in the computing power involved in bitcoin production.

It is called "hash rate". The year has increased dramatically, reaching the highs from the end of August to mid-October, as reported by Blockchain.com.

The creators of Bitcoin, also called miners, use massive computing power – and electricity – to solve complex math problems that underlie the blockchain. They are rewarded with new bitcoins.

But if the bitcoin price falls below the cost of doing it – costs like electricity bills – then the miners can switch to alternative cryptocurrencies or give up altogether. The hash rate has started to decline in recent weeks, suggesting that bitcoin mining could be growing uneconomically for some.

Despite the decline from the highs at the end of 2017, bitcoin is worth even more than it was at the beginning of last year. It started in January 2017 at $ 963.66, according to CoinMarketCap.com.

"If you had invested in bitcoins a year and a half ago, you are profitable: if you had invested when the price was $ 19,000, it is a disastrous investment," says Campbell Harvey, a finance professor at Duke University.

Erlam, the analyst, says that bitcoin is still growing by over 300 percent since the start of 2017 or "represents a considerable gain or a much more advanced downside potential" and adds: "I think it's probably The second one".

Aside from recent developments, Harvey says that bitcoin is just unstable.

"With bitcoins, there are some people who fundamentally believe it's worth zero, and others who basically believe that they will soon be worth $ 1 million a coin," he says. "This is a great deal of disagreement and uncertainty, which translates into extreme volatility."

In comparison, the Dow Jones Industrial Average lost at least 4% in two days this year. Bitcoin has lost at least 4 percent on at least 50 days in a bag. Harvey states that bitcoin is four to five times more volatile than the stock market.