[ad_1]

[ad_1]

Total market capitalization has fallen to $ 129 billion. All the currencies encrypted in the top 10 have had to cope with heavy price losses. Bitcoin cash has lost half its value.

We are in the deep bear market. Only seven cryptographic currencies in the top 100 recorded price gains. Most of these coins are stable and fluctuating. As reported on November 25, not only did Bitcoin fall below US $ 4,000, but also XRP fell below the 20-week moving average. Although the market has been able to recover a bit, we are still a long way from a real market turnaround. Bitcoin Cash was hit again particularly hard, its price has halved. Litecoin has had to cope with price losses of 20 percent and can therefore get the best result in the top 10.

In terms of market capitalization, this sale led to a decline from USD 173 billion to USD 129 billion.

Considering the charts as a whole, it is rather bearish: all ratings are negative, so short positions become profitable. The "rather" in "rather bearish" is due to the small glimmer of hope that the RSI is oversold. Overall, therefore, the market is currently mainly interesting for the short film. The first targets are the indicated supports and the resistances are the stopping losses.

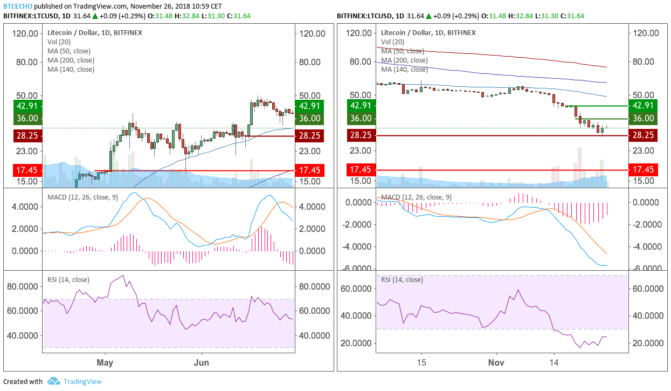

Best price: Litecoin (LTC)

Speaking of "winner of the week" sounds like a joke, because even the price of Litecoin has suffered losses of 20%. Litecoin is in a better position than all other crypto currencies of the top 10, excluding cables. However, Litecoin dropped deeply and tested a support that was last reached in July 2017 (see box on the left in the table).

The negative, but currently stabilizing the MACD together with the oversold RSI gives hope. However, the general situation is rather bearish. With a fall below support at 28.75 US dollars, a window will open for a short position with a stop loss of 33.25 US dollars and targets at 21.90 US dollars and 17.45 US dollars.

If the price were to effectively undermine the resistance to 36.00 US dollars, a stop loss at 33.25 US dollars could target the 42.91 US dollars in a long position.

Worst price performance: Bitcoin Cash (BCH)

The price of Bitcoin Cash is still marked by the Hash War. This week, Bitcoin's little brother had to bleed a lot and lost over 50% of his market value. The price is now testing a long-term support that has been in place for a year.

As with most other cryptographic currencies, the MACD is negative and the overseased RSI, so that overall a rather bearish impression is created. At the moment, we should wait and see: if the price exceeds the resistance to 260.32 US dollars, a prudent choice with a stop loss of 200 US dollars and a first target at 330.54 US dollars would be the obvious choice. However, if the price falls below the support at 146.80 US dollars, the price will find depth that has never reached before. A first rough target would be 77.26 US dollars, while the stop loss could be set at around 180 US dollars.

Stability of the Top 10

Currently, the midfield fight is very exciting: Bitcoin Cash, EOS and Stellar are just a few points away. If the stellar price increases by five percent, there may be a new cryptocurrency in fourth place, moving Bitcoin Cash to fifth place. The gap between Litecoin and Tether is also very small: Litecoin is only three percent in addition to stable currency. The narrower neck-and-neck contest, however, takes place at the back of the field, because only 1% is between the market capitalization of Moneros and Cardano.

Winners and losers of the week

On average, the top 100 fell by 24% and faced about the same Bitcoin price losses. Factom was able to continue the uptrend last week and gain a solid 28 percent gain. All other price gains, however, are fading: Sirin Labs has gained five percent, while QuarkChain has earned eight percent.

In addition to Bitcoin Cash, Metaverse ETP also recorded price losses of over 50 percent, placing itself at the top of the performance league this week.

58 percent of the first 100 cryptocurrencies had worse results than Bitcoin. Bitcoin's market share therefore climbed slightly to 54 percent.

Join our Telegram channel or Follow @CaptainAltcoin

The writers and authors of CapitanAltcoin may or may not have a personal interest in any of the projects and activities mentioned. None of the contents on CaptainAltcoin is an investment advice, nor does it replace the advice of a certified financial planner.

The opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin.com

[ad_2]Source link