[ad_1]

Passive funds benefit from low fees. As of December 12, the average remuneration of 463 listed index funds (ETFs) in Korea is approximately 0.32%. The 1% is not comparable to the far higher active fund commission. However, in the ETF industry recently, there is a feverish struggle to squeeze dry towels to reduce the fee from one decimal to two decimal places.

Shutterstock

# 0.09% received, 0.07% gone!

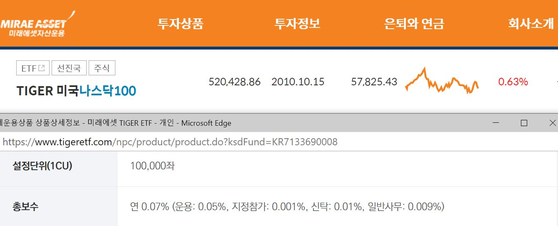

= On the 29th of last month, Korea Investment Trust Management launched the US NASDAQ 100 ETF with a 0.09% fee. A week later, KB Asset Management also listed an ETF that follows the same index, with a 0.07% commission.

= As latecomers switched to cheap rates as a weapon, existing managers could not sit still. Mirae Asset Asset Management, which listed ETFs after the NASDAQ 100 first in Korea, lowered the fee from 0.49% to 0.07% from 12th. It was a day later that KB Asset Management promoted the “lowest pay in the world”, saying “we are the lowest”. “As ETF has established itself as a representative product of Jaetech, we will provide products such as the representative index at the lowest remuneration in the industry so that investors can be more profitable when investing long-term,” said Oh-sung Kwon, CEO ETF Marketing Delegate at Mirae Asset Asset Management.

#We are a ‘0%’ war that started in America

= The movement of funds from active to passive funds is a global phenomenon. The idea that “you can’t beat the market even if you choose more” has become a trend. America is at the center of everything. In the United States, the percentage of passive funds exceeded the active one last year.

= The market has matured and competition has increased. Fidelity launched a “zero pay” index fund in August 2018. More than 1 trillion won was raised in one month. The following year, SoFi, a fintech company, launched an ETF that does not receive any compensation for a certain period of time. BNY Mellon, which is the largest trust bank in the world but lagging behind the ETF market, unconditionally listed an unpaid ETF in April.

Mirae Asset Asset Management website

#Is low distribution the secret?

= If you don’t get paid, you want to dig the land and do business, but it’s not. US managers can offer zero-premium ETFs because they have a separate profit. Managers can lend shares held by investor funds to other investors and receive commissions. You can return this commission income to the investor, but it is not necessary. In fact, BlackRock, the world’s largest manager, took over more than 30% of the stock rental fees earned in 2018.

= Domestic managers can also sell ETFs and lend stocks as secondary work, but all profits obtained must be returned to investors in the form of distribution As in the US, it is not possible to “give less distribution instead of receiving no compensation”. Zero compensation is impossible.

= If you only pay attention, it is advantageous to buy products from US managers “directly”. However, offshore ETFs cannot be traded in time for domestic stock market opening hours and cannot be incorporated into retirement accounts, so there is no tax advantage. Also, if the product is too little paid, you need to look into whether the distribution is too small.

= In case of leverage and inverse ETFs, investor sensitivity to netting is low. However, even if you only want to invest for a short period of time, it’s best to compare the fees. If you don’t earn as expected, it can be an unwanted long-term investment. Additionally, leveraged, inverse and commodity ETFs have higher payouts than other ETFs, so they are worth considering.

Journalist Moon Hyun-kyung

[ad_2]

Source link