[ad_1]

[ad_1]

What will be the price of Bitcoin in 2019? Can we expect a new bull run, will the price of the BTC stabilize or will we be in another bear year? Many experts and influencers shared their price forecast for Bitcoin in 2019 and Chepicap gives an overview of their BTC pricing forecasts.

Michael Novogratz: $ 20,000 or more

Michael Novogratz, CEO of the investment company Galaxy Digital, expects Bitcoin to finish 2018 somewhere between $ 8,800 and $ 9,000 and sees BTC beating $ 10K & # 39; by the end of the first quarter of 2019 & # 39 ;. "And then, we'll be back to new highs – to $ 20,000 or more," Novogratz said in an interview with Financial Times in November 2018.

The main reason for the price spike in 2019 will be the entry of more institutional investors into space, thinks Novogratz. "There will be a case of institutional FOMO, just like in retail," said the investor.

Sonny Singh: $ 20,000 by the end of 2019

Sonny Singh, chief commercial officer of Bitpay, a Bitcoin payment processing company, agrees with Novogratz that $ 20,000 is a reasonable price target for Bitcoin by the end of 2019. Singh predicts that Bitcoin will rise to $ 20,000 and will never fall again under $ 15,000 later.

He thinks that the new race will be driven by the launch of products from institutional companies such as Fidelity, Bakkt, Square and BlackRock. Singh said in an interview with Bloomberg in November 2018: "Next year we will see new operators and miners emerge in the sector: we will not see any rapid change, but by the end of the first and second quarters, the bitcoin it will emerge as a vital commodity ".

Anthony Pompliano: bear market until the third quarter of 2019

Anthony Pompliano, founder of Morgan Creek Digital Assets, initially expected Bitcoin to reach $ 50,000 by the end of 2018, but had to admit that his prediction was wrong. Pomp thinks we could see Bitcoin go down to $ 3000 before, and he says it could take up to the third quarter of 2019 before seeing a positive trend again in the market.

In a blog post, Pompliano states: "Bear markets continue to last longer – each bear market is measured from peak to downstream during a period of prolonged abatement.The first bear market lasted ~ 160 days (2011) and the second bear market lasted ~ 400 days (2013-2014) .The current bear market, if it follows the historical trend, should continue for 650 days.If this happens, cryptographic markets will not begin to recover from the recent negative movements of prices until the third quarter of 2019. "

I reviewed my Bitcoin perspective after spending more time digging into the data than I would like to admit. I'm still very optimistic, but it may take longer than expected: https://t.co/TYEuoBaChh pic.twitter.com/yjF0VRt5Ey

– Pomp 🌪 (@APPLANT) 24 August 2018

Sam Doctor and Tom Lee from Fundstrat: $ 36,000

In 2018, Fundstrat analysts predicted that Bitcoin will reach $ 36,000 by the end of 2019 based on the growth of the mining infrastructure. Sam Doctor, Quant Stategist at Fundstrat, said that based on predictable computing computation and rising miners' break-even costs, Bitcoin could reach 36,000,000 by the end of 2019, with an upper limit of $ 64,000 and a lower limit of $ 20,000.

The prediction was retweeted by CEO Tom Lee, who in turn is confident about Bitcoin in the short term. Lee said in November that Bitcoin will be worth $ 15,000 by the end of the 2018 year, cutting it by $ 25,000.

We believe the draw-off costs provide a level of support for $ BTC, such as #miners – main natural #Crypto sellers – reduce low sales $ BTCUSD price. Based on the expected computing power and the growth in break-even costs, this could imply #Bitcoin price of $ 36,000 by the end of the 2019 year. pic.twitter.com/CVwIWNz8Lr

