[ad_1]

[ad_1]

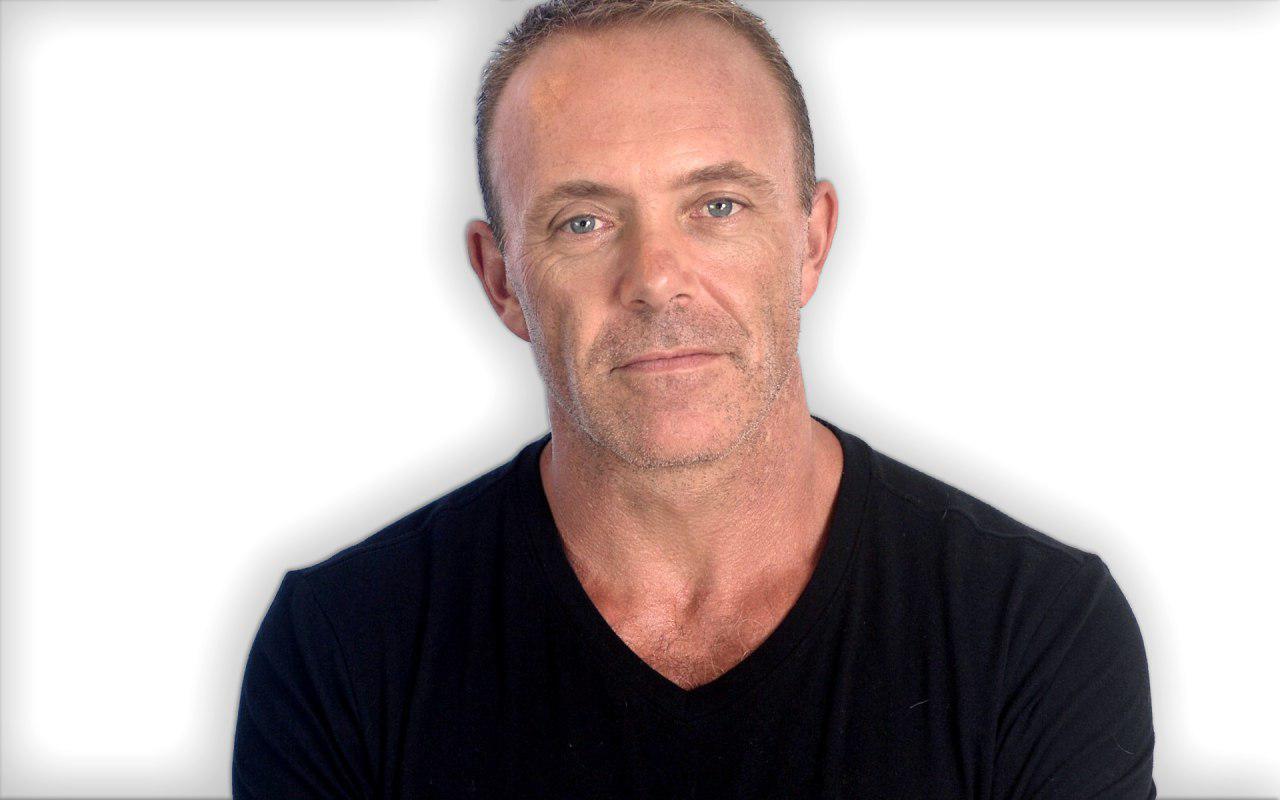

Bitcoinist spoke with Adam Todd, CEO of Digitex Futures, a trading platform that aims to become a non-guarded and unattended BitMEX for cryptocurrencies created on Ethereum.

Bitcoinist: What are the Digitex Futures? What are you doing is different / new? Can you give us your elevator pitch?

Adam Todd: Digitex Futures is an exchange of futures without custody and without commissions. Traders can speculate on the price of Bitcoin by paying at the same time zero transaction fees on their exchanges and without having to trust the exchange with their money. The exchange has its own native cryptocurrency, called the DGTX token, in which all account balances and trading profits and losses are denominated.

