[ad_1]

Park, 32, who gave birth to a daughter last month, plans to open a stock account in front of the baby and buy 300,000 won stock each month. Mr. Park said, “I decided it would be better to buy stock for a company that will grow in the future, because I decided I couldn’t trust the bank with the money, so I will invest in tech and bio stocks in the US and China “. It is said that this year, due to the stock investing craze, there are many people opening stock accounts by visiting stock companies like Park.

As the low interest rate and equity investment boom are combined, the number of underage stock accounts is also increasing significantly. Shutterstock

# Sudden increase in the opening of warehouse accounts for minors

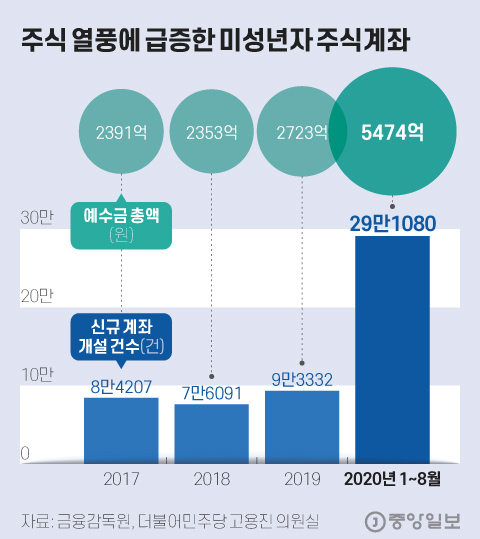

= The number of newly opened equity accounts by minors has increased significantly this year. According to the Financial Supervisory Service, the number of new underage inventory accounts opened from January to August this year is 29,1080. 9,332 accounts were opened last year.

= Deposits in smaller stock accounts also increased by 275 billion won, from 272.3 billion won last year to 5474 billion won this year.

Minor stock accounts that have soared in the stock craze. Graphics = Kim Hyun-seo [email protected]

# You can’t open face to face

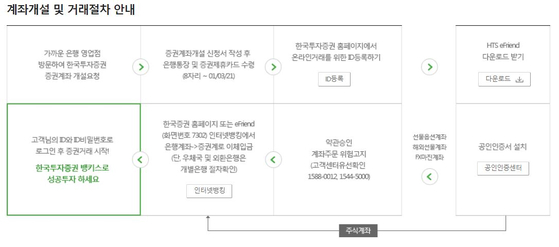

= You must visit a brokerage branch in person to open a stock account. Shinhan Financial Investment managed to open a non face-to-face account for minors, but it has now been discontinued.

= If you are not near the house of a brokerage branch, you can visit the bank branch. You can open an account with a brokerage firm affiliated with the bank. Some securities firms, such as Samsung Securities, may not be able to open a bank account, so be sure to check beforehand.

= There are many documents to prepare. You will need a copy of your child’s residence registration, family kinship certificate, your legal representative’s ID card, and a seal stamp. When issuing various certificates, the minor child must be the natural person and both the child’s resident registration number and that of the parents must be provided.

= After opening an account, you need to register as a member on the home page of a securities firm and obtain an accredited certificate. A public certificate in the name of the child is required not only when purchasing shares through an application of a securities firm or the Internet, but also when reporting a gift.

How to open an account when visiting a partner bank Korea Investment & Securities website

# You should report a donation for even a small amount

= Parents also deposit money into their children’s accounts and then buy shares is a gift. The donation must be reported within 3 months of the end of the month in which the property was donated.

= Gifts to minor children are subject to tax exemption with a limit of 20 million won every 10 years. If you donate 20 million won at the age of 1, you can donate 20 million won again at the age of 11, 10 years later, tax-free.

= You do not have to pay donation tax if you buy shares with donated money and generate profits from the normal increase in the value of the shares. Mi-sook Ko, who wrote “My Child’s Asset Management Bible” based on his experience working in a bank, said: “It is good to present a gift report every time you donate even a small amount and leave. proof of your investment “. If you expect it, it is much more advantageous to report it at the time of the cash gift and you can enjoy tax-free benefits every 10 years. ”

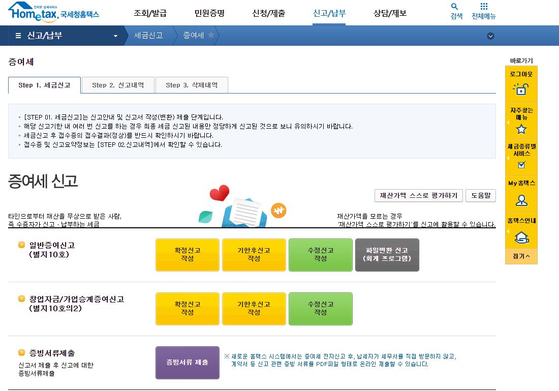

The content of the tax return on donations in the IRS tourist tax. You can report via the General Gift Report-Final Report. Acquisition of the home page

# Self-report is possible in Hometax

= You can submit a donation report to the National Tax Service Hometax. You can report the gift using your child’s official certificate. After entering the gift amount, scan and attach a family kinship certificate, account transfer details, and a copy of your bank book as proof.

= Shinhan Bank WM Promotion Department Tax Accountant Park Shin-wook said: “It is more procedurally efficient to donate and bring back 2 to 3 million won every six months or a year, rather than sending a small amount of 200,000 to 300,000 won every month. I said.

# Long-term investment + growth potential

= Most investment experts point out that long-term investments are better for underage accounts. It is said that it is good to choose an industry and a company that can grow with the child.

= Looking at the junior fund created by Meritz Asset Management for minors, it mainly invests in ETFs that invest in companies related to the 4th industrial revolution such as cloud services and robots or eco-friendly energy companies.

= “Don’t pay college tuition, buy stock,” said John Lee, CEO of Meritz Asset Management. If appropriate, the management report can be written more easily than the adult fund, or it can be used as financial education material by providing both Korean and English. ”

Reporter Ahn Hyosung

[ad_2]

Source link