[ad_1]

[ad_1]

Stablecoins: you may not have heard of it, but could become the new hot commodity in the world of cryptocurrencies. Unlike a more traditional cryptocurrency or altcoin – which tend to float freely with a fluctuating market value – these tokens are stabilized, for example, following the US dollar. This should help people to use and exchange the token with a better understanding of how it will change its value.

"The next wave of the cryptography market will be driven by real-world real-world and real-world use cases," said Tory Reiss, co-founder and partner of the TrustToken credit platform, Reverse. "This is the real excitement that traders feel about budgetary holdings in 2018: the promise of trillions of dollars worth of value easily accessed and exchanged by anyone with a smartphone, anywhere in the world."

Where the increase in the cryptocurrency of 2017 saw a start-up start powered by the "first offers of tokens", the stablecoin will define 2019 for crypto.

Stablecoins on the move

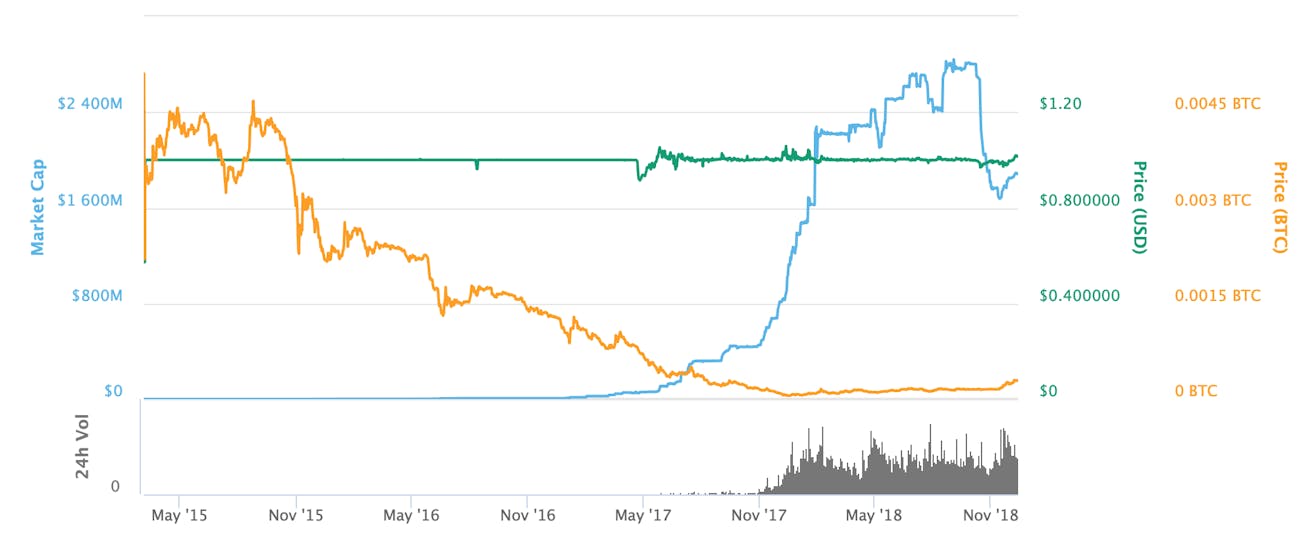

Stablecoins is seeing big jumps. Tether, the largest such market capitalization token, despite a credible academic study that found that the token was used for market infrastructure, has just come down from the January surge. The token itself is still worth around a dollar, as it was designed, but total capitalization rose from $ 451 million in October 2017 to a peak of $ 2.8 billion last month, only recently falling to $ 1 , 9 billion but still closing the year on a high note.

This is not just bound to Tether. CoinDesk We found that while the cryptocurrency market crashed in November, 24-hour trade volumes for stablecoins remained buoyant, with USD-C reaching $ 25 million, briefly pushing it into the list of the 50 largest tokens. TUSD also rose 234% over the same 24-hour period. A Diar report found that USD-C, TUSD, GUSD and PAX recorded an increase of 1.332% in on-chain transactions in November compared to September.

The market tends to fall into three types, according to Reiss. There are algorithmic stablecoins, trying to move supplies to keep a price with the dollar. There are encrypted stablecoins, which absorb the shock of price fluctuations in a more traditional cryptocurrency and tokens with balances in Latin where the value is based on a currency like the dollar or the euro.

"While some methods of algorithmic and crypto-collateralized stabilization have been celebrated by some in the industry as approaches that meet the original promise of crypto-currencies without constraints, it was ultimately the approach to support the law that created the & # 39; impact and has since opened the next wave of the industry, "says Reiss. "Why did the regulated stablecoin model, supported by fiat, receive so much attention in 2018? It is not the fact that the alternatives have not produced great results: no algorithmic stablecoin has successfully launched and maintained a stable price.The real excitement derives from the major implications to link real assets such as US dollars to the blockchain and the trillions of liquidity that this opens up to traders all over the world ".

Another Dud?

It is unclear whether the market can repeat another version of the "initial coin run", partly because the 2017 experience may have burnt a number of investors. In February of this year, 46% of the ICOs of the previous year had already failed, losing $ 233 million in value. There were 902 ICOs that year and 142 of them went bankrupt.

Experts are also raising the alarm on stablecoin supported by fiat, which depend on the trust of a central authority. Tether states that every token is supported by a real dollar, but delays in professional audits have raised doubts. Security researcher Tony Arcieri went forward again in January, revealing that "I, and many others, suspected bonding is used to effectively counterfeit hundreds of millions of dollars of perceived value." The question draws on the question of expenditure on stablecoins.

"To issue a value in Tether Dollars for you or me, the platform must draw a dollar of capital from you or you and put it in a dollar bank account," Barry Eichengreen, professor of economics at the University of California, Berkeley, wrote in The Guardian. "One of us will have exchanged a perfectly liquid dollar, supported by the full trust and credit of the US government, for a cryptocurrency with a questionable support that is inconvenient to use.This exchange can be interesting for money launderers and evaders but not for others – in other words, it is not obvious that the model will be on a scale, or that governments will leave it ".

When Satoshi Nakamoto introduced bitcoins in 2008, he came with the promise of a decentralized cryptocurrency, free from central banks that could manipulate the offer. It did not mean intermediaries, people who exchanged value with less entry barriers. While stablecoin maintains the advantages of bitcoin "digital money", the activities supported by fiat seem to raise the same problems that led to the creation of cryptocurrency in the first place.

19 Predictions for 2019: What Inverse Thinks

While the cryptocurrency market recovers from a serious accident over the course of the year, stablecoins show that developers are examining applications of the underlying technology beyond price speculation. Reverse provides that, as defined by the ICO in 2018, the stablecoin will define the next year in encryption, both in terms of volume of trade and increase of new projects.

Related video: What is TrustToken?

[ad_2]Source link