[ad_1]

[ad_1]

With OverStock (NASDAQ: OSTK) that sells its retail business and becomes a blockchain developer, the business value of the company should increase. If the sale is made at a reasonable price, OverStock will be an interesting name. With liquidity and operating in the high-growth blockchain sector, the company would have to trade at 1.1x-6.7x sales like the other blockchain developers. There seems to be an opportunity since the company currently negotiates with 0.2x direct revenue.

Source: 10-Q

Business

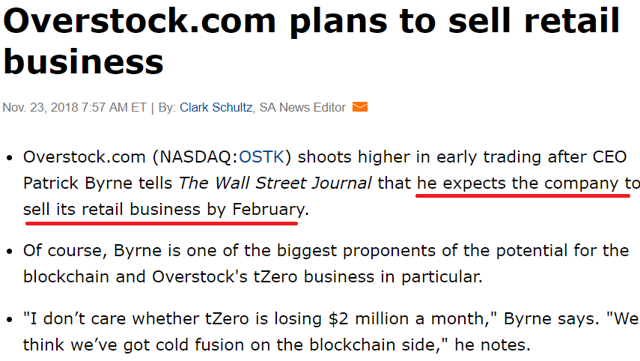

Founded in 1997 and headquartered in Midvale, Utah, OverStock is an online retailer and blockchain technology developer. The company offers a wide range of products including furniture, home decor, bed linen and towels, household items, jewelry and watches, among others. The picture below was taken from the company's website:

Source: Overstock

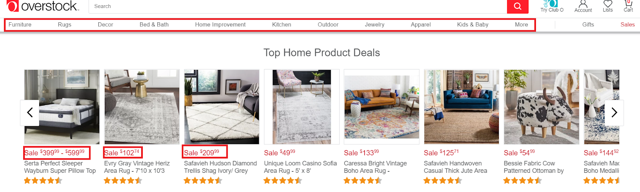

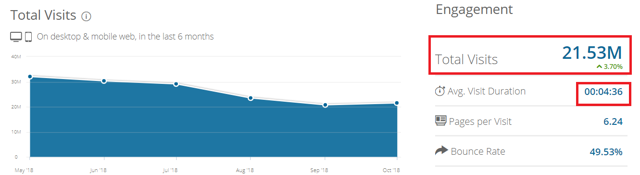

The OverStock website receives approximately 21.53 million visitors per month and each visitor stays on the website for more than 4 minutes. Moreover, the number of pages per visit seems high, equal to 6.24. These are great figures. Keep in mind that the numbers of OverStock are sometimes even better than those of Amazon (AMZN), which shows an average duration of visits lower. The images below provide further details on this:

Source: Similarweb

Source: SimilarWeb – Amazon

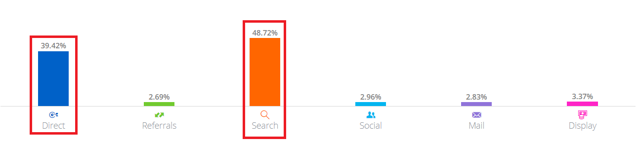

39.42% of visitors know the website and access directly to the website address. 48.72% of visitors use search engines, which means that the company can offer its inventory through Google (GOOG) or any other platform. Traffic from other sources is small:

Source: Similarweb

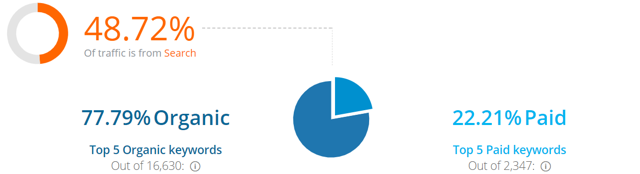

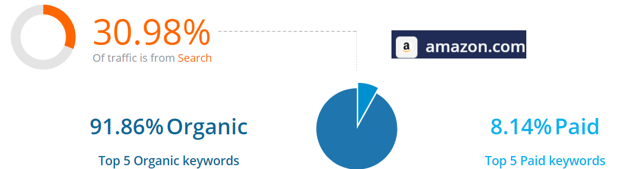

Of traffic from search engines, traffic of 22.21% is paid by OverStock. Compared to Amazon, the company is paying large sums for keywords, which investors may not appreciate. The picture below provides further details on this subject:

Source: SimilarWeb

Source: SimilarWeb – Amazon

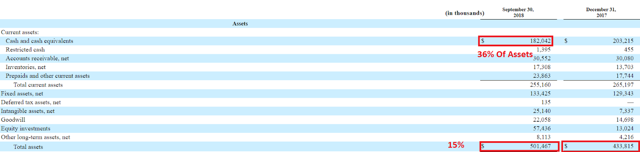

Cash includes 32% of the total amount of assets

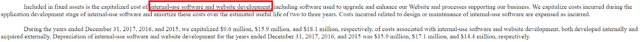

As of September 30, 2018, the company's balance sheet seemed fairly solid with a 2x assets / liabilities ratio. OverStock also has a fair amount of money, $ 182 million, about 32% of total assets. The amount of fixed assets is also very valuable. The company reported $ 133 million in fixed assets, in which the development of software and websites developed seems to be significant. The following image provides further details on the list of activities published in the last quarterly report:

Source: 10-k

Source: 10-Q

The company seems to be joining the blockchain business since the growth of the business does not seem as great as it was in the years & # 90 and in 2000. The previous budget shows this feature very well. The growth in the amount of business or money is not exciting. The company only released a 15% increase over the same quarter of 2017.

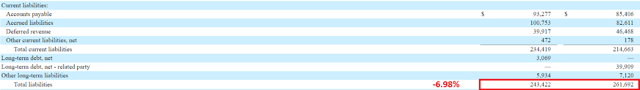

On the liabilities side, it seems positive that the total amount of liabilities has decreased by -6.98% compared to 2017. Moreover, the total long-term debt seems very small, amounting to $ 3.06 million, which is rather ideal. The financial risk seems very low on OverStock. The picture below provides further details on this subject:

Source: 10-Q

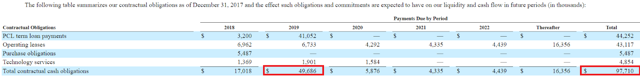

Contractual obligations should not worry investors. Current money is enough to pay for them. At December 31, 2017, the company released a total amount of contractual obligations of $ 97 million. The picture below shows the list of contractual obligations released in the last annual report:

Source: 10-K

Decline and small gross profit margins and negative CFO

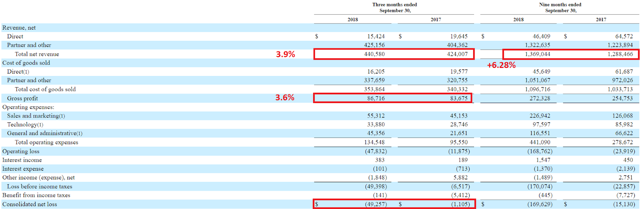

The increase in revenue is not so great. The company recorded a 3.9% increase in total net revenues for the three months ended September 30, 2018 compared to the same data for 2017. In addition, net sales recorded in the nine months ended September 30, 2018 increased by 6 , 28%, equal to 1,369 million. Growing investors should not be attracted to this revenue growth, so the company is looking to operate in the new and growing blockchain business.

Gross profit margins are also not large and are declining. In the last quarter, gross profit fell 3.6% to $ 86.71 million. In addition, the consolidated net loss for the quarter was – $ 49 million, worse than that of the same quarter of 2017. The value of investors should not appreciate the profitability numbers reported by OverStock. The following picture shows the income statement reported for the quarter ended September 30, 2018:

Source: 10-Q

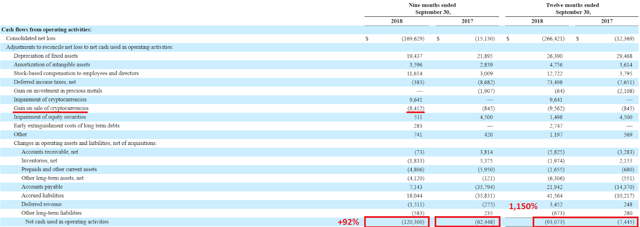

Analysts who run DCF models should also not appreciate the company. Net cash used in operating activities in the nine months ended September 30, 2018 rose from $ 62.44 million to $ 120.3 million. Without generating cash flows, even value investors will not appreciate the company. The cash flow statement is shown below:

Source: 10-Q

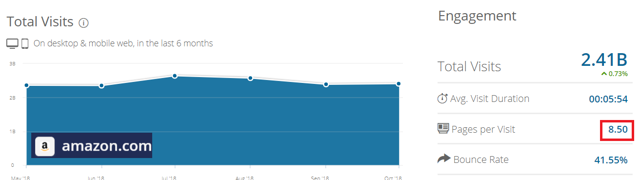

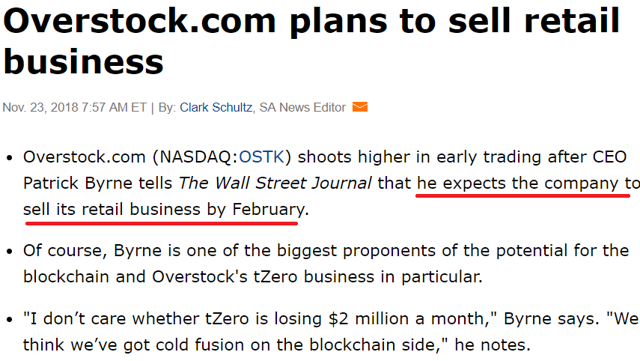

The sale of the retail trade – The reaction of the market

On November 23, 2018, the CEO announced that he plans to sell his retail business in February. The market reaction has been quite impressive. The share price has risen quite a lot by passing the $ 21 sign before falling to around $ 17. The images below provide further details on this:

Source: Seeking Alpha

Source: Seeking Alpha – Graph

The sale of the OverStock retail segment could be very beneficial for the company. Keep in mind that gross profit margins and revenue should increase. Perhaps, in the early years, OverStock will have to make a lot of investments and cash flow losses should be expected. However, in the long run, the business of the company should grow much more.

There is also a very useful function. If OverStock sells its retail business, it should have huge amounts of money to invest in developing new blockchain technologies. With this, the company has IT employees with proven experience and know-how. With this in mind, the company seems very well prepared to compete in this emerging sector.

Evaluation and competitors

As of November 26, 2018, with 32 million outstanding shares at $ 17.62, market capitalization should be $ 563 million. Cash deduction of $ 182 million and debt of $ 3 million, the value of the company is $ 384 million. We use forward revenue of $ 1.83 billion, which seems very reasonable with revenue growth of only 3.9%. Using this figure, the company exchanges to 0.2x direct revenue.

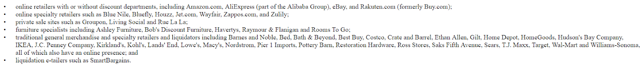

The list of competitors is quite extensive. The following lines have been provided in the annual report on companies competing with Overstock:

Source: 10-K

Among the competitors, Bed Bath & Beyond Inc. (BBBY) seems a comparable peer. It has a business value of $ 2.85 billion with revenue growth of 1.57% and a gross profit margin of 35%. BBBY trades at 0.23x sales, so OverStock does not seem undervalued or overvalued compared to this competitor. Best Buy Co. (BBY) trades at 0.46x sales with a 7.87% revenue growth and a 24% gross profit margin. With this in mind, Overstock does not seem very undervalued compared to BBY. Costco Wholesale Corporation (COST) trades at 0.73x sales and its figures are not much better than those of OverStock.

What happens if OverStock sells the retail trade?

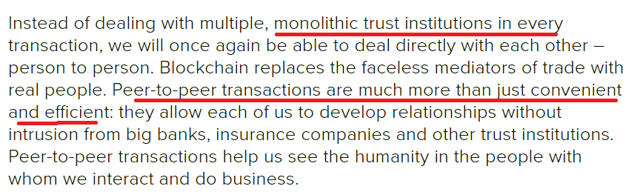

In 2014, the company started the development of Doctors, a new blockchain technology that intends to increase the amount of peer-to-peer transactions in very different sectors. Read the following lines concerning the new activities of the subsidiary of the company, Medici:

Source: Medici Ventures

Source: Medici Ventures

Their explanation of new technologies seems a little generalist. However, investors should know that OverStock has already delivered its first product, blockchain preferred shares of Overstock. Read the following lines on this subject:

"In 2015, we were the first public company to issue private security using blockchain technology and in December 2016, as a demonstration of our technology, we issued publicly traded shares of Overstock, Inc." Source: 10-K

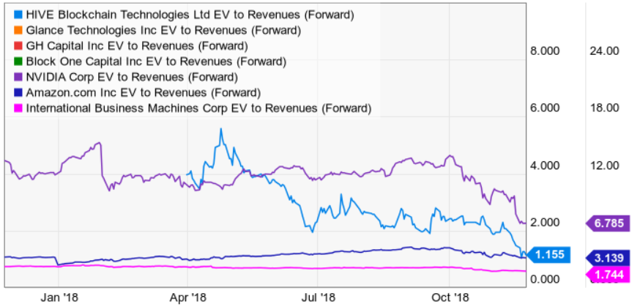

If the company is able to sell its retail business, OverStock should trade in a higher EV / Revenue ratio. As a result, the price of shares should increase. The image below shows companies operating in the blockchain industry. Trade at 1.1x-6.7x sales. With OverStock trading below 1x sales, the market opportunity seems decent.

Ycharts – Blockchain Companies

Conclusion

With OverStock selling its retail business and becoming a blockchain developer, its EV / Revenue ratio is expected to increase in the near future. The amount of money to be received from the sale of the retail branch will be significant. Keep in mind that money will be used for the development of the blockchain. With this, if the sale is made at a reasonable price, the price of the shares should increase. OverStock will have both liquidity and plans in a growing industry.

Revelation: I / we have no positions in any of the above mentioned titles, and we do not plan to start any positions within the next 72 hours.

I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

[ad_2]Source link