Operators must therefore own the DGTX token 00 participate, so an intense exchange that attracts thousands of traders will create strong demand for the DGTX token. The exchange covers its costs by creating a small number of new tokens each year and selling them in planned, public and transparent token sales.

This token delivery system is governed democratically by all DGTX token owners. As a hybrid exchange, Digitex combines the speed and reliability of a centralized order-matching engine with untrustworthy confidence in decentralized account balances. For the first time, traders can take advantage of real-time and chain trading in a no-cost, trust-free environment.

Bitcoinist: can you give us the numbers? What is the allocation of tokens, market capitalization, etc.?

Adam Todd: There is a total circulation of one billion DGTX tokens. Last month we entered the list of the 100 best cryptocurrencies on the Coin Market Cap when the price of DGTX reached a new $ 0.16 ATH from an ICO launch price of $ 0.01 at the start of this issue. ;year.

In the most brutal bear market ever registered for the cryptography market in general, our market capitalization went from zero at the start of this year to $ 160 million in October, producing over 100 times ETH yields for our original ICO buyers.

Bitcoinist: your Beta launch is scheduled for a few weeks. How do you plan to quickly establish the network and ensure a liquid exchange for traders?

Adam Todd: We have already created the network effect with the most committed Telegram group in the world and over half a million people have registered on our official waiting list. The problem we have with our launch is how to manage the pure volume of the operators who want to participate.

Bitcoinist: what kind of merchant have you designed? Who will use your exchange?

Adam Todd: The Futures exchange of Digitex will be interesting for different types of traders for different reasons. For example, zero trading commissions and a one-click lineup trading interface will be very attractive for short-term scalers who will be able to place hundreds of trades at the time and still earn a profit.

The liquidity created by these highly active short-term traders, in turn, will attract long-term traders who will be able to place large trades with little or no slippage.

Other traders will be attracted to the opportunity to trade without having to trust us to hold their money, confident in the knowledge that they can immediately withdraw their funds at any time and for any reason.

Bitcoinist: you are working for a hybrid and non-custodial exchange. Can you tell us more about this and how does it work?

Adam Todd: Digitex will be a hybrid exchange that combines the best parts of centralized and decentralized technologies. It combines the speed and reliability of a centralized order matching engine with the trustless security of decentralized balances that are not under control of the exchange.

Traders send their funds to an independent smart contract on the Ethereum blockchain, not the exchange. This smart contract communicates with the exchange in real time, informing the exchange on the amount of credit for which the trader is good, but at no time the exchange is actually in possession of your private keys.

Merchants can withdraw their funds at any time and for any reason and there is nothing that the exchange can do to prevent such withdrawals.

An integrated fraudulent that controls the smart contract monitors the exchange of any fraudulent transactions and automatically returns all operator funds if they are found.

This combination of real-time, verifiable and on-chain trading without the exchange necessary to keep merchant's private keys has just become possible with recent advances in blockchain scalability technology from the Plasma core development team, which are now applying their latest technology innovations for Digitex exchange.

For the first time ever, traders will be able to trade in real time despite having all their trades recorded on a fully verifiable blockchain and eliminating the need for traders to trust the exchange with their money.

Bitcoinist: And the partnership with Matter Inc? You said you were integrating the plasma protocol into the exchange, but it is still far away, why is it so important to Digitex, when can we expect it and what can we expect in the meantime?

Adam Todd: Matter Inc is a core member of the Plasma development team working closely with Vitalik Buterin and Joseph Poon to solve the current problems of downsizing Ethereum. They are at the forefront of developing a cutting-edge blockchain scaling technology that will finally allow the use of cryptocurrency to achieve mass adoption in the real world, high volume applications.

We were very happy when Matter informed us that we had just reached 25,000 transactions per second without errors on a fully verifiable side chain of the main Ethereum chain (which should be ~ 65,000 tps very early) and that they were ready to adopt this cut- cutting-edge technology to build the Digitex system of non-custodial account balances.

By increasing the speed and scalability of the Ethereum blockchain, transactions can now be entered into the flow of operations in real time, which means that the exchange can verify if the trader has enough money to place the trade without needing to physically possess of that trader's funds.