– Sam Doctor (@fundstratQuant) 10 mei 2018

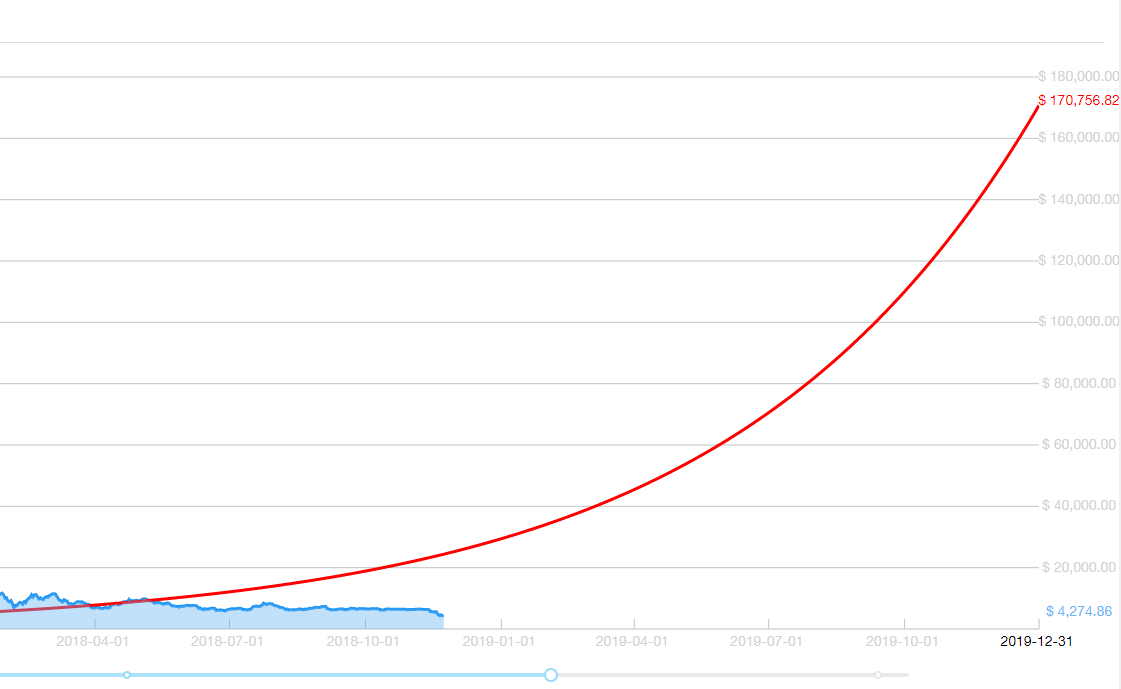

John McAfee: $ 170,000

Many of you know the (in) famous Bitcoin price forecast of John McAfee, who said he will eat his dick on national television if BTC does not reach $ 1 million by the end of 2020. Now, McAfee has not given a goal of price for 2019 (yet), but based on its forecast for 2020, Bitcoin should be worth just over $ 170,000 on December 31, 2019, to be on track to reach one million dollars a year later.

When I predicted Bitcoin at $ 500,000 by the end of 2020, it used a model that included $ 5,000 at the end of 2017. BTC accelerated much faster than the assumptions of my model. Now I'm preaching Bircoin for $ 1 million by the end of 2020. I'll still eat my dick if I'm wrong. pic.twitter.com/WVx3E71nyD

– John McAfee (@officialmcafee) November 29, 2017

According to McAfee Prediction Tracker Bircoin.top, Bitcoin must grow at a rate of 0.484095526% per day from the day McAfee shared its price forecast until December 31, 2020, to reach $ 1 million.

Ronnie Moas: $ 28,000

The cryptocurrency analyst Ronnie Moas predicted that Bitcoin will reach $ 28,000 in 2019. According to Moas, "institutions and the top 1% are buying as they did in the 2008 stock market crash." In September 2018, he warned small investors that "you have made the move from $ 600 to $ 6,000 … You will miss the move from $ 6,000 to $ 60,000".

Moas added that it is "sad to see the last 1% scare you, separating you from your BTC and keeping the gap between rich and poor". It is expected that the price of BTC will increase in 2019 due to the increasing demand and the decrease in the Bitcoin offer.

Sad to see the last 1% scare your crap | separating you from yours $ BTC #bitcoin and keeping the gap between rich and poor Reiterating the $ 28,000 goal for the end of 2019 | Do not make a bet that you can not afford to lose I surround myself with #brightest minds and they are all in agreement with me

– Ronnie Moas (@RonnieMoas) 9 September 2018

Vinny Lingham: $ 20K bet on BTC NOT hitting $ 28,000

The CEO of CivicKey Vinny Lingham does not agree with the prediction of the prices of Moas. During a conference in Las Vegas in November 2018, the two experts placed a $ 20,000 bet on the price of Bitcoin in 2019. Where Moas predicts that BTC will have a value of $ 28,000 by the end of 2019, according to Lingham the price will not hit that brand.

Lingham said that cryptocurrency companies are not making profits and "need to trade their businesses for sustainability". In the long run, however, Lingham is much more optimistic.

Fun fact: in the next 10 years will be created more wealth in encryption than the previous 10 years … but remember, as in any case of success, it will not be a straight line. Continue to believe and be patient …

– Vinny Lingham (@VinnyLingham) November 8, 2018

Fran Strajnar: $ 200,000

Fran Strajnar, CEO of the cryptographic research firm Brave New Coin, expects the price of Bitcoin to reach $ 200,000 by January 1, 2020. In an interview with Inverse in 2018, Strajnar said that "rates of adoption they continue to be fairly constant, and adoption rates are strongly correlated with price, so unless for some reason people simply stop using Bitcoin, we should see $ 200,000 for Bitcoin by January 1, 2020 at the latest. "

Arthur Hayes: long bear market in 2019

Arthur Hayes, CEO of Crypto Derivatives Exchange BitMEX, expected Bitcoin to reach $ 50,000 in 2018, but the bear market made it significantly change its forecast. Now Hayes thinks we are ready for a long bear market in 2019, one that could last until the spring of 2020. Returning from his prediction of $ 50K in 2018, Hayes said that Bitcoin would fall below $ 5K, which he did in November, with $ 3K or even $ 2K as a fund. According to his prediction, 2019 will not see a bull run in crypto at all.

Follow Chepicap now chirping, Telegram and Facebook!

[ad_2]Source link