[ad_1]

[ad_1]

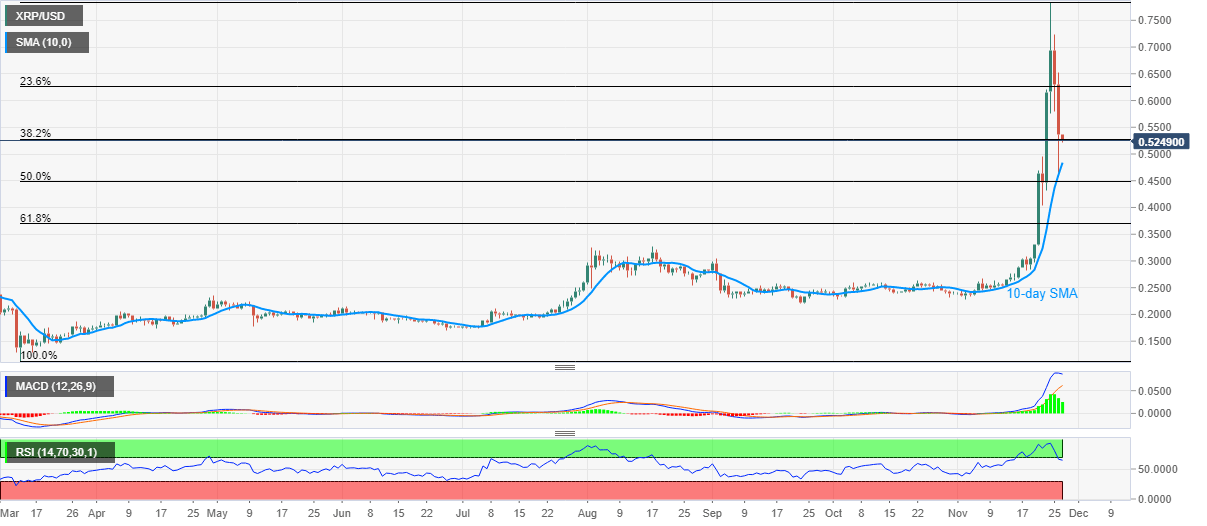

- Ripple remains depressed near the weekly low, falling below 0.5500 late.

- The withdrawal of the RSI from overbought conditions keeps sellers confident.

- The key Fibonacci retracements hold the gate for further disadvantages.

Ripple fades bounce to 0.4581 as they drop to 0.5240, down more than 2% early Friday. The cryptocurrency plunged the previous day before bouncing off the SMA.

However, failures in extending the corrective recovery are combined with conditions on the RSI easing from the overbought region to keep sellers confident.

Therefore, XRP / USD sellers are currently looking at a revisit to the 10-day SMA level of 0.4840 before falling to the 50% Fibonacci retracement of the March-November high near 0.4485.

Also acting as a downward filter is the 61.8% Fibonacci retracement level of 0.3693 and the August high near 0.3280.

Meanwhile, an upside clearance of 0.5500 may trigger new recovery moves targeting early week lows below 0.5800. However, any further increase will have more hurdles to break above the 0.6000 threshold before hitting the last high near 0.7845.

XRP / USD daily chart

Trend: bearish

.[ad_2]Source link