The implications of this technology for mass adoption of cryptocurrencies are enormous and we are pleased to announce that we will be doing the code for our open source non-secure account balancing system to do what we can to move forward. use of blockchain. The subject expects that the initial Beta version of our unpaid account balances will be ready in March 2019 with a production release expected in the summer of 2019.

Until then we will start the Digitex Futures Exchange with deposit balances, with the goal of replacing them with non-controlling account balances in the summer of 2019.

Bitcoinist: you were at the Blockchain summit in Malta. Is Digitex trying to locate itself in Malta? What would be the main advantages of this?

Adam Todd: We have not yet made a final decision, but yes, Digitex is planning to move to Malta. Malta has developed friendly legislation on blockchain technology and there are many advantages in becoming a European future and a fully regulated spot exchange. The greater credibility of being an authorized exchange with the EU would provide obvious benefits and we are currently examining the next steps to make it happen.

Bitcoinist: You are trying to chase BitMEX customers. How do you plan to do this? Why traders will want to switch to Digitex?

Adam Todd: Digitex is often cited in various online trading groups and we are already known as potential competitors among many current BitMEX users. We have a very busy community that is active on many of the platforms where you can find BitMEX traders.

We have created a waiting list for the early access of over half a million people and enthusiasm and enthusiasm grow as we get closer to launch time. Our marketing campaigns have been very effective and we expect the biggest problem to be part of the high volume of traders rather than attracting traders or not.

Currently, BitMEX operators must send their trading funds to BitMEX for custody and must pay transaction fees. On Digitex, those same merchants can buy and sell without transaction fees and they will not have to trust the exchange with their money.

Bitcoinist: you also said that you are trying to include spot trading. Can you elaborate on this? What will this mean for Digitex?

Adam Todd: Digitex will introduce spot markets in the summer of 2019 when we become completely non-custodial. Traders will be able to buy and sell tokens without trading fees and without having to trust the exchange with their money. Instead of paying commissions on spot transactions, traders have to wager a small number of DGTX tokens to buy and sell tokens.

Operators can pick up these targeted DGTXs at any time. This creates the DGTX token demand that improves the performance of the token emission system and allows you to operate on spot markets without applying trading fees.

Our spot markets will include the best parts of futures trading, such as our one-click lineup trading interface and a standardized size larger than the notch and standardized quantities, making point trading a much more enjoyable experience. for many traders compared to the currently larger, difficult-to-use exchange interfaces.

We believe that spot markets will bring a large number of economic operators into contact with our highly liquid futures markets at no cost and the two sides of the exchange will complement each other.

Bitcoinist: So, you have the next launch and after that, what will be next on the roadmap? Are you trying to be included in more exchanges?

Adam Todd: A lot is planned for next year, such as the transition to fully non-custodial account balances, the introduction of spot markets, multiple futures pairs, a mobile app and much more.

We are focused on acquiring a large number of traders using the exchange and we believe we can become one of the top 10 exchanges by volume and by number of users very quickly. We will soon be listed on Changelly and a couple of other exchanges and we will continue to make it easier for people to buy DGTX tokens.

Bitcoinist: And can you briefly talk about the current market and selloff crisis? Obviously, this has influenced the DGTX, what do you think and what do you see in the near future for crypto as a whole?

Adam Todd: 2018 was a bear market of unprecedented proportions, it was brutal from the beginning to the end. The pain of owning cryptocurrency this year was inexorable and had a very negative effect on the price of DGTX. Every time our price fell on the general cryptography market it would have had another bad incident and we would have been dragged down again.

However, the price of DGTX has increased again by 500% + this year, even after the recent incidents that saw ETH fall by over 90% in value over the same period. Under normal market conditions the price of the DGTX would be much higher, but despite this, we continue to be strong and we are still on track to deliver a very good product to a very large user list.

Crypto is not going anywhere, it just has to have these violent purges to get rid of the uncommitted ones.

Digitex is very busy in a world where the adoption of blockchain and cryptocurrency is equivalent to the adoption and use of the Internet today, we just need to go through times like this to get to that promised land.

Is this the dawn of non-custodial trade? What do you think of zero-fare trading? Share your thoughts below!

Images courtesy of Shutterstock